Scotiabank Initiates Coverage on PTC Therapeutics with Sector Perform Rating

Fintel reports that on March 7, 2025, Scotiabank began coverage of PTC Therapeutics (NasdaqGS:PTCT) with a Sector Perform recommendation.

Analyst Price Forecast Indicates 20.70% Upside Potential

As of March 5, 2025, analysts have set an average one-year price target for PTC Therapeutics at $63.48 per share. Predictions vary significantly, with a low estimate of $41.41 and a high of $118.65. This average price target signifies a potential increase of 20.70% from the latest closing price of $52.59 per share.

See our leaderboard of companies with the highest price target upside.

Revenue and Earnings Projections

Projected annual revenue for PTC Therapeutics is estimated at $1,081 million, reflecting an increase of 33.99%. Meanwhile, the annual non-GAAP EPS is projected to be -$3.63.

Investors’ Sentiment Analysis

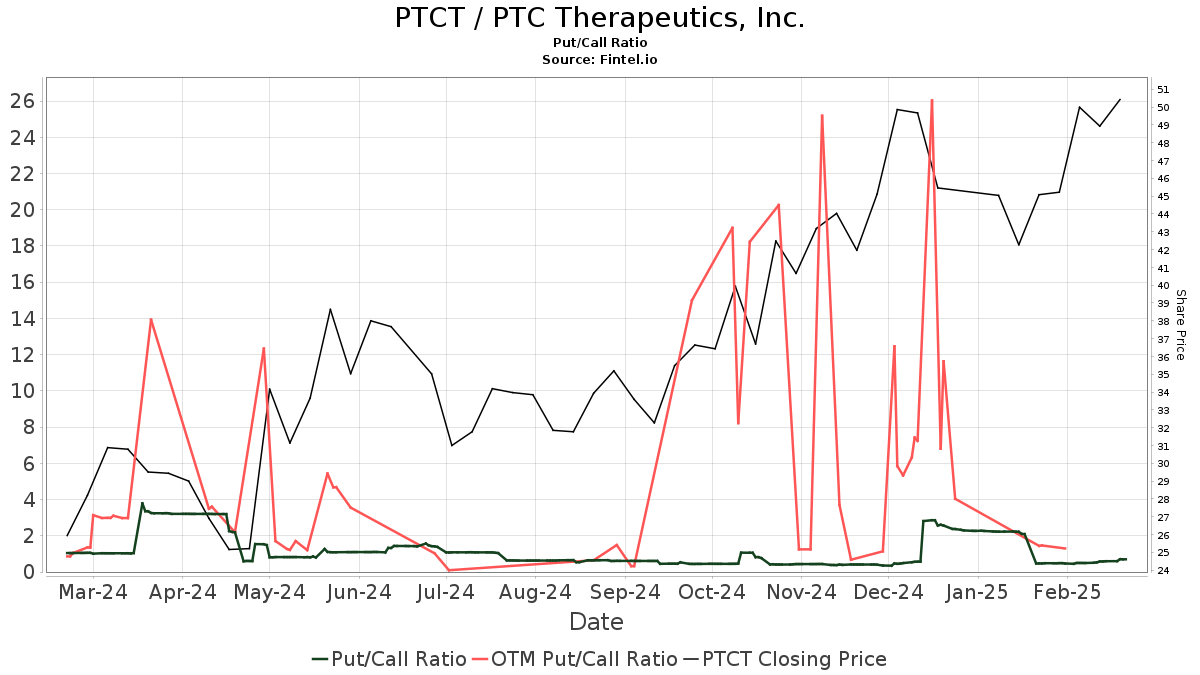

Currently, there are 512 funds or institutions reporting positions in PTC Therapeutics, a notable increase of 48, or 10.34%, from the previous quarter. The average portfolio weight of all funds invested in PTCT is 0.16%, an increase of 6.43%. However, total shares owned by institutions decreased by 2.03% over the last three months to 86,913K shares.  The current put/call ratio of PTCT stands at 0.78, suggesting a bullish market outlook.

The current put/call ratio of PTCT stands at 0.78, suggesting a bullish market outlook.

Shareholder Activity Review

Rtw Investments retains 7,393K shares, which equates to 9.37% ownership of the company, with no changes noted in the last quarter.

Meanwhile, Armistice Capital owns 6,378K shares, representing 8.09% of PTC Therapeutics. This marks a decrease of 13.44% from the 7,235K shares reported previously, resulting in an 8.50% reduction in portfolio allocation.

Wellington Management Group LLP holds 4,787K shares, now constituting 6.07% ownership. This reflects a significant drop of 64.88% from the last report of 7,893K shares, resulting in an 89.20% decrease in portfolio allocation related to PTCT.

The VGHCX – Vanguard Health Care Fund Investor Shares owns 4,026K shares, which represent 5.10% ownership, although this is a minor decrease of 3.56% from the prior holding of 4,169K shares. The firm has, however, increased its portfolio allocation in PTCT by 21.67% over the previous quarter.

Lastly, Toronto Dominion Bank has acquired 3,287K shares, representing 4.17% ownership, a substantial increase from its previous position of 0K shares.

About PTC Therapeutics

PTC Therapeutics Background Information

(This description is provided by the company.)

PTC is a biopharmaceutical company that emphasizes scientific innovation, committed to discovering and developing clinically differentiated medicines aimed at rare disorders. The company focuses on global commercialization of its products as it invests in a diverse pipeline of transformative treatments, striving to provide access to best-in-class therapies for patients with significant medical needs. PTC aims to leverage its strong scientific foundation and commercial expertise to enhance value for patients and stakeholders alike.

Fintel serves as one of the most comprehensive investing research platforms, offering data that includes fundamentals, analyst reports, ownership insights, options analysis, insider trading tracking, and more. Our exclusive Stock picks utilize advanced, backtested quantitative models designed to optimize profits.

Click to Learn More.

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.