Dividends, ah dividends – every investor’s sweet reward for their financial acumen, a tangible symbol of a successful partnership with a revered stock. The Dividend Aristocrats, the crème de la crème of income-producing stocks, represent a bastion of unwavering financial fortitude with track records spanning at least a quarter-century of consistent dividend payouts and increases. Among these esteemed members stand PepsiCo (PEP), Target (TGT), and Genuine Parts (GPC) – each offering a slice of the pie to those yearning for a steady income stream.

PepsiCo

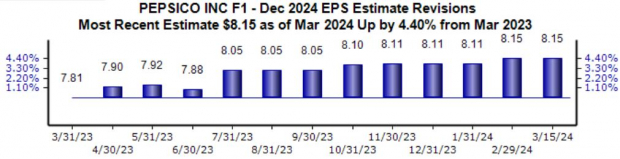

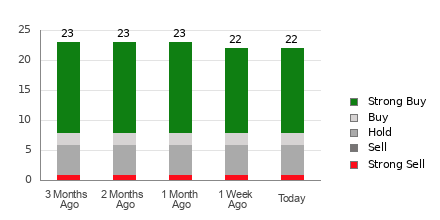

Picture a ship steadily sailing through calm waters, unmoved by the whims of the tempestuous market winds. PepsiCo, in a similar vein, has charted a steady course, with its stock value maintaining equilibrium over the past year. But behind this seemingly tranquil facade lies a revelation – a 4% surge in the Zacks Consensus EPS estimate, indicative of a quiet yet potent momentum building within the company. A testament to its commitment, PepsiCo has not only weathered the storm but flourished, with an annual 6.7% dividend growth over the past five years, offering investors a bountiful 3.1% yield annually with a conservative 66% payout ratio.

Target

Target, a beacon of resilience, has emerged as a shining star in the market constellation, outshining the S&P 500 with a commendable nearly 20% surge in value year-to-date. Its latest quarterly triumph sent shockwaves of delight through the investor community, with earnings exceeding expectations by a remarkable 20% and sales modestly surpassing the consensus. Basking in the afterglow of this victory, Target stands tall with a 2.7% annual yield and a sustainable 49% payout ratio, having raised its dividend five times in the last five years, offering investors a delectable 15% five-year annualized growth rate.

Genuine Parts

Genuine Parts, akin to a seasoned marathon runner, has sprinted ahead of the market, recording a noteworthy 11.6% gain year-to-date compared to the S&P 500’s 7.2%. Poised for success, Genuine Parts exemplifies stability with a solid 2.6% annual yield, surpassing the industry average. A feast for income seekers, Genuine Parts boasts a 5.6% five-year annualized dividend growth rate, painting a portrait of financial resilience against the backdrop of market turbulence.

Bottom Line

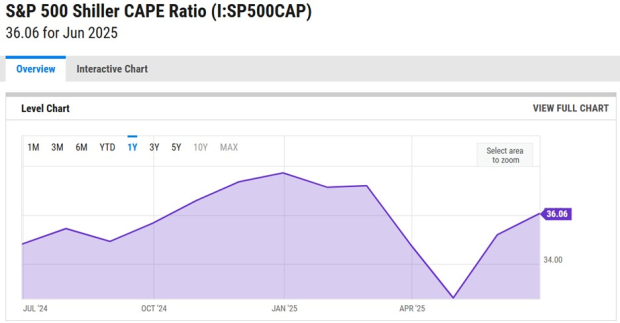

For investors seeking a harmonious blend of stability and income, Dividend Aristocrats like PepsiCo, Target, and Genuine Parts offer a tantalizing prospect. With a legacy of unwavering dividend payouts spanning over two decades, these stalwarts stand as beacons of financial reliability amidst an ever-shifting market landscape.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Target Corporation (TGT) : Free Stock Analysis Report

Genuine Parts Company (GPC) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.