Alternatives to Buy Kellanova Shares Through Put Selling Strategies

Investors looking to acquire Kellanova (Symbol: K) while hesitant about the current market price of $82.31 per share may find value in selling put options. One notable strategy is the June put contract with a $65 strike price, currently offering a bid of 10 cents. Collecting this premium translates to a return of 0.1% based on the $65 commitment, or an annualized yield of 0.9%, referred to as the YieldBoost on Stock Options Channel.

It’s important to understand that selling a put does not provide access to Kellanova’s rising stock potential like owning shares does. The put seller only owns shares if the contract is exercised. The buyer would only opt to exercise their right at the $65 strike if it is financially advantageous compared to the prevailing market price. This means that, unless Kellanova’s shares fall by 21.1% to trigger the contract, the only benefit for the put seller is the collected premium which yields a 0.9% annualized return.

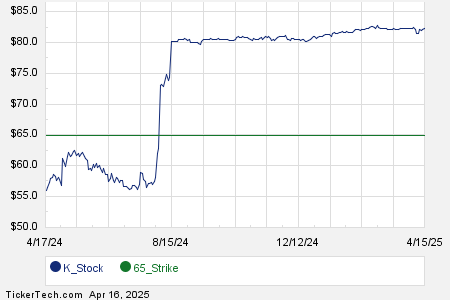

Below is a chart demonstrating Kellanova’s trailing twelve-month trading history, with the $65 strike highlighted in green:

This chart, along with Kellanova’s historical volatility, contributes to assessing whether selling the June put at the $65 strike for a 0.9% annualized return offers an acceptable reward for the associated risks. Analyzing the last 251 trading days plus today’s price of $82.31, we find Kellanova’s trailing twelve-month volatility is 22%. To explore additional put options for various expiration times, visit the K Stock Options page on StockOptionsChannel.com.

During mid-afternoon trading on Wednesday, put volume among S&P 500 components reached 1.15 million contracts, while call volume stood at 1.43 million. The resulting put:call ratio is 0.80 for the day, significantly above the long-term median ratio of 0.65. This indicates an unusual increase in put buyers in today’s options trading compared to call buyers.

![]() Top YieldBoost Puts of the S&P 500 »

Top YieldBoost Puts of the S&P 500 »

Also see:

- XNCR Options Chain

- WWJD Videos

- Lennox International shares outstanding history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.