Investors Weigh Options on Citigroup: Selling Puts at $35 Strike

For investors considering Citigroup Inc. (Symbol: C) Stock but hesitant about the current market price of $58.30 per share, an alternative strategy to explore is selling put options. One noteworthy option is the January 2027 put with a $35 strike, currently bidding at $2.41. By selling this put, an investor can secure a premium that yields a return of 6.9% on the $35 commitment, translating to a 3.9% annualized rate of return, a concept we refer to as YieldBoost at Stock Options Channel.

Understanding the Mechanics of Selling Puts

It’s essential to recognize that selling a put does not grant investors the same upside potential as owning shares. The put seller typically gains shares only if the contract is exercised—occurring only if it is financially advantageous compared to the prevailing market price. Unless Citigroup’s share price drops by 39.5%, resulting in the contract being exercised, the sole benefit for the put seller lies in collecting the premium for the annualized return of 3.9%.

Comparing Dividend Yield to Selling Puts

Interestingly, the annualized figure of 3.9% exceeds Citigroup’s current annualized dividend yield of 3.8%, based on the share price. Conversely, acquiring the Stock at the market price to receive dividends presents a higher risk. The share price would need to decrease by 39.5% to reach the $35 strike price, creating a greater downside for dividend-seeking investors.

The Unpredictability of Dividends

When discussing dividends, it’s crucial to acknowledge that they are variable and often correlate directly with a company’s profitability. Investors can refer to Citigroup’s dividend history chart below to gauge whether the latest dividend is likely to persist, which could, in turn, inform their expectations for a 3.8% annualized yield.

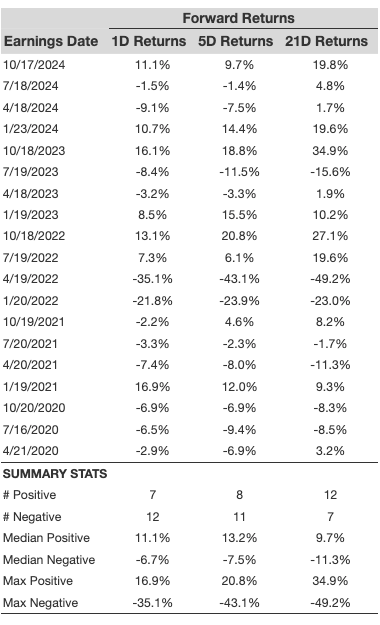

Evaluating Historical Performance

The chart below outlines Citigroup Inc.’s trailing twelve-month trading history, emphasizing the position of the $35 strike price relative to past performance:

This analysis, combined with the Stock‘s historical volatility, provides valuable insight into whether selling the January 2027 put at the $35 strike, for a 3.9% annualized return, is worthwhile considering the associated risks. The trailing twelve-month volatility for Citigroup is calculated at 33%, factoring in the last 250 trading day closing values alongside today’s price of $58.30. For an array of other put options contracts with varied expiration dates, investors can check the C Stock Options page on StockOptionsChannel.com.

Current Market Sentiment

As of mid-afternoon trading on Monday, the put volume among S&P 500 companies reached 1.80 million contracts, while call volume stood at 2.15 million. This yields a put:call ratio of 0.84 for the day, indicating an unusually high presence of put buyers compared to the long-term median ratio of 0.65, reflecting increased bearish sentiment in the options market.

![]() Top YieldBoost Puts of the S&P 500 »

Top YieldBoost Puts of the S&P 500 »

Also See:

- Historical PE Ratio

- GSBC Videos

- Funds Holding MHFI

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.