Why Staying Invested During Market Drops is Often the Smartest Move

A few weeks ago, I decided to check my portfolio. That turned out to be a poor choice.

Red. Red. More red. Numbers that seemed stable not long ago have now plummeted. My retirement account? Down. My brokerage account? Also down. Even my confidence in the market? Suffering. (Okay, maybe not that drastic.)

Many share this sentiment. Whenever the market declines, fear grips investors. It’s a cycle as predictable as the market itself: Signs of economic weakness appear, headlines scream “RECESSION FEARS,” and many investors contemplate selling.

I understand the anxiety. Watching your hard-earned savings diminish is distressing. Yet before you withdraw entirely — or worse, hit the “sell” button — remember a valuable lesson repeated in financial history:

Every market downturn is temporary.

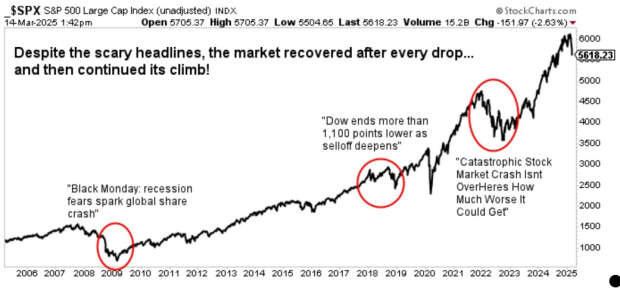

Historically, after each downturn, the market not only recovers but reaches new highs. Don’t believe it? Look at the S&P 500’s 20-year chart and witness the consistent recoveries over time.

Therefore, while acknowledging the fear, it’s essential to recognize that experienced investors typically buy during market drops instead of selling.

I’ll clarify: I’m not advocating for purchasing individual stocks. Some companies may not withstand a recession, and predicting which stocks will thrive is uncertain. But if you’re invested in broad market funds like the S&P 500 and have a long-term investment horizon, historical trends support that this is precisely when you should consider buying.

Understanding Psychological Responses to Market Drops

The expectation is that the stock market will rise, right? That’s its primary function. Thus, when it begins to drop, even with the knowledge that downturns are part of market cycles, alarms go off in our minds.

Our brains respond more intensely to potential losses than we react to equivalent gains. This phenomenon is known as loss aversion: losing $1,000 feels significantly worse than the pleasure of gaining $1,000 feels good. Watching your portfolio decrease in value — even if it’s short-lived — can feel devastating.

This triggers a need to take action. You may consider stopping your investments, selling shares, or persuading yourself that this downturn is unlike previous ones.

However, the reality remains: market crashes are commonplace, and recoveries happen.

Yet, with every drop, investors panic as if recovery is impossible. Allow me to illustrate why that fear has never been warranted.

The Historical Pattern of Market Recovery

If you’ve been investing for a while, you’ve likely witnessed this trend: the market plummets, panic ensues, and sensational headlines flood the media describing the “worst downturn since [insert alarming event].”

Then what happens?

The market recovers. Every. Single. Time.

Consider some of the most significant downturns in history:

- 2008 Financial Crisis: The S&P 500 dropped 57%, with many fearing an impending collapse. Yet within four years, it fully rebounded.

- Dot-Com Bust (2000): A 49% plunge in shares led to widespread trepidation. However, five years later, the market returned to record highs.

- COVID-19 Crash (2020): The market dropped 34% in just weeks. Within six months, it had rebounded and continued to surge.

This pattern holds true: every market crash has been temporary. In fact, after recovering, the market often sets new record highs. It doesn’t merely return to previous levels; it surpasses them.

Are there instances where recoveries took longer? Certainly.

- Following the 1929 crash, the market took 25 years to reach new highs, especially during an era facing severe economic challenges.

- After the 1973-74 recession, it required seven years for the market to stabilize.

Nevertheless, even in these extreme cases, the market did eventually recover.

The key takeaway? The longer your investment horizon, the more likely you are to benefit. Even amid prolonged recessions, the market has historically rebounded more robustly.

It is vital for investors to remember this in times of uncertainty. While bear markets occur, bull markets endure longer.

Since 1950, the average bear market has persisted for approximately 10 months, whereas the average bull market lasts for nearly three years.

When facing a declining market, you essentially have two choices:

- Panic, sell, and lock in your losses.

- Stay invested (or ideally, purchase more) and brace for the eventual recovery.

One approach has proven successful throughout history; the other tends to lead to financial setbacks.

Strategies for Smart Investing During Market Declines

If history suggests the market will recover, what should you do when stocks are in decline?

The answer is straightforward: continue investing.

Successful investors engage in this practice not because they possess perfect foresight, but because they recognize that downturns represent buying opportunities.

Consider this analogy: if you entered a store and discovered your favorite item discounted by 30%, would you:

a) Become anxious, deem it worthless, and refuse to make a purchase?

b) Take advantage of the sale?

Most would opt for B. Yet, in the stock market, many investors do the reverse: they buy when prices are high and sell when low, driven by the fear of loss.

This behavior is why so-called “dumb money” frequently underperforms the market. They lock in losses by selling low and miss opportunities to gain by buying high — the exact opposite of effective investing principles.

Instead, consider the following strategies:

1) Consistent Dollar-Cost Averaging

Adopting a steady investment approach during these uncertain times is advisable. This strategy, known as dollar-cost averaging, involves consistently investing at regular intervals regardless of market performance.

By adhering to this approach, you’ll automatically acquire more shares when prices dip and fewer when they rise. Over time, this helps mitigate market volatility and facilitates wealth accumulation without attempting to predict market movements, which even seasoned investors struggle with.

2) Invest in Broad Market Funds

It’s important to note that during downturns, some companies may not survive, as evidenced during past crises.

Instead of buying individual stocks, focus on broad-market funds such as SPY, which closely follows the S&P 500. The S&P 500 comprises the top 500 successful companies in the U.S. and is structured to thrive over time.

When companies falter, they are replaced with stronger ones, ensuring that the S&P 500 continues to recover and reach new heights.

3) Adopt a Long-Term Perspective

Market declines may seem catastrophic in the present moment.

Long-Term Market Trends Show Opportunity Amid Current Declines

When examining a long-term stock chart, one consistent truth emerges: the market tends to rise over time. Despite experiencing every crash, correction, and bear market, the overall trajectory remains upward.

Currently, the market is down; however, for those investing with a long-term perspective, the best strategy is to stay the course and continue purchasing.

In hindsight, you may realize that this period was actually a prime buying opportunity.

Enduring the Tough Times: Key to Successful Investing

At present, the market is facing a downturn. It could decline further. Headlines may continue to alarm you, and your portfolio might be under pressure. Your instincts may urge you to panic.

However, resist that urge. This moment is a true representation of investing. It’s not solely about capitalizing during booming times; it’s also about maintaining discipline when the market falters.

Every previous recession and market downturn has presented investors with similar choices:

- Panic, sell, and miss out on the recovery.

- Stay committed (or even buy more) and welcome the rewards.

Historically, one approach has proven successful, while the other has led to missed opportunities. If you’re investing in broad market funds with a long-term vision, you already understand the solution based on past trends:

Buy the dips. Trust in the market’s recovery. Keep moving forward.

Your future self is likely to appreciate the choices you make today.

Maximizing Your Finances with Expert Guidance

Are you looking for practical insights to navigate today’s economic landscape? Zacks’ complimentary Money Sense newsletter offers straightforward advice and actionable tips perfect for saving money, minimizing taxes, and building a lasting financial future.

From valuable investment strategies to effective budgeting tips, Money Sense can assist you in intelligently growing your wealth. Subscribe now and start working toward your next financial goal! Signing up is completely free.

Get Money Sense absolutely free >>

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.