Seaport Global Initiates Coverage of NVIDIA with Sell Recommendation

Fintel reports that on April 30, 2025, Seaport Global initiated coverage of NVIDIA (NasdaqGS: NVDA) with a Sell recommendation.

Analyst Price Forecast Shows Significant Upside Potential

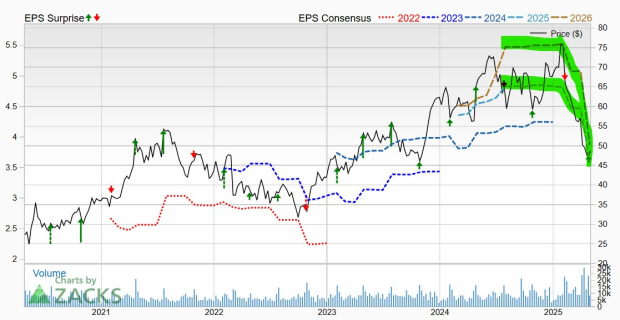

As of April 23, 2025, the average one-year price target for NVIDIA stands at $169.04 per share. Forecasts vary from a low estimate of $116.15 to a high of $247.72. This average price target indicates a potential increase of 55.40% from the most recent closing price of $108.78 per share.

The projected annual revenue for NVIDIA is $40,499 million, reflecting a decrease of 68.97%. Additionally, the estimated annual non-GAAP EPS is $7.31, down 18.98% from prior forecasts.

Institutional Sentiment Toward NVIDIA

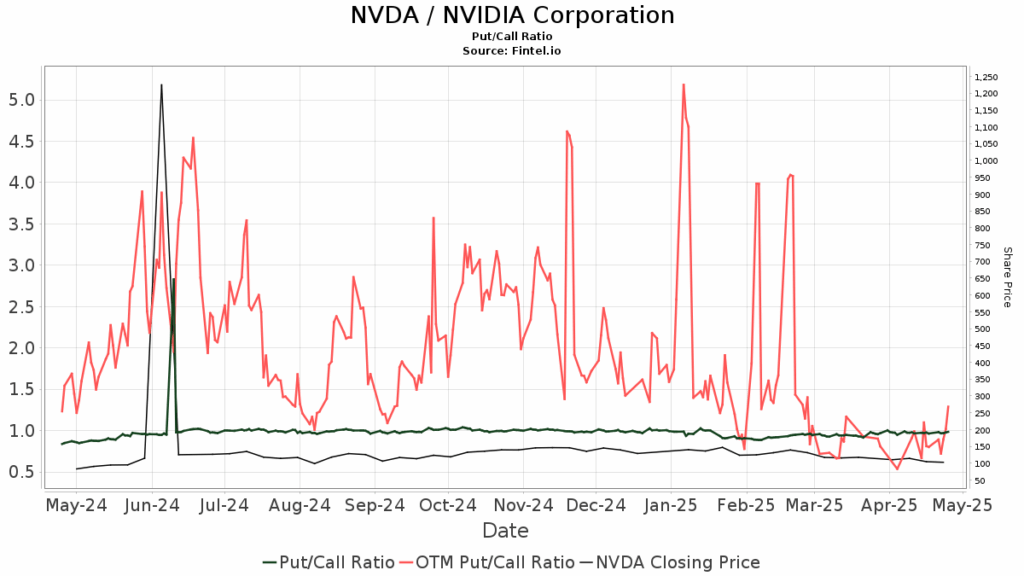

Currently, 7,260 funds or institutional investors report holdings in NVIDIA, which marks an increase of 481 owners, or 7.10%, over the last quarter. The average portfolio weight dedicated to NVDA is 3.09%, indicating a rise of 17.04%. Total institutional ownership has risen by 3.04% in the last three months, amounting to 18,235,939K shares. The put/call ratio for NVDA is 0.96, suggesting a bullish sentiment in the market.

Activity Among Major Shareholders

Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 728,901K shares, accounting for 2.99% of the company. This reflects a decrease from 740,783K shares reported in its previous filing, marking a reduction of 1.63%. The firm, however, had increased its allocation in NVDA by 7.23% over the last quarter.

Similarly, the Vanguard 500 Index Fund Investor Shares (VFINX) reports ownership of 664,005K shares, representing 2.72%. This is an increase from 644,278K shares, indicating a growth of 2.97%. The portfolio allocation for NVDA also increased by 7.82% over the last quarter.

Geode Capital Management owns 555,548K shares, representing 2.28% of NVIDIA, up from the prior 546,079K shares, which shows a growth of 1.70%. Their portfolio allocation for NVDA increased by 7.76% in the last quarter.

JPMorgan Chase holds 413,813K shares or 1.70% ownership of NVIDIA, slightly up from the previous 409,280K shares, representing a 1.10% increase. The firm’s allocation in NVDA rose by 9.56% last quarter.

Price T. Rowe Associates owns 411,329K shares, equating to 1.69% ownership. This is an increase from 407,608K shares reported earlier, marking a 0.90% rise, with a portfolio allocation increase of 11.73% over the last quarter.

NVIDIA’s Overview

(This description is provided by the company.)

NVIDIA is a leader in GPU-accelerated computing, specializing in products and platforms for key markets such as gaming, professional visualization, data centers, and automotive technology. Known for its high-performance products, NVIDIA plays a crucial role in addressing significant technological trends.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.