Scotiabank Boosts Comcast’s Outlook: What You Need to Know

Fintel reports that on November 1, 2024, Scotiabank upgraded their outlook for Comcast (SNSE:CMCSACL) from Sector Perform to Sector Outperform.

Current Fund Sentiment on Comcast

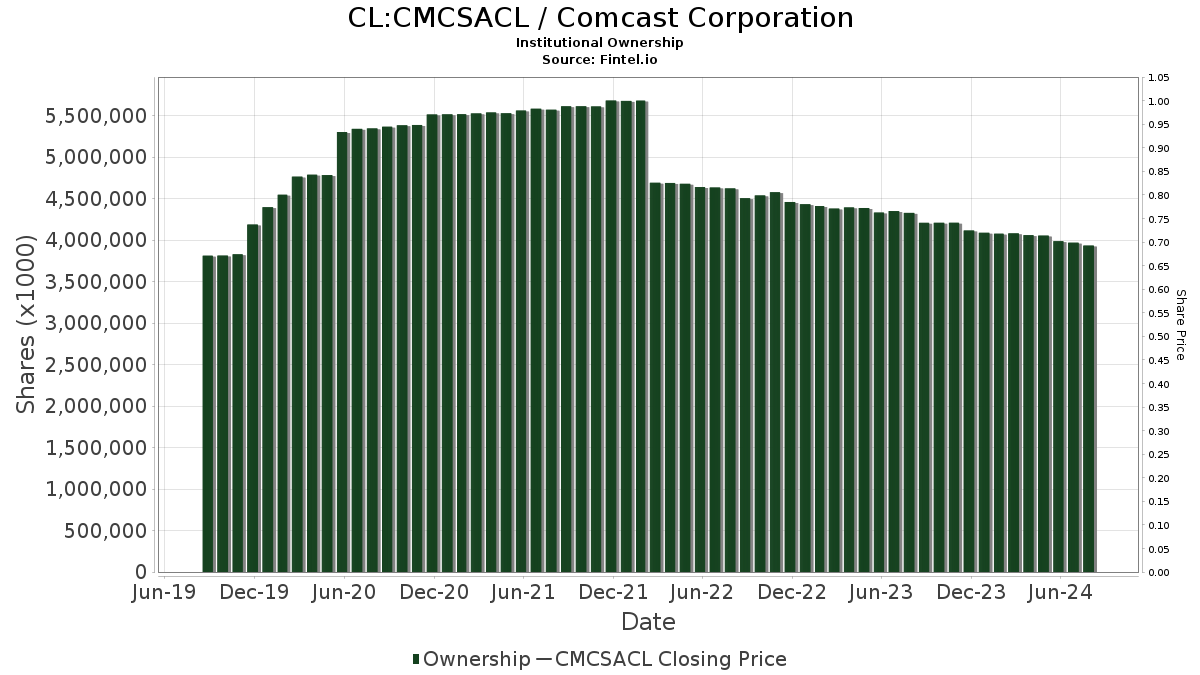

There are now 3,710 funds or institutions reporting positions in Comcast, which marks a decline of 90 owners or 2.37% since the last quarter. The average portfolio weight dedicated to CMCSACL has increased by 2.95% to 0.57%. However, total shares owned by institutions have decreased by 0.96% over the last three months, bringing the total to 3,892,306K shares.

Recent Moves by Major Shareholders

Capital World Investors now holds 128,148K shares, accounting for 3.32% of the company. This reflects a significant increase of 9.71% from 115,703K shares reported in its previous filing, although its percentage allocation to CMCSACL decreased by 1.43% over the quarter.

The Vanguard Total Stock Market Index Fund Investor Shares holds 123,606K shares, representing 3.20% ownership. Their last reported figure was 124,518K shares, showing a modest decrease of 0.74%. The allocation in CMCSACL also fell by 12.80% in the last quarter.

Vanguard 500 Index Fund Investor Shares counts 100,460K shares for 2.60% ownership, up from 99,846K shares, marking a slight increase of 0.61%. However, its portion dedicated to CMCSACL decreased by 13.96% recently.

JPMorgan Chase holds 86,410K shares, which is a decrease of 12.71% from 97,397K shares previously reported. This institution has lowered its portfolio allocation in CMCSACL by 22.17% over the past quarter.

Geode Capital Management’s stake includes 85,791K shares or 2.22% ownership, up from 83,684K shares, reflecting a 2.46% increase. Yet, its allocation of CMCSACL shares decreased by 12.13% quarter-over-quarter.

Fintel is a leading research platform designed for investors, traders, financial advisors, and small hedge funds. Our extensive data covers global fundamentals, analyst reports, ownership data, and fund sentiment, along with many other investment insights.

This article was originally published by Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.