Investors Consider Selling Puts on Evolent Health Shares

Investors interested in purchasing shares of Evolent Health Inc (Symbol: EVH) at the current market price of $9.33 may want to explore alternative strategies, such as selling put options. One noteworthy opportunity is the June put option with a $7.50 strike price, which is currently bidding at 45 cents. By selling this put, investors can collect a premium that offers a 6% return on the $7.50 commitment, translating to an annualized rate of 22.1%, a strategy we term as the YieldBoost at Stock Options Channel.

However, it’s important to note that selling a put does not give investors the same upside potential as directly owning shares. The put seller only acquires shares if the buyer exercises the contract. For the contract to be exercised at the $7.50 strike price, it has to be more beneficial than selling at the current market price. Specifically, unless Evolent Health’s shares drop by 20.2% and the contract is exercised (resulting in an effective cost basis of $7.05 per share after accounting for the premium), the primary benefit to the put seller will be the premium received, equating to that 22.1% annualized return.

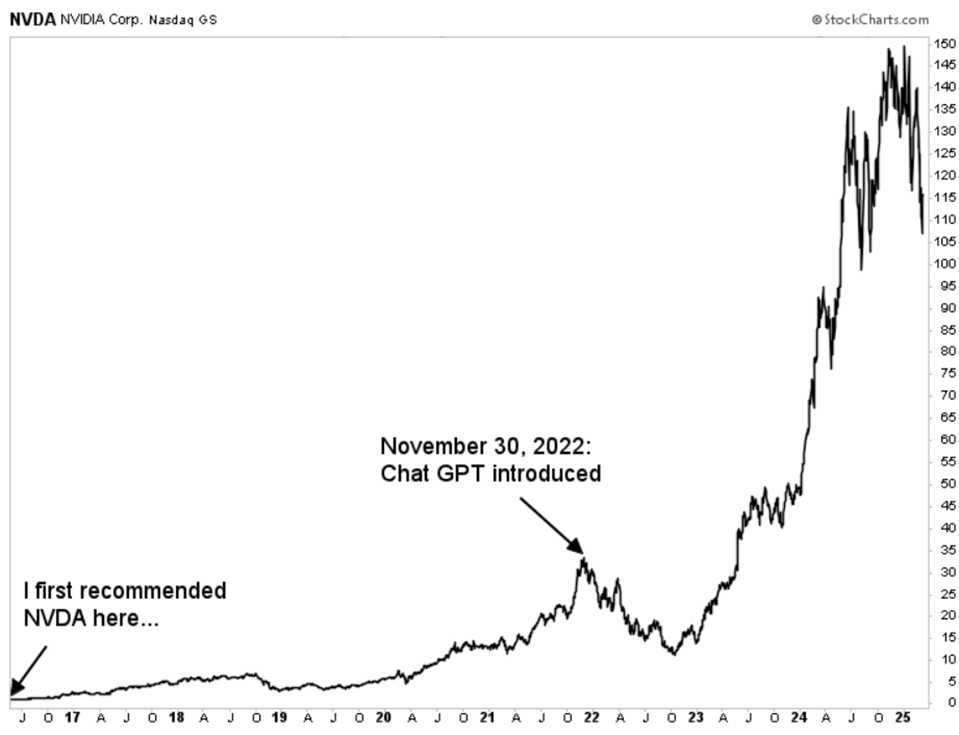

Below is a chart visualizing the trailing twelve-month trading history for Evolent Health Inc, with the $7.50 strike price highlighted in green:

The chart above, paired with Evolent Health’s historical volatility, provides insight when evaluating if selling the June put at a $7.50 strike for a 22.1% annualized return represents an acceptable risk-reward profile. The trailing twelve-month volatility for Evolent Health, based on the past 250 trading days and the current price of $9.33, stands at 85%. For additional put option strategies across various expirations, interested investors can visit the EVH Stock Options page on StockOptionsChannel.com.

As of mid-afternoon trading on Thursday, the put volume among S&P 500 components reached 1.17 million contracts, while call volume totaled 1.52 million. This leads to a put:call ratio of 0.77 for the day, reflecting an unusually high activity level compared to the long-term median ratio of 0.65. This indicates a significant increase in put buyers relative to call buyers in today’s options trading landscape. Discover which 15 call and put options are currently generating interest among traders.

![]() Top YieldBoost Puts of the S&P 500 »

Top YieldBoost Puts of the S&P 500 »

Also See:

- Institutional Holders of PSMT

- CVA Options Chain

- NTCT Average Annual Return

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.