Seaport Global Initiates Neutral Coverage on QUALCOMM Amid Fund Activity

Fintel reports that on May 9, 2025, Seaport Global initiated coverage of QUALCOMM (BMV:QCOM) with a Neutral recommendation.

Fund Sentiment Analysis

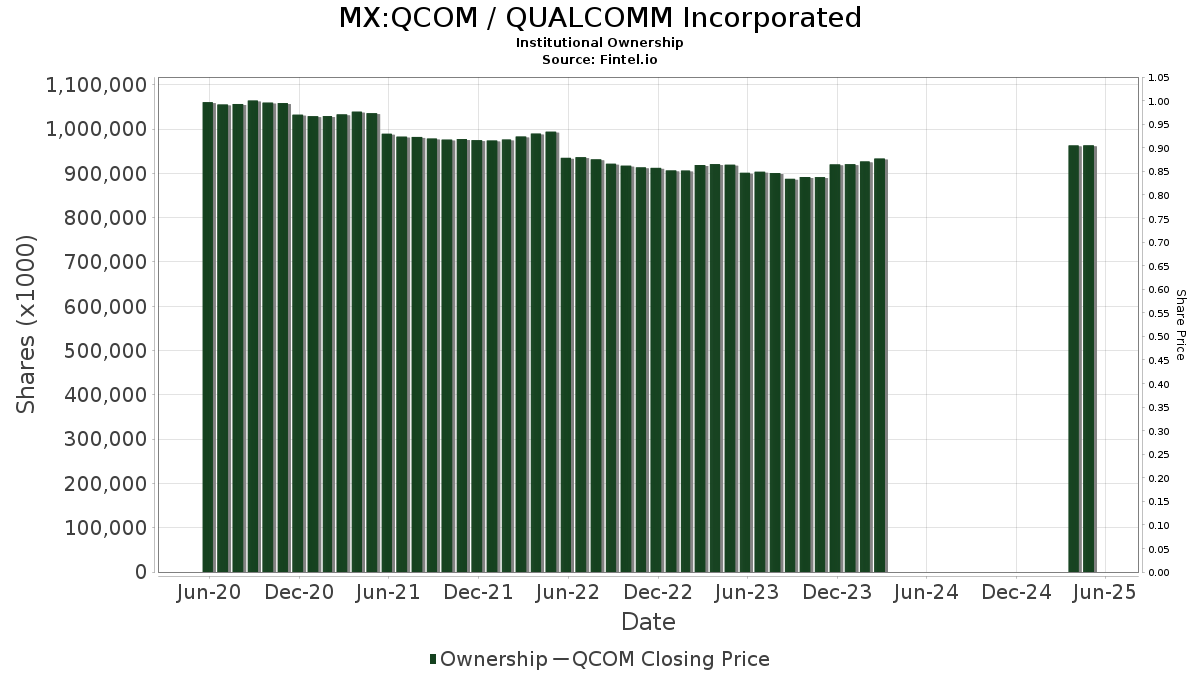

A total of 3,152 funds or institutions are currently reporting positions in QUALCOMM, reflecting an increase of 130 owners, or 4.30%, compared to the previous quarter. The average portfolio weight of all funds dedicated to QCOM stands at 0.82%, showing a rise of 15.87%. Furthermore, total shares held by institutions increased by 0.48% over the last three months, amounting to 1,018,999K shares.

Activity Among Major Shareholders

The Vanguard Total Stock Market Index Fund (VTSMX) holds 34,803K shares, representing 3.06% ownership of QUALCOMM. This is a decrease from the 35,310K shares previously reported, indicating a decline of 1.46%. The allocation to QCOM within its portfolio has decreased by 12.25% over the last quarter.

The Vanguard 500 Index Fund (VFINX) owns 30,073K shares, which accounts for 2.65% of the company. This represents an increase from the earlier 29,177K shares, marking a growth of 2.98%. However, its portfolio allocation in QCOM has decreased by 11.91% over the past quarter.

Geode Capital Management possesses 27,799K shares, equating to 2.45% ownership. This is an increase from the previous 27,128K shares, reflecting a rise of 2.41%. Nevertheless, the firm’s portfolio allocation in QCOM has also fallen by 11.34% in the last quarter.

Invesco QQQ Trust, Series 1 holds 22,536K shares, representing 1.98% ownership, up from 21,635K shares, showing a growth of 4.00%. Like others, Invesco has seen a decline in its portfolio allocation in QCOM, dropping by 13.09% over the last quarter.

Norges Bank significantly increased its position by holding 17,718K shares, or 1.56% ownership, compared to its earlier filing of 0K shares, marking a substantial increase of 100.00%.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.