Scotiabank Rates Amazon.com as a “Sector Outperform”

On October 11, 2024, Scotiabank began tracking Amazon.com (WSE:AMZN) and issued a Sector Outperform rating for the tech giant.

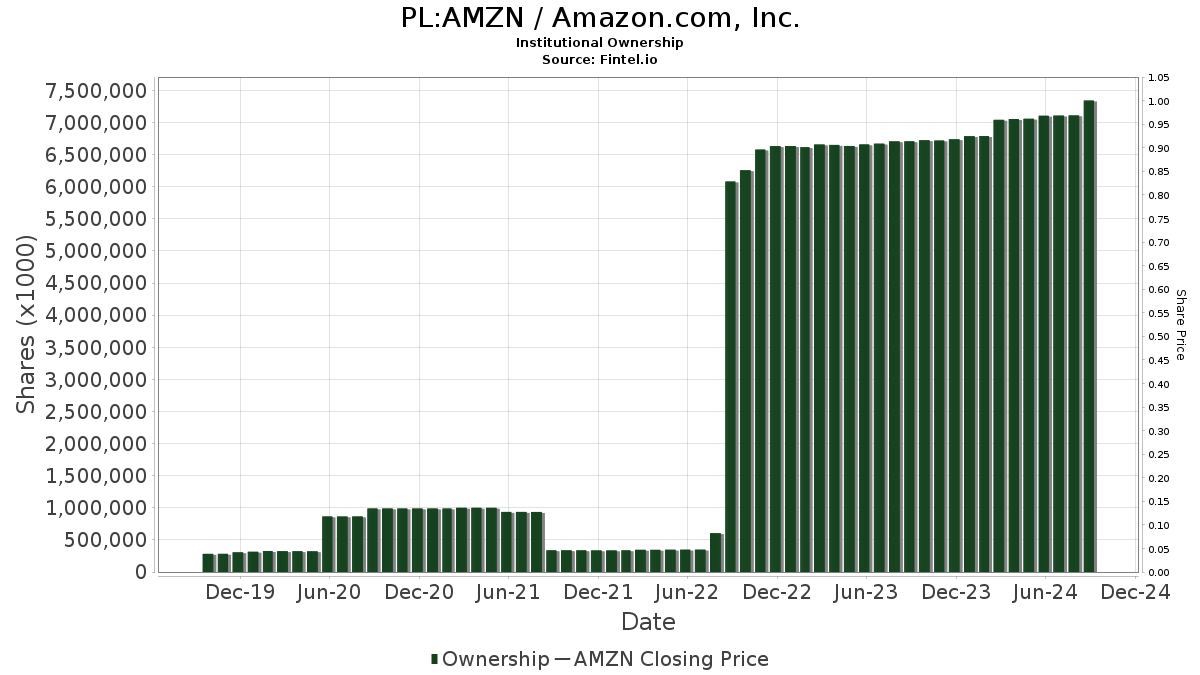

Increasing Fund Interest in Amazon.com

Currently, 6,846 funds or institutions have reported holding positions in Amazon.com. This marks an increase of 132 new owners, or 1.97%, over the previous quarter. Overall, the average portfolio weight for all funds invested in AMZN is 2.50%, showing a rise of 0.57%. In the past three months, total shares owned by institutions have increased by 5.67%, reaching 7,337,459K shares.

Institutional Shareholder Activity

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares now holds 295,886K shares, which represents 2.82% ownership of Amazon. In its last filing, this fund reported ownership of 293,875K shares, indicating an increase of 0.68%. Furthermore, the firm’s allocation to AMZN grew by 4.90% in the last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares has reported ownership of 235,043K shares, equivalent to 2.24% of Amazon. This is an increase from 230,356K shares, showing a growth rate of 1.99%. The firm raised its portfolio allocation in AMZN by 3.48% over the last quarter.

Geode Capital Management’s holdings grew to 193,369K shares, reflecting 1.84% ownership. Previously, they held 187,843K shares, thus achieving an ownership boost of 2.86%. This firm’s allocation in AMZN increased by 4.66% last quarter.

Price T Rowe Associates holds 181,610K shares, which accounts for 1.73% ownership. Their earlier filing noted ownership of 189,705K shares, indicating a decrease of 4.46%. However, their allocation in AMZN still rose very slightly by 0.13% in the last quarter.

Lastly, J.P. Morgan Chase now owns 172,868K shares, representing 1.65% of the company. Their previous filing recorded ownership of 171,742K shares, marking an increase of 0.65%. Their allocation in AMZN was raised by 4.72% over the last quarter.

Fintel stands out as a top investment research platform catering to individual investors, traders, financial advisors, and smaller hedge funds.

Our extensive data includes global market fundamentals, analyst reports, ownership statistics, investment sentiment, insider trading details, options flow, and much more. Moreover, our unique stock recommendations are informed by advanced, backtested quantitative models aimed at enhancing profitability.

Click to Learn More

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.