Leveraging Put Options for MicroStrategy Shares: An Alternative Investment Strategy

Investors eyeing MicroStrategy Inc. (Symbol: MSTR) shares may find themselves hesitant to buy at the current market price of $311.36 per share. For those looking for alternative strategies, selling puts could offer a compelling option. One noteworthy contract is the June 2027 put option with a $50 strike price, currently featuring a bid of $9.50. By selling this put, investors can earn a premium representing a 19% return on the $50 commitment, translating to an annualized rate of 8.8% (at Stock Options Channel, we refer to this as the YieldBoost).

Understanding Put Selling and Its Implications

It is essential to understand that selling a put option does not provide the same upside potential as owning the underlying shares. The seller of the put only acquires shares if the option is exercised. The counterparty would choose to exercise the option at the $50 strike price only if it results in a better outcome than selling at the current market price. To put this in perspective, MSTR’s share price would need to fall by 83.9% for the put option to be exercised, with an effective cost basis of $40.50 per share after accounting for the premium received ($50 minus $9.50). Thus, the primary advantage for the put seller is the premium income yielding an 8.8% annualized return, unless the stock declines significantly.

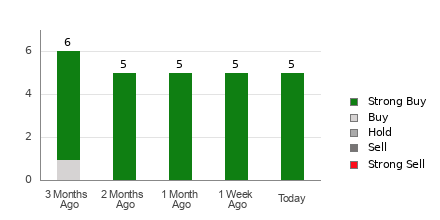

Analysis of Historical Performance

The following chart illustrates the trailing twelve-month trading history for MicroStrategy Inc., highlighting the location of the $50 strike relative to this history:

This chart, when viewed in conjunction with MicroStrategy’s historical volatility, can assist investors in determining whether the June 2027 $50 put option offers a commendable reward relative to the risks involved. Our calculations indicate that MicroStrategy’s trailing twelve-month volatility stands at 102%, based on data from the last 251 trading days, along with today’s price of $311.36. For additional put options strategies across various expirations, investors can explore the MSTR Stock Options page on StockOptionsChannel.com.

Current Market Activity

As of mid-afternoon trading on Thursday, the put volume for S&P 500 components reached 1.15 million contracts, while call volume was at 1.39 million, resulting in a put:call ratio of 0.82 for the day. This ratio is notably high compared to the long-term median of 0.65, indicating a surge in put buyers relative to call buyers in today’s options trading. To see which call and put options are stirring conversation among traders today, click here.

![]() Top YieldBoost Puts of the Nasdaq 100 »

Top YieldBoost Puts of the Nasdaq 100 »

Also see:

- FFC YTD Return

- ZMLP Videos

- CNYA YTD Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.