Scotiabank Initiates Coverage of Gain Therapeutics with Positive Outlook

Fintel reports that on March 7, 2025, Scotiabank began covering Gain Therapeutics (NasdaqGM:GANX) with a Sector Outperform recommendation.

Analyst Price Forecast Indicates Significant Potential Upside

As of March 4, 2025, analysts suggest an average one-year price target of $7.48 per share for Gain Therapeutics. Projections vary, with forecasts ranging from a low of $5.05 to a high of $10.50. This average price target represents an impressive potential upside of 297.87% from its recent closing price of $1.88 per share.

See our leaderboard for companies with the largest price target upside.

Projected Financials for Gain Therapeutics

The anticipated annual revenue for Gain Therapeutics is forecasted at $0 million, translating to an increase of ∞%. Additionally, the expected annual non-GAAP earnings per share (EPS) stands at -1.47.

Fund Sentiment and Institutional Investing

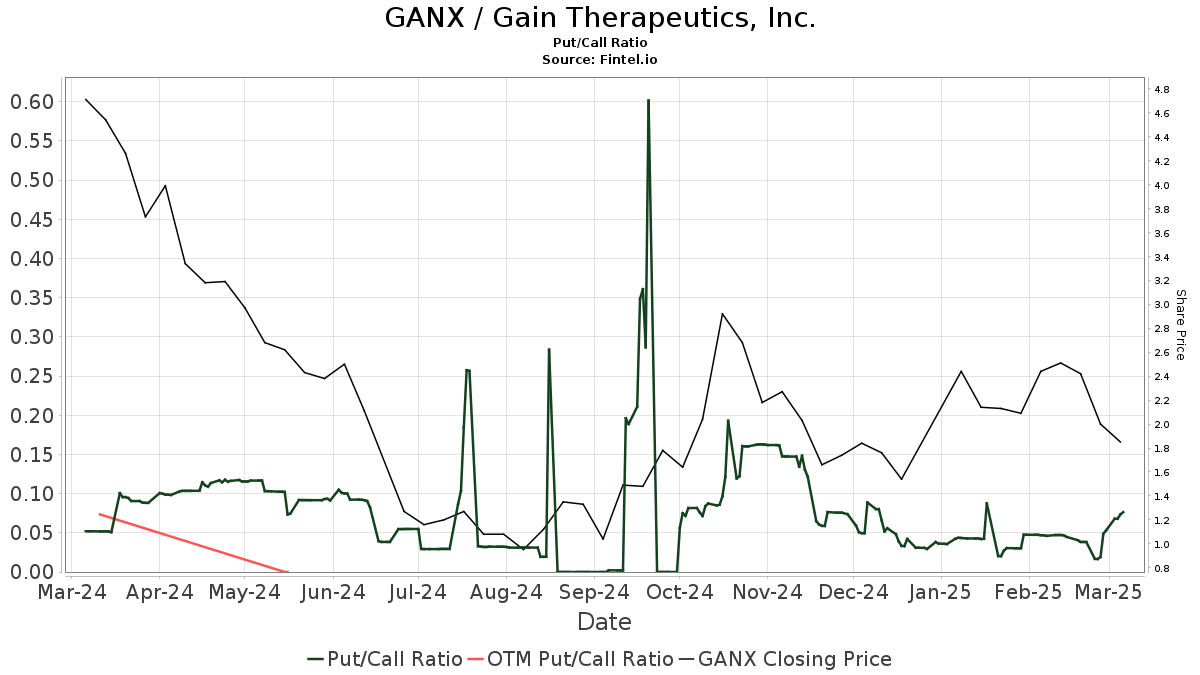

Currently, there are 35 funds or institutions reporting positions in Gain Therapeutics. This is an increase of 5 shareholders, representing a 16.67% rise from the last quarter. The average portfolio weight of all funds in GANX is 0.00%, reflecting a 27.15% increase. Over the past three months, total shares owned by institutions have risen by 18.94%, totaling 2,296,000 shares.  The put/call ratio for GANX is 0.09, indicating a bullish market sentiment.

The put/call ratio for GANX is 0.09, indicating a bullish market sentiment.

Recent Activities of Other Shareholders

DME Capital Management remains steady with 566,000 shares, reflecting 2.13% ownership with no change over the last quarter. Geode Capital Management holds 267,000 shares, accounting for 1.01% ownership. The firm reported a decrease from 272,000 shares, representing a 1.70% decline, but increased its portfolio allocation in GANX by 14.18% over the last quarter.

Vanguard Extended Market Index Fund (VEXMX) holds 168,000 shares, or 0.63% ownership. This marks an increase from 136,000 shares, showing a growth of 19.01%, and a 44.50% rise in portfolio allocation in GANX over the past quarter.

Gotham Asset Management shows a decrease to 158,000 shares, making up 0.60% ownership from a previous holding of 335,000 shares, indicating a drop of 111.56%. The fund reduced its portfolio allocation in GANX by 53.57% in the last quarter.

Fidelity Extended Market Index Fund (FSMAX) increased its holdings to 143,000 shares, equating to 0.54% ownership. Previously, it owned 85,000 shares, reflecting a 40.70% increase, with a 170.59% rise in its allocation to GANX over the last quarter.

Overview of Gain Therapeutics

Gain Therapeutics Background Information

(This description is provided by the company.)

Gain Therapeutics, Inc. is changing the landscape of drug discovery through its see-Tx™ target identification platform. This innovative approach discovers and optimizes allosteric binding sites previously overlooked, seeking new treatment pathways for challenging conditions associated with protein misfolding. In July 2020, Gain Therapeutics completed a share exchange with Gain Therapeutics, SA, a Swiss corporation, establishing GT Gain Therapeutics SA as a wholly owned subsidiary.

Fintel is recognized as one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers a global landscape and includes fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, unusual options trades, and extensive data analysis. Additionally, our exclusive Stock picks leverage advanced, backtested quantitative models aimed at enhancing profits.

Click to Learn More.

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.