Scotiabank Initiates Coverage of Meta Platforms, Suggests Caution Ahead

On October 11, 2024, Scotiabank began coverage of Meta Platforms (BIT:1FB) with a Sector Perform recommendation.

Analyst Price Forecast Indicates Potential Decline

The average one-year price target for Meta Platforms, as of September 25, 2024, is €522.43 per share. Predictions vary significantly, with estimates ranging from a low of €236.77 to a high of €624.84. This average target suggests a decline of 2.64% from its latest closing price of €536.60 per share.

Check out our leaderboard for companies with the largest price target upside.

Funding Outlook Shows Positive Growth

Meta Platforms is projected to achieve annual revenue of €154,048 million, reflecting a 2.85% increase. The anticipated annual non-GAAP EPS stands at 17.74.

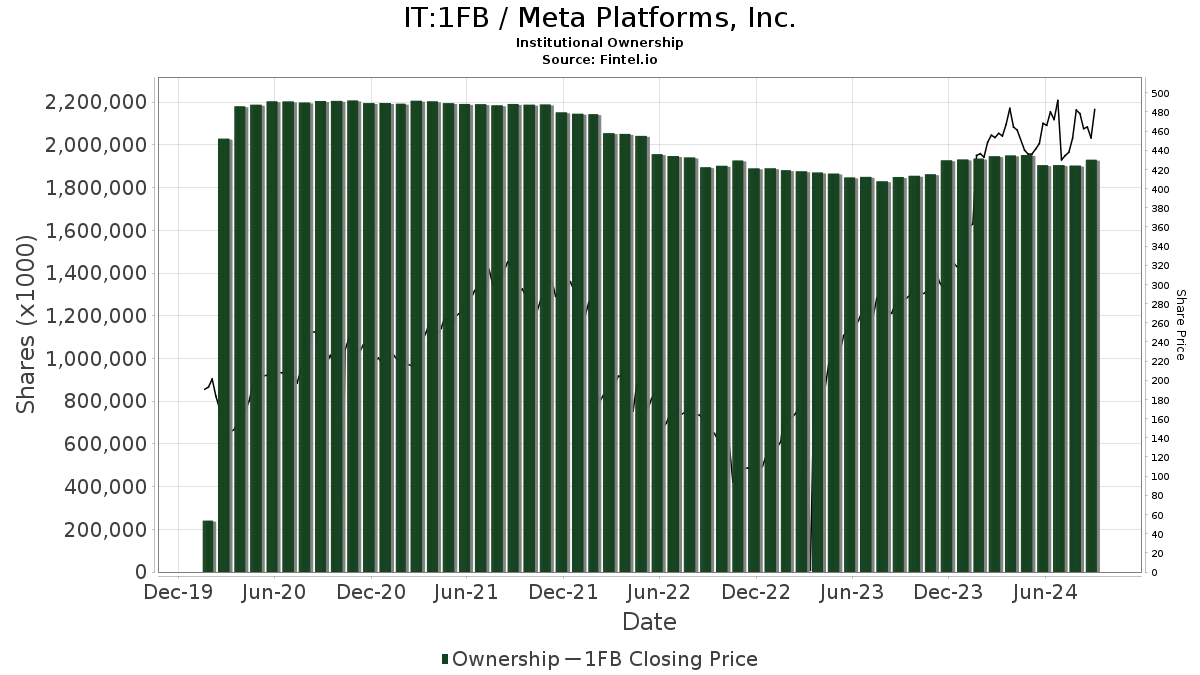

Fund Sentiment Towards Meta Platforms

A total of 6,002 funds and institutions currently hold positions in Meta Platforms. This marks an increase of 91 owners or 1.54% in the last quarter. The average portfolio weight for all funds dedicated to 1FB is 1.73%, which is up by 2.47%. In the past three months, total institutional shares held rose by 3.45%, reaching 1,933,250,000 shares.

Actions of Major Shareholders

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 69,230,000 shares, representing 3.17% of the company. Previously, they reported owning 69,157,000 shares, indicating a 0.11% increase in their holdings. Their portfolio allocation in 1FB saw an increase of 1.08% over the last quarter.

The Vanguard 500 Index Fund Investor Shares (VFINX) has 56,245,000 shares, or 2.57% ownership. In their last filing, they reported 55,443,000 shares, showing a 1.43% increase, yet their portfolio allocation decreased by 0.28% this quarter.

JPMorgan Chase owns 52,228,000 shares, constituting 2.39% of ownership. Their previous report listed 50,183,000 shares, showcasing a 3.92% increase and a 4.95% rise in portfolio allocation in the last quarter.

Geode Capital Management’s stake amounts to 47,462,000 shares, representing 2.17% ownership. This is an increase from 46,413,000 shares, reflecting a 2.21% growth in their holdings, with a 0.73% increase in portfolio allocation over the last quarter.

Price T Rowe Associates possesses 41,709,000 shares, indicating 1.91% ownership. Their previous report indicated 43,118,000 shares, marking a 3.38% decrease in ownership and a 1.94% drop in their portfolio allocation in the last quarter.

Fintel stands as one of the most extensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our platform provides global coverage on various aspects such as fundamentals, analyst reports, ownership data, and fund sentiment, along with insights into options sentiment and trading activities.

Click to Learn More

This article originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.