Scotiabank Lowers T-Mobile US Outlook Amid Mixed Investor Sentiment

The global financial landscape shifts as Scotiabank revises its stance on T-Mobile US (LSE:0R2L) from Sector Outperform to Sector Perform as of October 18, 2024.

Analysts Predict Minor Decline in Stock Price

The average one-year price forecast for T-Mobile US, as of September 25, 2024, stands at 217.43 GBX/share. Predictions vary widely, with estimates ranging from a low of 144.53 GBX to a high of 272.26 GBX. This average indicates a slight expected drop of 0.73% from its most recent closing price of 219.02 GBX/share.

Solid Revenue Growth Expected

T-Mobile US is projected to generate annual revenue of 85,315MM, reflecting a healthy growth rate of 7.86%. Furthermore, the expected annual non-GAAP EPS is estimated at 9.79.

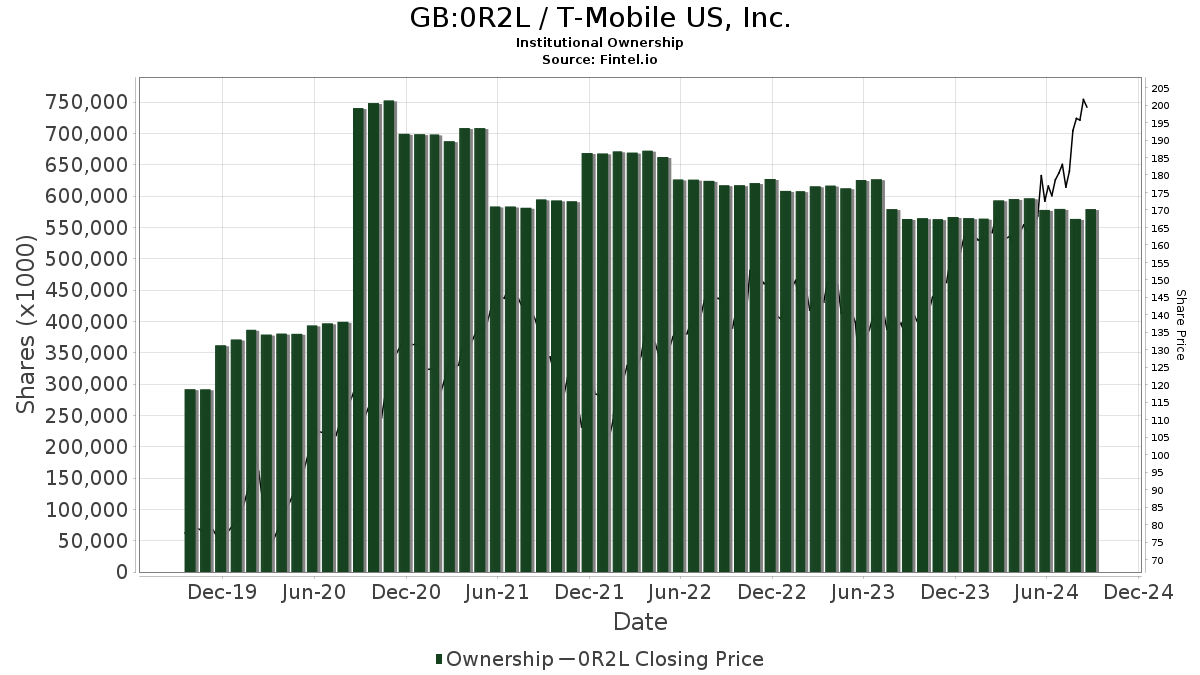

Institutional Investment Trends

Currently, 2,507 funds or institutions hold positions in T-Mobile US, marking an increase of 82 owners or 3.38% from the previous quarter. The average portfolio weight across these funds dedicated to 0R2L is 0.50%, up by 0.83%. Over the last three months, total institutional shares owned rose by 2.70%, totaling 579,966K shares.

Notable Shareholder Moves

Softbank Group currently possesses 85,361K shares, constituting 7.32% ownership of T-Mobile US. This marks a decrease from the 92,090K shares reported in a previous filing, representing a drop of 7.88%. Additionally, the firm has cut its portfolio allocation in 0R2L by 0.66% in the last quarter.

Price T Rowe Associates holds 24,311K shares, amounting to 2.08% ownership. This is a significant decrease from the previous quarter’s 30,441K shares, reflecting a drop of 25.21%. Their allocation in 0R2L was reduced by 15.84% over the last quarter.

Invesco QQQ Trust, Series 1 has increased its holdings with 22,570K shares, representing 1.93% ownership. Their prior filing cited 22,247K shares, indicating a small increase of 1.43%. However, the firm reduced its portfolio allocation in 0R2L by 1.43% in the last quarter.

Vanguard Total Stock Market Index Fund Investor Shares holds 16,660K shares, or 1.43% of the company. This shows a slight decrease from the earlier reported 16,763K shares, down by 0.61%, yet it has increased their portfolio allocation by 4.32% in the last quarter.

Norges Bank revealed a substantial increase in its holdings, acquiring 15,146K shares after previously having none, which translates to a complete 100.00% increase.

Fintel serves as a leading platform for investing research, providing essential data for individual investors, traders, financial advisors, and small hedge funds.

Our extensive global data covers fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, and more, all enhanced through advanced quantitative models for better profitability.

Click to Learn More

This article originally appeared on Fintel.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.