Nasdaq Enters Correction: Opportunity to Buy Tech ETFs

The Nasdaq (NASDAQINDEX: ^IXIC) has officially entered correction territory, down nearly 13% since mid-February. This past Monday marked the index’s worst single-day drop since 2022, plunging by 4%, which has raised concerns about a possible bear market or recession.

The future remains uncertain for the market, and it’s unclear whether stock prices will recover or if a deeper downturn is on the horizon. However, history suggests that the market will rebound in the long term.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to buy currently. Learn More »

Stock market crash chart.” src=”https://g.foolcdn.com/image/?url=https%3A%2F%2Fg.foolcdn.com%2Feditorial%2Fimages%2F810667%2Fstock-market-crash-with-bear-in-the-background.jpg&w=700″>

Image source: Getty Images.

Despite investor fears, this moment could provide an excellent chance to “buy the dip” as prices are lower now, potentially positioning investors to gain when the market eventually recovers. For those considering a tech ETF, the Vanguard Information Technology ETF ETF (NYSEMKT: VGT) is worth considering.

A Comprehensive Collection of Tech Stocks

The Vanguard Information Technology ETF comprises 316 stocks across various segments of the tech sector. With the Nasdaq in correction territory, many stocks in this ETF have also seen substantial declines recently. The fund itself has dropped about 11% since the beginning of the year, while its top three holdings—Apple, Nvidia, and Microsoft—have experienced declines of roughly 9%, 20%, and 10%, respectively.

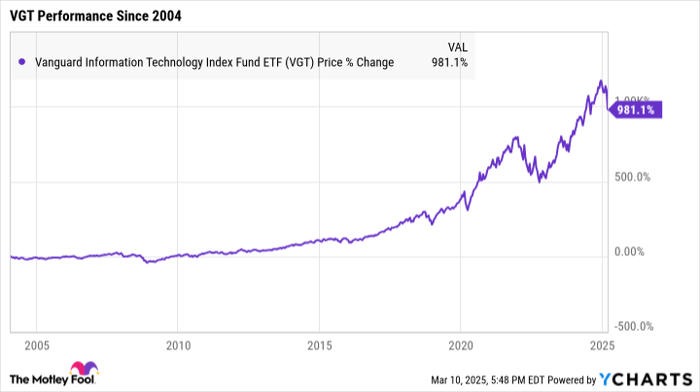

Historically, this ETF has weathered challenging periods well. Since its inception in 2004, it has endured the Great Recession, the COVID-19 market crash, and the downturn in 2022, achieving total returns close to 1,000%.

VGT data by YCharts

For example, if an investor had placed $10,000 in this ETF in 2004 and remained invested, that amount would now be approximately $108,000. However, it’s important to remember that past performance does not guarantee future returns. No one can assure that this ETF will continue to thrive or that all individual stocks will recover. Investing in an ETF provides exposure to hundreds of stocks simultaneously, which can help diversify risk and limit potential losses if market conditions worsen.

This fund’s diversification includes a mix of blue-chip stocks and smaller companies. Together, Apple, Nvidia, and Microsoft make up just over 44% of the ETF, with the remaining 313 stocks comprising about 56% of the fund. While heavy investment in a few major firms can increase risk, these established companies are more likely to withstand economic downturns. Conversely, smaller companies may face challenges during a market decline but can offer significant growth potential when the market improves.

This balance allows investors to take advantage of the stability provided by major companies while also capitalizing on the growth potential of smaller stocks.

Navigating Volatility in the Stock Market

Periods of market volatility can be daunting, especially if the current slump transitions into a bear market or recession, leading to considerable declines in your portfolio. The key to weathering such times is to hold on until the market recovers.

If the market continues to decline further in the near term, the value of this ETF could diminish significantly. Selling investments at a loss locks in those declines. By holding shares until the market rebounds, your portfolio stands a better chance of recovering. Therefore, before investing, ensure you can commit to holding those investments for several years. It’s also wise to have an emergency fund with several months’ expenses saved to afford to leave your investments in the market until prices recover.

Market fluctuations can be challenging, but they also present opportunities to acquire quality stocks at lower prices. If you are considering a tech-focused ETF with a strong track record of recovering from downturns, the Vanguard Information Technology ETF may enhance your portfolio.

Seize This Opportunity for Potential Returns

If you have ever felt you missed out on investing in highly successful companies, now may be your chance.

Occasionally, our team of analysts issues a “Double Down” Stock recommendation for companies poised for significant growth ahead. If you fear you’ve missed the chance to invest, this may be the best time to act before it’s too late. Consider these returns:

- Nvidia: If you had invested $1,000 when we issued a double down in 2009,you’d have $277,401!*

- Apple: If you had invested $1,000 when we doubled down in 2008, you’d have $43,128!*

- Netflix: If you had invested $1,000 when we doubled down in 2004, you’d have $467,393!*

Currently, we are issuing “Double Down” alerts for three outstanding companies, and this may be an opportunity that won’t come again soon.

Continue »

*Stock Advisor returns as of March 10, 2025

Katie Brockman has positions in Vanguard World Fund-Vanguard Information Technology ETF. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.