Scotiabank Boosts Comcast’s Outlook Amid Shifting Fund Sentiment

Fintel reports that on November 1, 2024, Scotiabank upgraded their outlook for Comcast (SNSE:CMCSA) from Sector Perform to Sector Outperform.

Investor Activity and Fund Sentiment

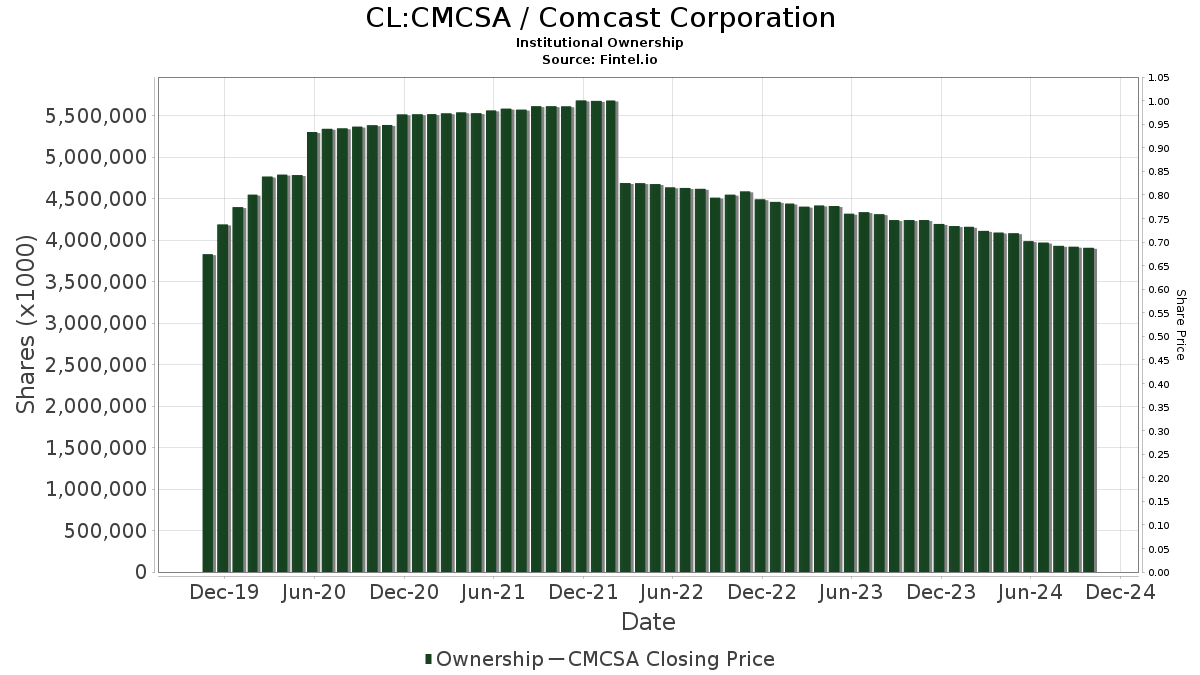

As of now, 3,710 funds or institutions have reported their positions in Comcast. This is a drop of 90 funds, or 2.37%, compared to the last quarter. The average portfolio weight for all funds in CMCSA is 0.57%, reflecting an increase of 2.95%. Over the last three months, total shares held by institutions decreased by 0.96%, totaling 3,892,306K shares.

Institutional Shareholder Moves

Capital World Investors owns 128,148K shares, which translates to 3.32% ownership of the company. Previously, they reported 115,703K shares, marking a 9.71% increase. However, their portfolio allocation in CMCSA was reduced by 1.43% this past quarter.

The Vanguard Total Stock Market Index Fund Investor Shares holds 123,606K shares, equating to 3.20% ownership. In their last filing, they reported owning 124,518K shares, indicating a 0.74% decline. The firm also decreased its allocation in CMCSA by 12.80% over the last quarter.

Similarly, the Vanguard 500 Index Fund Investor Shares holds 100,460K shares, representing 2.60% ownership. Previously, they had 99,846K shares, which shows an increase of 0.61%. Like other firms, they reduced their allocation in CMCSA by 13.96% during the last quarter.

JPMorgan Chase reported holding 86,410K shares, about 2.24% ownership of Comcast. Their previous filing showed 97,397K shares, which is a 12.71% drop. They also made significant adjustments, decreasing their allocation by 22.17% over the past quarter.

Geode Capital Management holds 85,791K shares, making up 2.22% of the company. In their last report, they had 83,684K shares, reflecting a 2.46% increase. However, their portfolio allocation in CMCSA was still reduced by 12.13% this past quarter.

Fintel is considered a leading investing research platform for individual investors, traders, advisors, and small hedge funds. Our comprehensive data includes fundamentals, analyst insights, ownership metrics, fund sentiment, options sentiment, insider trading, and unique stock picks derived from advanced quantitative models aimed at enhancing profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.