Scotiabank Sets Positive Outlook for Avidity Biosciences Stock

Fintel reports that on March 7, 2025, Scotiabank initiated coverage of Avidity Biosciences (NasdaqGM:RNA) with a Sector Outperform recommendation.

Analyst Price Forecast Indicates Significant Potential Upside

As of March 5, 2025, the average one-year price target for Avidity Biosciences is $68.71 per share. Forecasts range from a low of $51.51 to a high of $100.80, representing an overall potential increase of 126.84% from its latest reported closing price of $30.29 per share.

See our leaderboard of companies with the largest price target upside.

Projected Financial Performance

The projected annual revenue for Avidity Biosciences is expected to reach $8 million, reflecting a decrease of 22.76%. The anticipated annual non-GAAP EPS is predicted to be -3.53.

Current Fund Sentiment

There are currently 540 funds or institutions reporting holdings in Avidity Biosciences, which is unchanged from the previous quarter. The average portfolio weight dedicated to RNA shares is 0.22%, having increased by 27.51%. Total institutional shares owned rose by 2.09% in the last three months, totaling 142,783K shares.

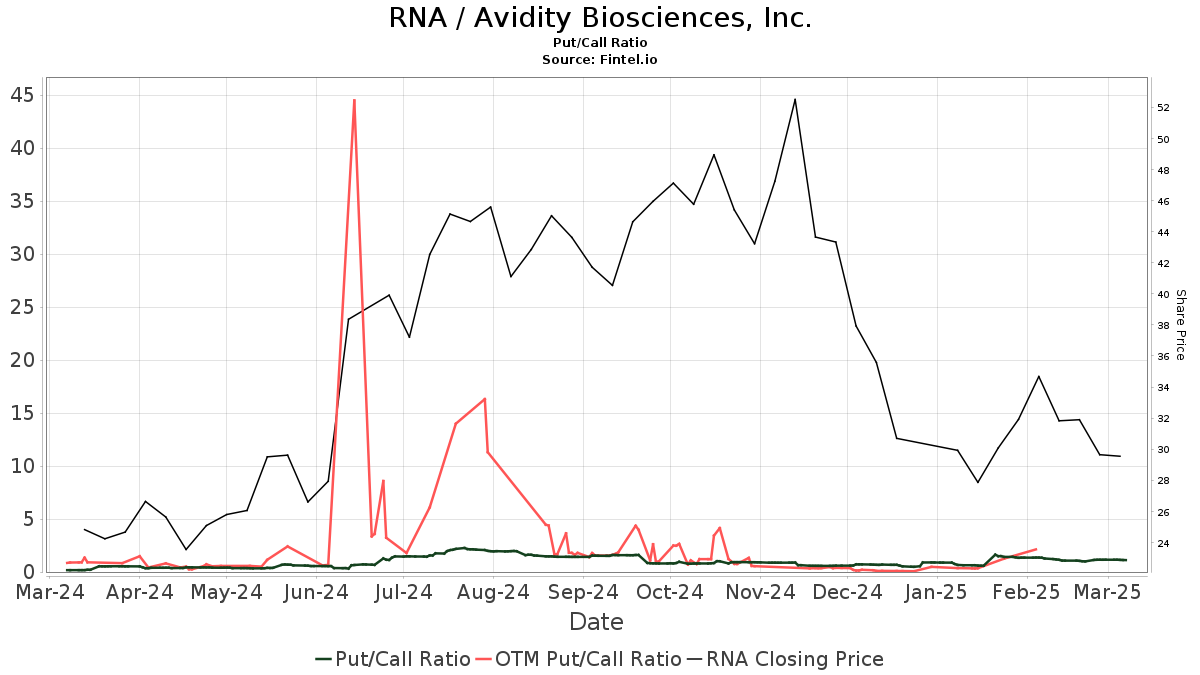

The put/call ratio for RNA is currently 1.12, indicating a bearish sentiment among investors.

Institutional Shareholder Movements

And now for some notable investors: Price T Rowe Associates holds 11,043K shares, which translates to 9.19% ownership of the company. This represents a 3.70% increase from their previous holding of 10,634K shares, although their portfolio allocation decreased by 34.17% last quarter.

Wellington Management Group LLP owns 8,106K shares, encompassing 6.74% ownership. Their previous filing indicated possession of 7,031K shares, reflecting a 13.26% increase, yet they cut their portfolio allocation by 89.32% in the last quarter.

Rtw Investments holds 7,933K shares for 6.60% ownership, a decrease of 2.52% from their last report of 8,133K shares, while also reducing allocation by 35.46% over the last quarter.

Avoro Capital Advisors has a stake of 7,500K shares, equating to 6.24% ownership, up 8.33% from 6,875K shares held previously. Their portfolio allocation has decreased by 33.00%.

Lastly, Janus Henderson Group holds 7,053K shares, accounting for 5.87% ownership. This is a 30.58% increase from the 4,896K shares reported before, despite a 66.40% reduction in their overall portfolio allocation in RNA.

Avidity Biosciences Overview

(This description is provided by the company.) Avidity Biosciences, Inc. strives to change lives through a new class of therapies known as Antibody Oligonucleotide Conjugates (AOCs). These therapies aim to overcome existing limitations associated with oligonucleotide treatments, addressing a wide range of serious diseases. Avidity’s proprietary AOC platform integrates the tissue selectivity of monoclonal antibodies with the precision of oligonucleotide therapies. This allows for targeting of previously undruggable tissues and genetic drivers of diseases. The lead candidate, AOC 1001, aims to treat myotonic dystrophy type 1, while the company’s other projects target Duchenne muscular dystrophy, facioscapulohumeral muscular dystrophy, Pompe disease, and muscle atrophy, among others. Additionally, they have research initiatives focused on immune, cardiac, and various other cell types.

Fintel is a comprehensive investing research platform that serves individual investors, traders, financial advisors, and small hedge funds.

Our data spans the globe and includes fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Our exclusive stock picks are driven by advanced, backtested quantitative models aimed at enhancing profits.

Click to learn more.

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.