Scotiabank Rates Meta Platforms as a ‘Sector Perform’

Fund Sentiment Shows Growing Interest in META

Fintel reports that on October 11, 2024, Scotiabank began coverage of Meta Platforms (WBAG:META) with a Sector Perform rating.

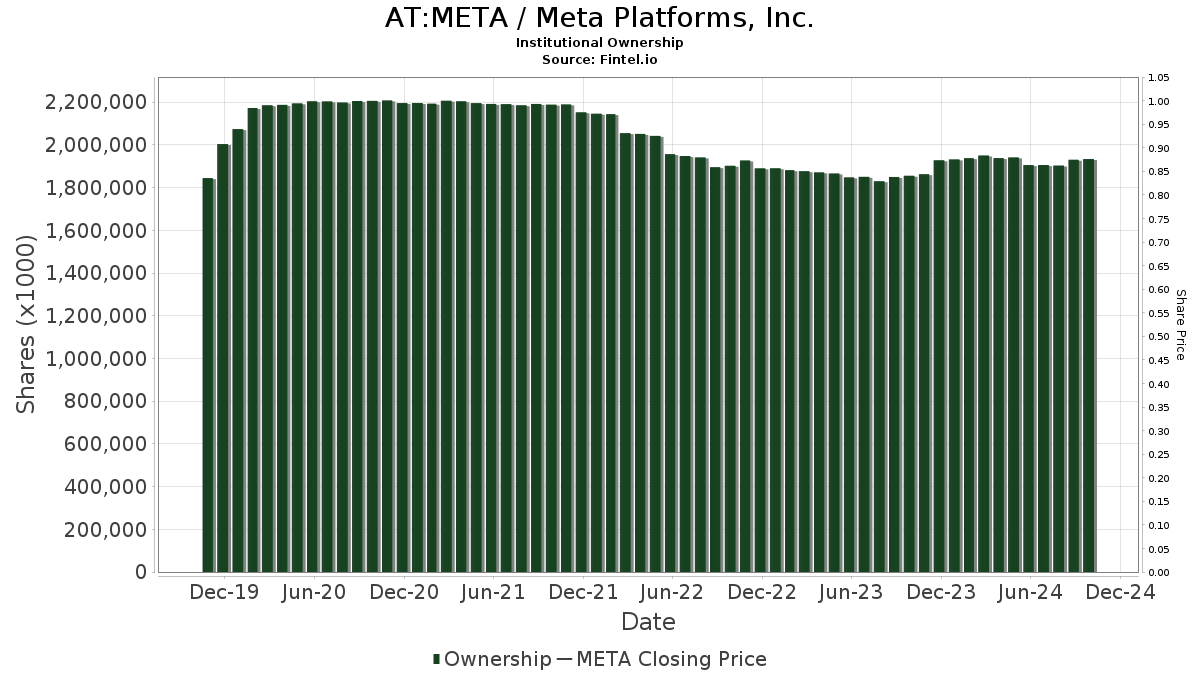

Institutional Holdings Reveal Mixed Strategies

Currently, 6,002 funds or institutions hold positions in Meta Platforms, marking an increase of 91 owners, or 1.54%, compared to the previous quarter. The average portfolio weight of all funds invested in META is now 1.73%, up by 2.48%. Over the past three months, total shares owned by institutions rose by 3.45%, reaching 1,933,250K shares.

Several key shareholders have adjusted their stakes recently. VTSMX – Vanguard Total Stock Market Index Fund Investor Shares now owns 69,230K shares, representing 3.17% of the company. This is a slight increase from their previous holding of 69,157K shares, or an uptick of 0.11%. Vanguard also raised its allocation in META by 1.08% over the last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares holds 56,245K shares, accounting for 2.57% ownership. This is an increase from 55,443K shares, reflecting a 1.43% rise. However, the firm did decrease its portfolio allocation in META by 0.28% during the same period.

JPMorgan Chase now possesses 52,228K shares, which is 2.39% of the company. They have increased their holdings from 50,183K shares, representing a 3.92% rise in ownership. As a result, their allocation in META rose by 4.95% over the last quarter.

Geode Capital Management also boosted its stake, now holding 47,462K shares, which is 2.17% ownership. This marks an increase from 46,413K shares, or a 2.21% rise, with a 0.73% increase in allocation over the last quarter.

Conversely, Price T Rowe Associates reduced its holdings to 41,709K shares, representing 1.91%. This is a decrease from 43,118K shares, reflecting a drop of 3.38%. They also decreased their portfolio allocation in META by 1.94% during the last quarter.

Fintel stands out as a leading investing research platform for individual investors, traders, financial advisors, and small hedge funds.

The platform provides an extensive range of data, including fundamentals, analyst reports, ownership details, fund sentiment, options sentiment, insider trading, options flow, and unusual options trades, among others. Fintel’s unique stock picks leverage advanced, backtested quantitative models aimed at enhancing profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.