Amazon and Apple’s Upcoming Earnings: Key Insights and Expectations

Amazon AMZN and Apple AAPL will release their quarterly results after the market closes on Thursday, May 1. This marks a significant week for investors as multiple major tech companies report earnings.

Investors are optimistic that both Apple and Amazon will deliver better-than-anticipated results to help mitigate recent tariff concerns. Each of these companies has seen their stock prices decline by about 15% year to date.

However, it’s worth noting that Amazon shares have appreciated over 50% in the past three years, outperforming broader market indexes. In contrast, Apple has gained approximately 33%, aligning closely with the S&P 500 but trailing the Nasdaq.

Image Source: Zacks Investment Research

Amazon’s Q1 Expectations

Amid scrutiny from the White House, Amazon plans to emphasize how increased import charges are influencing pricing on its platform, particularly for low-cost items. Investors are keen to understand the implications of tariffs on the company’s outlook. Amazon’s Q1 sales are projected to rise by 8% to $154.56 billion, compared to $143.31 billion last year.

Regarding earnings, Q1 EPS is expected to show a 19% increase to $1.35 from $1.13 a share in the same quarter last year. Remarkably, Amazon has outperformed the Zacks EPS Consensus for nine straight quarters, achieving an average earnings surprise of 25.27% in its last four quarterly reports.

Image Source: Zacks Investment Research

Apple’s Q2 Expectations

Despite much of Apple’s production occurring in China, the company has secured some exemptions from U.S. tariffs, notably for iPhones, which currently face a 20% tariff instead of higher rates on other goods.

However, Apple faces a challenging environment, given its reliance on international manufacturing. The company has begun shifting some production to India to mitigate tariff impacts. For its fiscal second quarter, Apple expects a 3% increase in sales to $93.56 billion versus $90.75 billion in the same quarter last year.

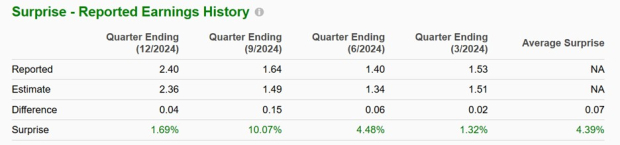

The anticipated Q2 EPS for Apple is projected to rise by 4% to $1.60 from $1.53 per share in the prior year. Apple has beaten earnings expectations for eight consecutive quarters, posting an average EPS surprise of 4.39% over its last four quarters.

Image Source: Zacks Investment Research

Tracking Amazon & Apple’s Outlook

According to Zacks’ estimates, Amazon’s total sales are projected to increase by 8% in fiscal 2025, with expectations of an additional 10% jump in FY26, reaching approximately $759.21 billion. Annual earnings are estimated to rise by 12% this year and then by another 15% in FY26, resulting in $7.14 per share.

Image Source: Zacks Investment Research

In the case of Apple, its top line is expected to grow by 3% in FY25 and to increase by another 5% in FY26, reaching approximately $423.83 billion. Annual earnings projections suggest a 6% rise in FY25, with another 8% increase next year, resulting in $7.80 per share.

Image Source: Zacks Investment Research

Conclusion & Final Thoughts

Both Amazon and Apple currently hold a Zacks Rank #3 (Hold). The upcoming quarterly results and any guidance provided will be critical in reaffirming the growth trajectories of these tech companies. While management aims to mitigate the impact of higher tariffs, market conditions may present further buying opportunities.

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.