Scotiabank Begins Coverage of Meta Platforms with Cautious Optimism

On October 11, 2024, Scotiabank initiated coverage of Meta Platforms (BVC:META), giving the stock a Sector Perform recommendation.

Current Fund Sentiment Towards Meta

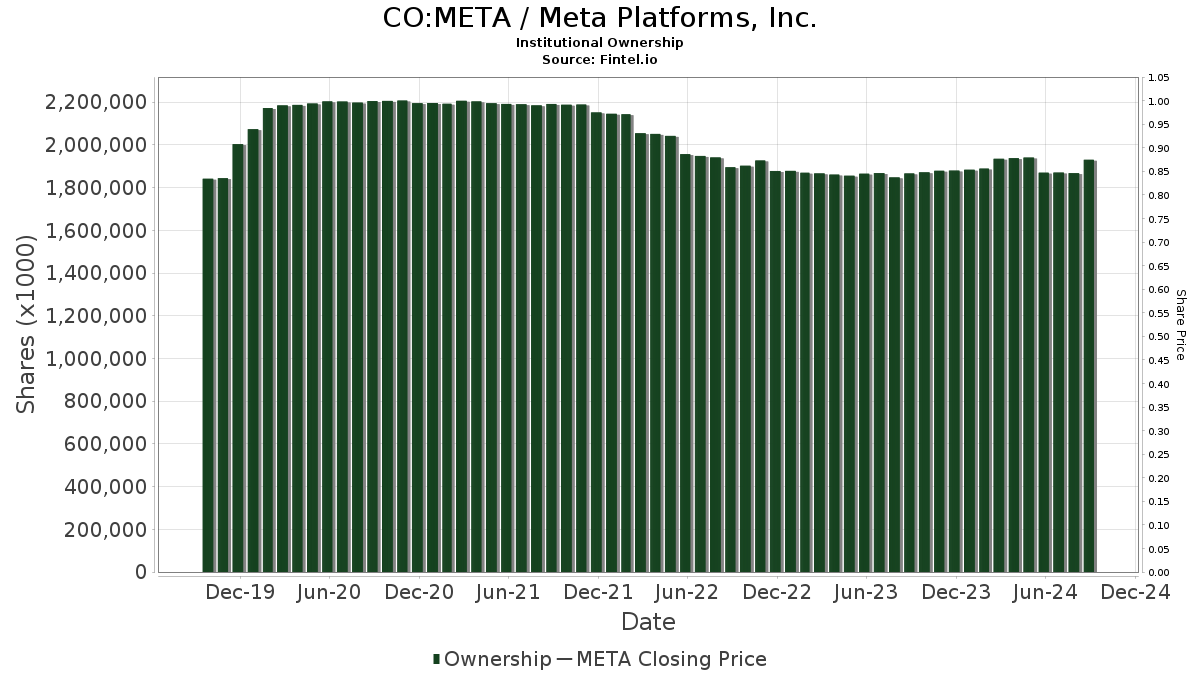

As of now, 6,002 funds or institutions have reported their positions in Meta Platforms. This marks an increase of 105 new owners, or 1.78%, from the previous quarter. The average portfolio weight allocated to META across all funds is currently at 1.73%, reflecting a rise of 3.85%. Over the last three months, total institutional shares owned increased by 3.45%, bringing the total to 1,933,250K shares.

Institutional Shareholder Activity

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) currently holds 69,230K shares, which represents 3.17% ownership of the company. Previously, they reported owning 69,157K shares, indicating a modest increase of 0.11%. Their portfolio allocation in META has risen by 1.08% over the last quarter.

The Vanguard 500 Index Fund Investor Shares (VFINX) has 56,245K shares, equating to a 2.57% ownership stake. In their last report, they outlined ownership of 55,443K shares, which shows an increase of 1.43%. However, their portfolio allocation to META has seen a slight decrease of 0.28% since last quarter.

JPMorgan Chase has increased its holdings to 52,228K shares, representing 2.39% ownership. Previously, they held 50,183K shares, an increase of 3.92%, while their portfolio allocation in META rose by 4.95% over the last three months.

Geode Capital Management now has 47,462K shares, representing 2.17% ownership; this is an increase from 46,413K shares previously, or a rise of 2.21%. They have also slightly increased their portfolio allocation in META by 0.73% during the last quarter.

Price T Rowe Associates has adjusted their holdings to 41,709K shares, which covers 1.91% ownership of the company. This is a decline from their prior ownership of 43,118K shares, marking a decrease of 3.38%. Their portfolio allocation to META has also dropped by 1.94% in the last quarter.

Fintel provides extensive investment research for individual investors, traders, financial advisors, and small hedge funds. Our data encompasses global fundamentals, analyst reports, ownership statistics, fund sentiment, and much more. We use advanced, backtested quantitative models to recommend stock picks for improved profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.