Seaport Global Downgrades Block’s Outlook Amid Rising Institutional Interest

Fintel reports that on May 2, 2025, Seaport Global downgraded their outlook for Block (BIT:1SQ) from Buy to Neutral.

Analyst Price Forecast Suggests 47.19% Upside

As of April 24, 2025, the average one-year price target for Block stands at €76.13 per share. This forecast ranges from a low of €45.41 to a high of €113.47. The average price target indicates a potential increase of 47.19% compared to its latest closing price of €51.72 per share.

Projected Revenue Growth

Block’s projected annual revenue is expected to reach €28,601 million, reflecting an increase of 19.49%. The non-GAAP EPS is projected at 3.20.

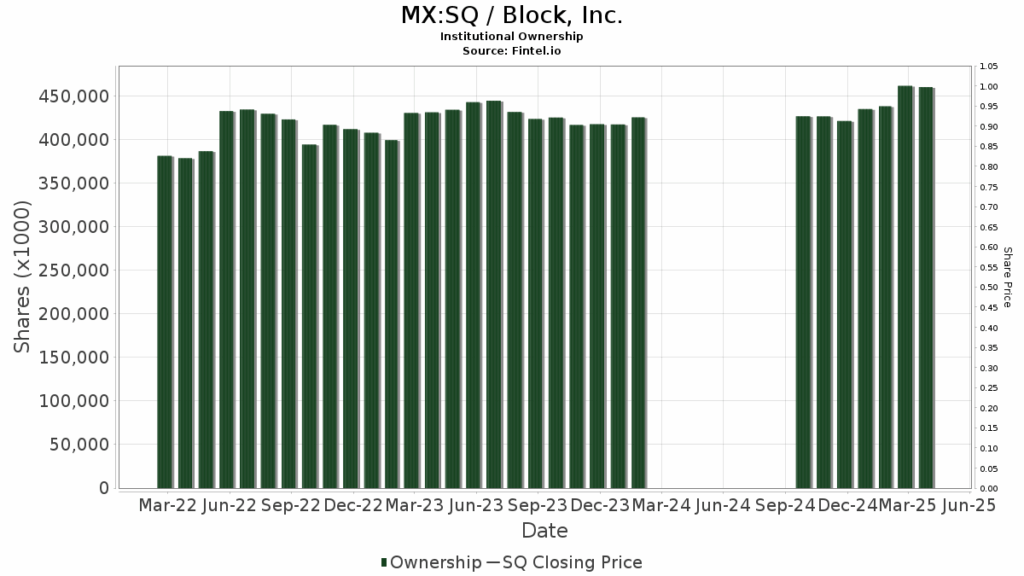

Fund Sentiment Towards Block

Currently, 1,813 funds or institutions are reporting positions in Block, marking an increase of 126 owner(s) or 7.47% in the last quarter. The average portfolio weight of all funds dedicated to 1SQ is now 0.34%, a notable increase of 105.69%. Over the past three months, total shares owned by institutions have risen by 4.72% to 458,268K shares.

Recent Moves by Major Shareholders

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 17,548K shares, representing 3.14% ownership. Previously, they reported owning 17,637K shares, showing a decrease of 0.51%. The fund has, however, increased its portfolio allocation in 1SQ by 24.14% in the last quarter.

JPMorgan Chase holds 17,237K shares, equating to 3.08% ownership. In their last filing, they noted 15,888K shares, an increase of 7.82%. Their allocation in 1SQ saw a rise of 34.59% over the past quarter.

VIMSX – Vanguard Mid-Cap Index Fund Investor Shares holds 12,028K shares, which is 2.15% ownership. They previously reported 11,757K shares, revealing an increase of 2.25%, alongside a 28.54% boost in portfolio allocation.

Baillie Gifford controls 11,168K shares, representing 2.00%. In prior filings, they owned 10,233K shares, reflecting an increase of 8.37% and a 41.87% ramp-up in their portfolio allocation.

Sands Capital Management owns 10,340K shares, or 1.85% of Block. Their previous report showed 11,228K shares, indicating a decrease of 8.59%. This firm still increased its portfolio allocation in 1SQ by 13.67% over the last quarter.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of any affiliated organizations.