Scotiabank Initiates Coverage of Blueprint Medicines with Positive Outlook

Fintel reports that on March 7, 2025, Scotiabank initiated coverage of Blueprint Medicines (NasdaqGS:BPMC) with a Sector Outperform recommendation.

Analyst Price Forecast Indicates Significant Upside Potential

As of March 4, 2025, the average one-year price target for Blueprint Medicines stands at $129.20 per share. Predictions vary widely, ranging from a low of $83.83 to a high of $177.45. This average price target signifies a potential increase of 48.30% from its latest closing price of $87.12 per share.

Check out our leaderboard for companies with the largest price target upside.

Financial Projections Show Growth

The projected annual revenue for Blueprint Medicines is $513 million, reflecting a modest increase of 0.90%. Furthermore, the anticipated annual non-GAAP earnings per share (EPS) is -$8.00.

Institutional Fund Sentiment

There are currently 812 funds or institutions reporting positions in Blueprint Medicines, which is an increase of 32 owners or 4.10% over the last quarter. The average portfolio weight dedicated to BPMC across all funds is 0.30%, up by 4.72%. Moreover, total institutional shares owned in the last three months rose by 7.06% to 82,350,000 shares.

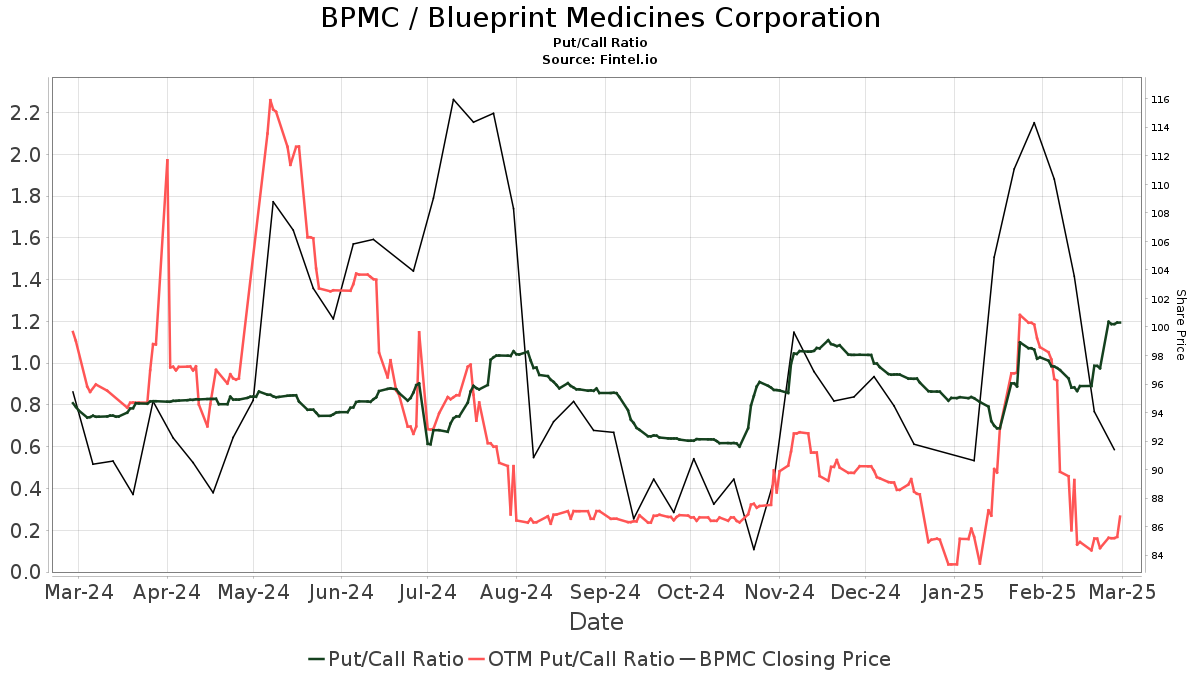

The put/call ratio for BPMC is 1.05, indicating a bearish sentiment among some investors.

Actions of Major Shareholders

Price T Rowe Associates holds 5,679,000 shares, equating to 8.89% ownership of the company. This shows a 5.14% increase from the firm’s previous ownership of 5,387,000 shares, though its portfolio allocation in BPMC decreased by 0.47% over the last quarter.

Wellington Management Group LLP holds 4,281,000 shares, representing 6.70% ownership. This marks a 7.40% increase from its previous position of 3,965,000 shares, while subsequently reducing its portfolio allocation in BPMC by 85.10% in the last quarter.

The Vanguard Health Care Fund Investor Shares (VGHCX) holds 2,090,000 shares, or 3.27% ownership. This is an increase of 27.69% from its prior filing, where it reported ownership of 1,511,000 shares, signifying a 19.39% increase in portfolio allocation.

The T. Rowe Price New Horizons Fund (PRNHX) owns 2,052,000 shares, translating to 3.21% ownership. In its prior filing, the firm reported holding 2,064,000 shares, reflecting a slight decrease of 0.62%, but it increased its portfolio allocation in BPMC by 0.64% over the last quarter.

Furthermore, the Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) possesses 1,984,000 shares for 3.10% ownership. This is down by 0.74% from its previous holdings of 1,999,000 shares, along with a 7.76% reduction in its BPMC portfolio allocation.

Overview of Blueprint Medicines

Blueprint Medicines Background Information

(This description is provided by the company.)

Blueprint Medicines is a global precision therapy company dedicated to developing life-changing medicines for individuals with cancer and hematologic disorders. The company employs a precise and agile approach, crafting therapies that selectively address genetic drivers, with the aim of advancing across various disease stages. Since its inception in 2011, Blueprint has utilized its research platform, which includes expertise in molecular targeting and high-level drug design capabilities, to efficiently translate scientific advances into a broad pipeline of precision therapies. Currently, the company is providing its approved medicines to patients in both the United States and Europe while globally advancing multiple programs for genomically defined cancers, systemic mastocytosis, and cancer immunotherapy.

Fintel is a comprehensive investing research platform for individual investors, traders, financial advisors, and small hedge funds.

Our data encompasses fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and more. Furthermore, our exclusive Stock picks are based on advanced, backtested quantitative models aimed at enhancing profitability.

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.