Seaport Global Rates QUALCOMM Neutral with Positive Price Forecast

Fintel reports that on May 9, 2025, Seaport Global initiated coverage of QUALCOMM (BIT:1QCOM) with a Neutral recommendation.

Analyst Price Forecast Indicates 31.29% Upside

As of May 6, 2025, the average one-year price target for QUALCOMM is €163.01 per share. Predictions range from a low of €125.32 to a high of €251.25. This average target suggests a potential increase of 31.29% from its latest reported closing price of €124.16 per share.

Fundamentals and Financial Projections

The projected annual revenue for QUALCOMM stands at €41,369 million, reflecting a decrease of 2.17%. Furthermore, the anticipated annual non-GAAP EPS is 10.30.

Current Fund Sentiment

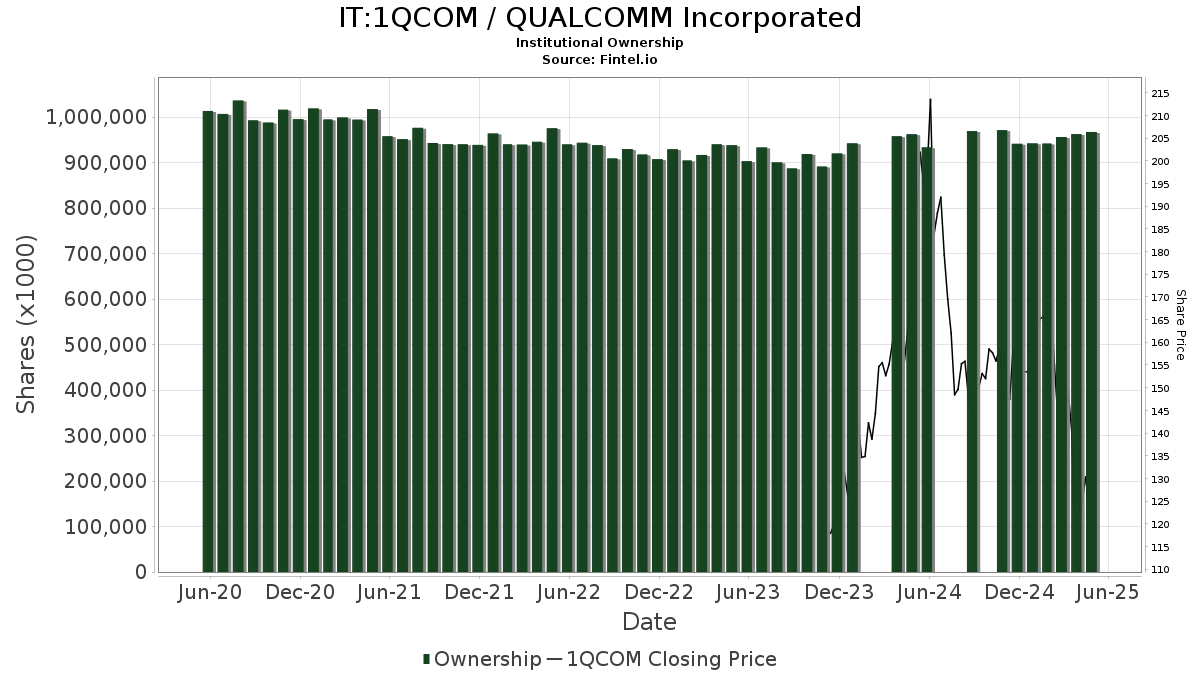

Currently, 4,226 funds or institutions report holdings in QUALCOMM, an increase of 113, or 2.75%, over the last quarter. The average portfolio weight allocated to 1QCOM by these funds is 0.49%, which marks an increase of 4.32%. Total shares owned by institutions rose by 2.08% in the past three months, reaching 967,449K shares.

Institutional Shareholder Activity

Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 34,803K shares, accounting for 3.17% ownership of QUALCOMM. This is a decrease from its previous holding of 35,310K shares, showing a reduction of 1.46%. The Vanguard fund cut its allocation to 1QCOM by 12.25% in the last quarter.

Vanguard 500 Index Fund Investor Shares (VFINX) owns 30,073K shares, representing 2.74% ownership. Previously, it held 29,177K shares, reflecting an increase of 2.98%. Nonetheless, this fund also reduced its portfolio allocation in 1QCOM by 11.91% over the last quarter.

Geode Capital Management has 27,799K shares, amounting to 2.53% ownership, up from 27,128K shares, which is a 2.41% increase. However, it significantly cut its portfolio allocation in 1QCOM by 11.34% recently.

Invesco QQQ Trust, Series 1, now owns 22,536K shares, representing 2.05% ownership, up from 21,635K, an increase of 4.00%. This fund also decreased its portfolio allocation in 1QCOM by 13.09% last quarter.

Norges Bank has reported newly acquiring 17,718K shares, now owning 1.61% of QUALCOMM, up from 0K shares previously, marking a 100.00% increase.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.