In a market landscape that gyrates to the tune of fluctuating interest rates and erratic economic data, the challenge of timing bond exposures and predicting equity performance remains a daunting task for investors. Amidst this chaos, midstream MLPs emerge as a beacon of hope, offering robust yields and consistent performance while still boasting attractive valuations.

The first quarter witnessed a robust rally in equities, particularly within the energy sector. However, it was the midstream master limited partnerships (MLPs) that outshined, edging past the broader energy sector in terms of performance.

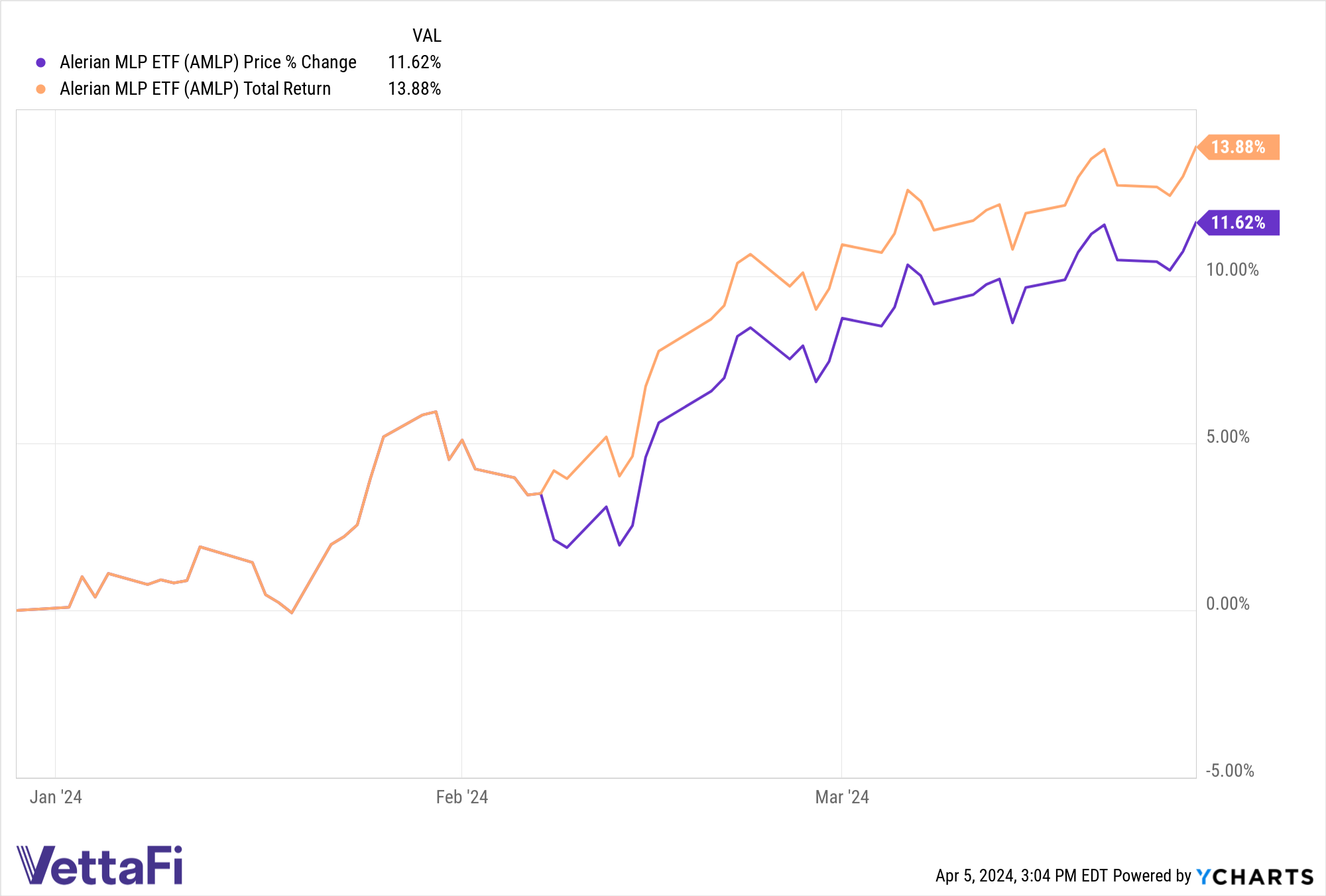

The Energy Select Sector SPDR ETF (XLE) closed Q1 2024 with a 13.51% total return. Contrast this with the Alerian MLP ETF (AMLP), which finished the quarter at a respectable 13.88% total return, as per Y-Charts data.

Discover More: Beating the S&P 500 Year-To-Date – The AMLP Story

MLPs: A Treasure Trove of Valuation

Despite their stellar performance, MLPs continue to trade at discounted valuations compared to historical data, indicated by their forward EV/EBITDA metric. AMLP mirrors the Alerian MLP Infrastructure Index (AMZI), comprising MLPs primarily engaged in midstream activities, providing a unique stance within the energy domain.

AMZI concluded the first quarter with a forward EV/EBITDA multiple of 8.59x, based on 2025 Bloomberg consensus EBITDA estimates. Noteworthy is midstream’s ability to offer outlooks ahead of the curve, helpful in their cash flow stability, as Stacey Morris, CFA, head of energy research at VettaFi, illustrated earlier this year.

The current EV/EBITDA ratio of AMZI slightly lags behind its three-year average of 8.82x, opening a window for keen investors. MLPs present a unique proposition within the energy ambit, with exposure to the sector while ensuring diversified returns and minimal vulnerability to commodity price fluctuations. These entities handle the intricate web of oil and gas transportation, storage, and processing, thereby acting as a shield against the volatility in oil and gas prices.

AMZI forms the core index for both the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB).

vettafi.com is under the umbrella of VettaFi LLC (“VettaFi”), the index provider for AMLP and MLPB, earning an index licensing fee. However, it’s pertinent to note that VettaFi does not issue, sponsor, endorse, or trade AMLP and MLPB, absolving itself of any obligations or liabilities associated with these entities.

For the latest news, insights, and analysis, do check out the Energy Infrastructure Channel.

Read more on ETFTrends.com.

The viewpoints and opinions articulated herein represent the author’s stance and do not necessarily mirror those of Nasdaq, Inc.