Scotiabank Upgrades NETSTREIT Outlook: What Investors Should Know

Analysts Predict 16.47% Price Increase

On November 11, 2024, Scotiabank upgraded NETSTREIT (NYSE:NTST) from Sector Perform to Sector Outperform.

As of October 22, 2024, analysts set an average one-year price target of $18.75 per share for NETSTREIT. This reflects potential growth, with predictions ranging from a low of $16.16 to a high of $23.10. The target suggests a 16.47% increase from the latest closing price of $16.10 per share.

Annual Revenue Projections and Earnings Insights

NETSTREIT’s projected annual revenue stands at $147 million, indicating a decline of 5.26%. Meanwhile, the projected annual non-GAAP earnings per share (EPS) is estimated at $0.18.

Institutional Interest in NETSTREIT

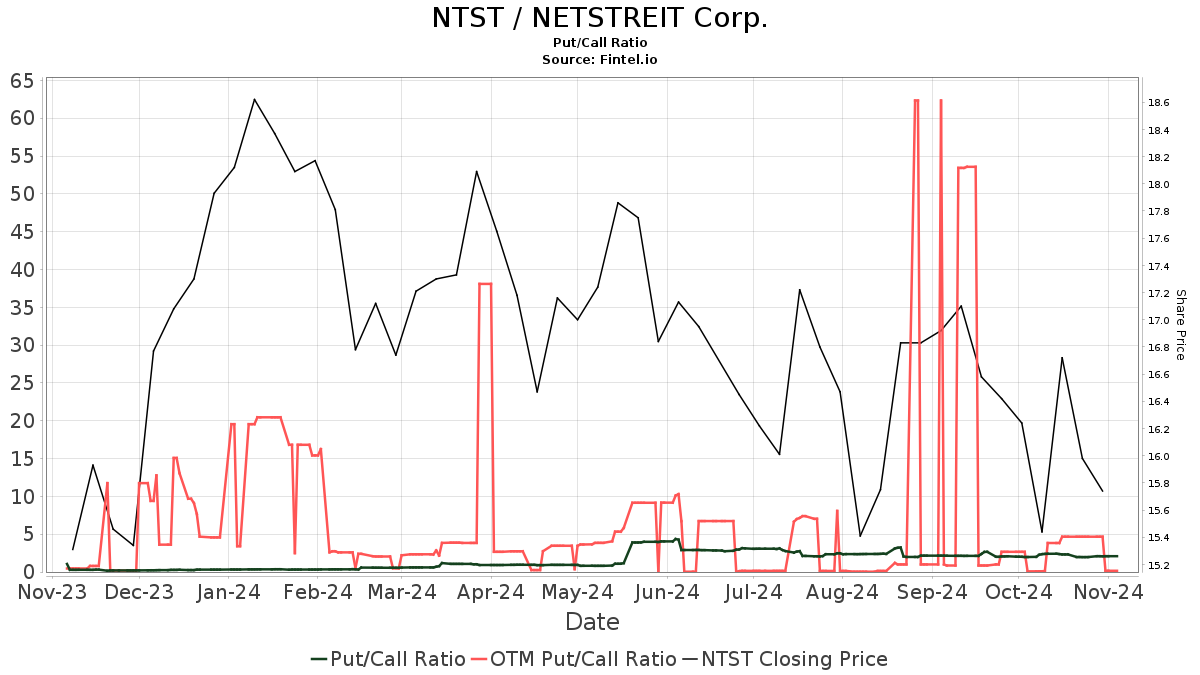

Currently, 406 funds or institutions hold positions in NETSTREIT, increased by 17 owners or 4.37% in just the last quarter. The average fund allocation for NTST has grown to 0.18%, a rise of 17.86%, with total institutional shares up by 7.09% to 115,388,000 shares. However, the current put/call ratio of 1.95 shows a bearish sentiment among investors.

Recent Movements Among Major Shareholders

Cohen & Steers owns 9,231,000 shares, amounting to 11.31% of NETSTREIT; however, this is a 2.89% decrease from their previous holding of 9,498,000 shares. Their portfolio allocation in NTST has decreased by 14.69% over the last quarter.

T. Rowe Price Investment Management increased its holdings to 5,437,000 shares, representing 6.66% ownership, a rise of 6.44% compared to their former holding of 5,087,000 shares, though their allocation decreased by 3.37% over the last quarter.

Long Pond Capital reduced its stake to 4,982,000 shares (6.11% ownership), down 19.78% from 5,967,000 shares. They also decreased their portfolio allocation in NTST by 31.70% over the last quarter.

Deutsche Bank AG increased its holdings from 2,998,000 shares to 4,818,000 shares, a significant rise of 37.77%. Nonetheless, they reduced their portfolio allocation by 71.59% recently.

CSEIX – Cohen & Steers Real Estate Securities Fund remains stable with 4,064,000 shares, representing 4.98% ownership, with no change this quarter.

Understanding NETSTREIT

(This description is provided by the company.)

NETSTREIT is a Real Estate Investment Trust (REIT) located in Dallas, Texas, focusing on the acquisition of single-tenant net lease retail properties across the United States. The firm maintains a portfolio of high-quality properties leased to tenants resilient to e-commerce challenges, all supported by robust financial health. With a management team skilled in commercial real estate, NETSTREIT strives to build a leading net lease retail portfolio, generating reliable cash flows and dividends for its investors.

Fintel serves as a comprehensive investment research platform catering to individual investors, traders, financial advisors, and small hedge funds.

Our resources span global financial data and cover fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, and much more. Our exclusive stock picks leverage advanced quantitative models aimed at enhancing profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.