Salesforce Aims to Restore Growth Amid AI Concerns and Market Struggles

Salesforce (CRM) stock has notably underperformed the tech sector over the past five years. Investors are concerned about the company’s slowing growth and the potential impact of artificial intelligence on the cloud software market.

In response, Salesforce is investing heavily in artificial intelligence through its Agentforce initiative, enhancing profitability, and initiating dividend payments. Despite recent challenges, its earnings outlook has remained stable, and the company’s valuation has improved.

With the stock down 20% from recent highs, investors may consider buying Salesforce shares ahead of its Q1 fiscal 2026 earnings report scheduled for Wednesday, May 28.

The Bull Case for Salesforce Stock

Recognized as a leader in business software, customer relationship management, and software-as-a-service, Salesforce offers a comprehensive portfolio that supports sales, marketing, analytics, app development, and more. Companies of all sizes depend on Salesforce products, integrating them deeply into their operations.

Image Source: Zacks Investment Research

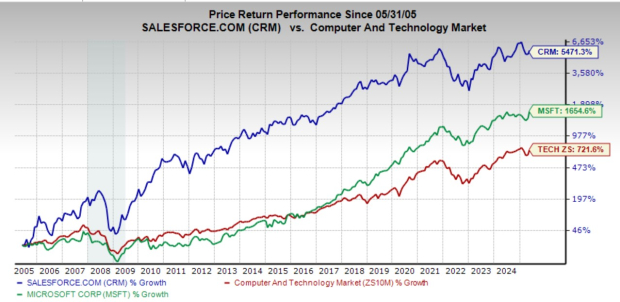

From 2012 to 2022, Salesforce saw an average revenue growth of around 29% per year. However, this growth rate has slowed; sales increased by just 9% in the last fiscal year (2025) and 11% in FY24. The company is now transitioning into a more mature growth technology firm similar to Microsoft (MSFT) and others, emphasizing long-term profitability.

Image Source: Zacks Investment Research

To enhance shareholder value, Salesforce has initiated buybacks and declared its first-ever dividend in 2024, aligning with other tech giants like Meta and Alphabet.

Salesforce’s AI Initiatives and Growth Projections

Salesforce introduced its Agentforce AI tool in October 2024, enabling clients to automate tasks like customer service and marketing through existing software. The company reported securing 5,000 Agentforce deals since its launch, including over 3,000 paid contracts.

Salesforce’s Data Cloud & AI segment saw annual recurring revenue surge by 120% year-over-year last fiscal year (FY25). Nearly half of the Fortune 100 companies now use both AI and Data Cloud services from Salesforce, with all top 10 sales in Q4 incorporating these technologies.

Image Source: Zacks Investment Research

In the last quarter, Agentforce managed 380,000 conversations, achieving an 84% resolution rate, with only 2% requiring human intervention. Salesforce aims to integrate generative AI throughout its product suite as more businesses prioritize AI solutions.

Salesforce’s earnings outlook remains promising since its last quarterly report, giving it a Zacks Rank #3 (Hold). EPS estimates have stayed relatively stable over the past year.

CRM anticipates a 9% growth in EPS this year and an 11% increase next year, following the 24% growth noted last year. The company has exceeded EPS estimates in 19 of the past 20 quarters.

Revenue is expected to grow by 8% this year and 9% next year, contributing an additional $6.5 billion between FY25 and FY27.

Potential Investment Opportunity for Salesforce?

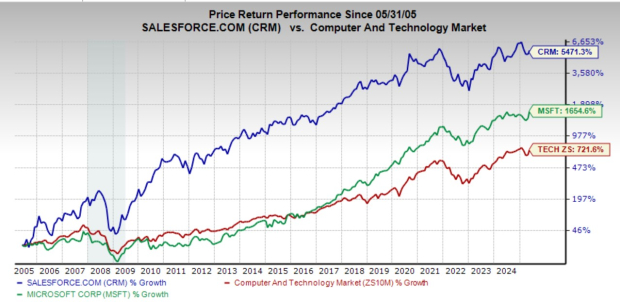

Over the last two decades, CRM shares have skyrocketed 5,500%, far surpassing Microsoft’s 1,700% and the technology sector’s overall growth of 720%.

In the last decade, Salesforce shares increased by 280%, aligning closely with the tech sector’s 290%, yet significantly lagging behind Microsoft’s 860% rise.

Salesforce Stock Underperforms Tech Sector, Presenting Investment Opportunity

Salesforce (CRM) has shown a modest performance, gaining only 60% over the past five years. This lags behind the tech sector’s 115% surge and Microsoft’s impressive 150% increase during the same period.

Year-to-date, CRM stock is down 16%, while the broader tech sector has experienced a slight dip of just 2%. This recent decline may provide investors with an opportunity to purchase Salesforce stock at 25% below its average Zacks price target and 20% below its peak in December.

Technical Analysis Points to Mixed Signals

Recently, Salesforce stock was unable to surpass its 200-day moving average. However, it continues to hold above its 50-week moving average, indicating a potential stabilization around its 2020 breakout levels while trading at neutral relative strength index (RSI) levels.

Favorable Earnings Outlook Assessment

The company’s improved earnings outlook has resulted in a forward valuation of 33 times its projected 12-month earnings, which is a 75% discount to its 10-year median. Notably, this valuation aligns closely with its industry average.

Salesforce’s PEG ratio, accounting for its long-term earnings growth, stands at 2.6. This reflects an 85% discount to its historical highs and only a slight premium in relation to its industry peers.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.