It’s Not Too Late: Bitcoin Remains a Strong Investment Option

Many Bitcoin critics have held back, thinking they’ve missed the opportunity to invest. In truth, it’s still an ideal time to get involved. Bitcoin continues to show itself as a valuable investment choice, whether you are looking to invest $25 each week or millions.

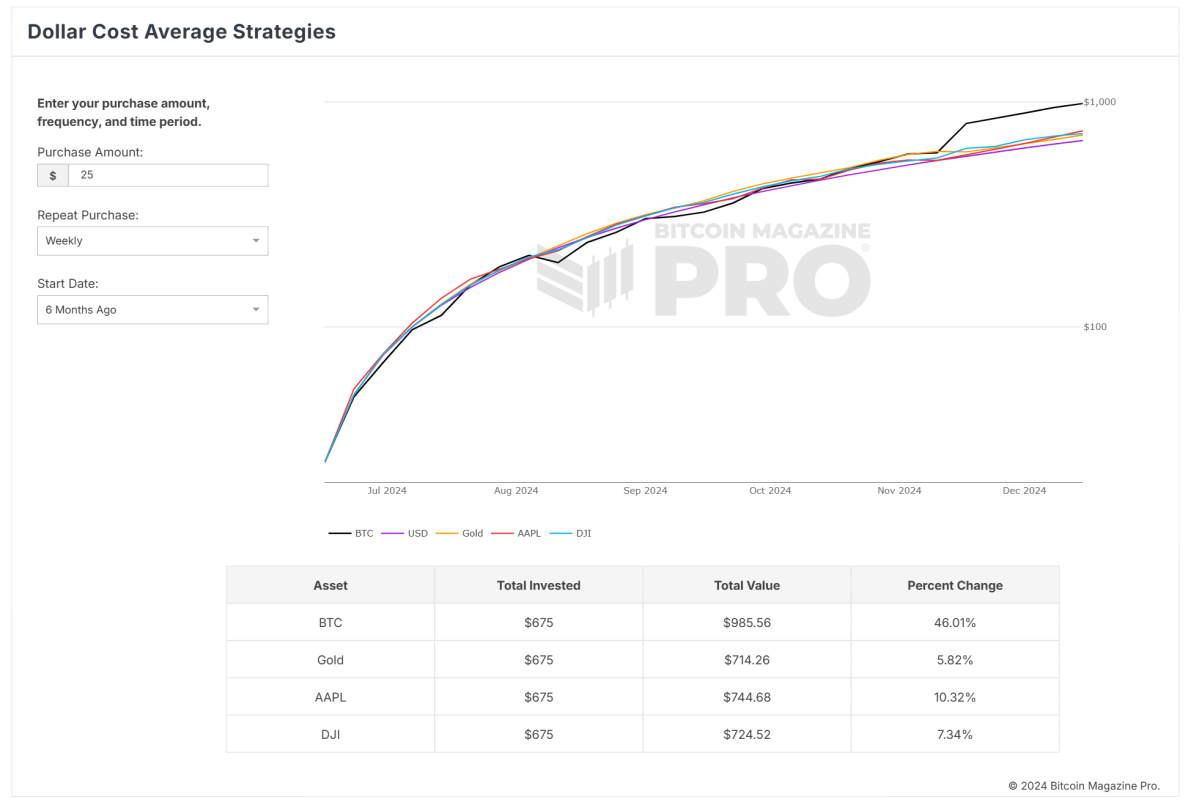

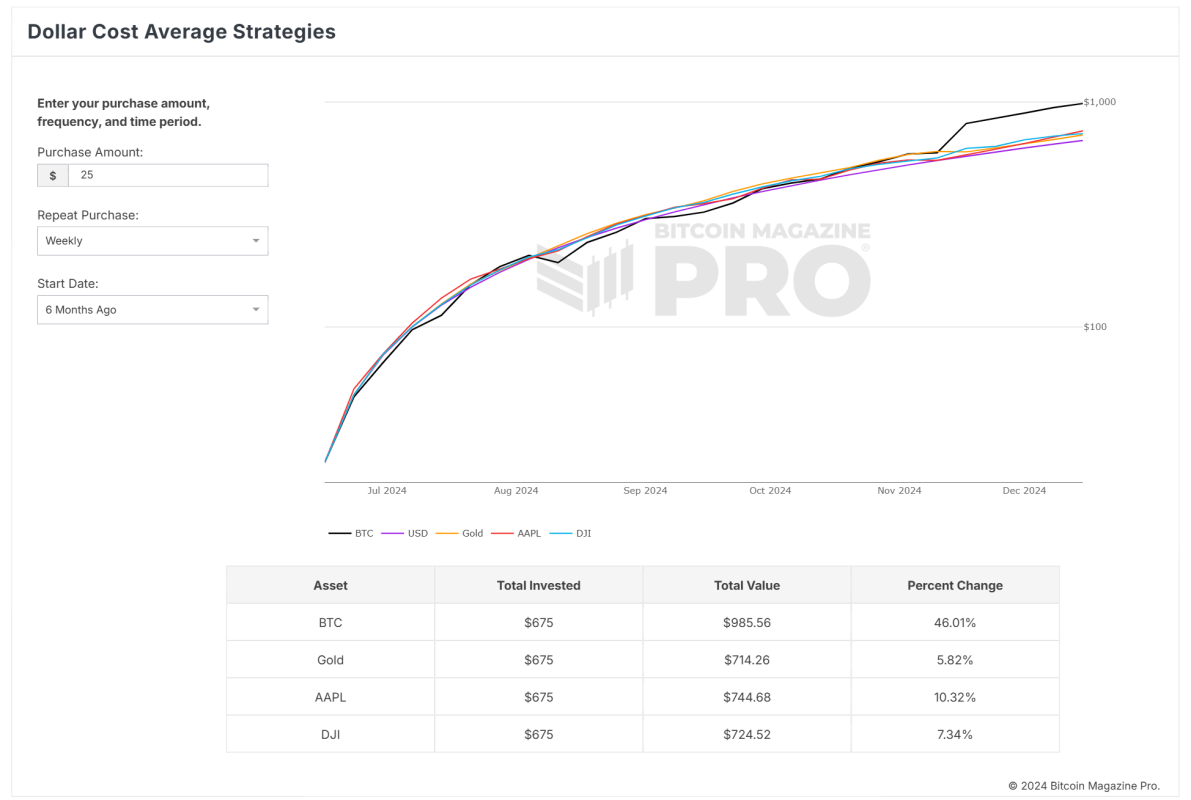

Bitcoin Magazine Pro offers a complimentary portfolio analysis tool called Dollar Cost Average (DCA) Strategies. This tool lets investors assess Bitcoin’s performance versus other major assets such as gold, the Dow Jones (DJI), and Apple (AAPL) stock. With factual data, it highlights how consistent and disciplined investing over time can yield impressive results, even with small investments.

Understanding Bitcoin Dollar Cost Averaging

Dollar cost averaging means investing a set amount at regular intervals regardless of price fluctuations. This strategy helps remove emotions from investing and smooths out the highs and lows of the market. By continually purchasing Bitcoin over a specified time, investors can take advantage of price dips while steadily growing their portfolios.

Bitcoin’s Performance Outshines Traditional Assets

Using the DCA Strategies tool, let’s look at Bitcoin’s performance over various timeframes, beginning with the last six months:

- 6 Months:

Investing $25 weekly in Bitcoin would have turned $675 into $985.56, a 46.01% return. In contrast, Gold rose only 5.82%, Apple (AAPL) gained 10.32%, and the Dow Jones (DJI) delivered just 7.34%. - 1 Year:

A $1,325 investment in Bitcoin would now be valued at $2,140.20, resulting in a 61.52% return. For comparison, Gold increased by 14.50%, Apple grew 22.80%, and the Dow Jones expanded by 11.36%. - 2 Years:

Investing $25 weekly, total spending of $2,650 would now equate to $7,145.42, translating to a 169.64% return. Gold rose by 26.56%, Apple grew 36.22%, and the Dow Jones provided a 21.13% return. - 4 Years:

A larger $5,250 investment would now be worth $14,877.77, an impressive 183.39% return. Meanwhile, Gold increased by 37.26%, Apple gained 54.05%, and the Dow Jones grew by 27.32%.

Bitcoin consistently outperforms traditional assets in every timeframe, offering strong returns over short periods of six months to a year.

Why Market Timing Is Less Important

If you’re unsure about entering the market, remember that Bitcoin’s long-term trends are clear. Evidence suggests that a DCA approach mitigates the risks of market timing while maximizing returns over time. Even small, regular investments accumulate significantly as Bitcoin’s value rises.

Moreover, Bitcoin has evolved from being viewed as a speculative asset to being seen as a dependable store of value, particularly during unpredictable economic times. The growth in institutional adoption, technical progress, and Bitcoin’s limited supply all contribute positively to its future outlook.

Why Bitcoin’s Best Days Are Still Ahead

The global acceptance of Bitcoin remains in its early stages. Although Bitcoin has had remarkable success, its total market capitalization is still considerably less than more traditional assets like gold or stocks. This opens up opportunities for further growth as more individuals, companies, and even governments begin to appreciate its benefits and value.

Currently, Bitcoin’s market cap represents only 10.82% of gold’s market cap, indicating its potential for expansion. To reach parity with gold, Bitcoin would need to increase by a factor of 9.24, leading to a potential price of $934,541 per BTC.

This outlook is consistent with recent Bitcoin projections, such as Eric Trump’s confident assertion that Bitcoin will reach $1 million.

With tools like Bitcoin Magazine Pro’s DCA Strategies, investors can explore how consistent, incremental investments can lead to substantial growth. Whether starting with $25 a week or $2,500, the key takeaway is clear: it’s never too late to invest in Bitcoin.

Customizing Investment Strategies for Success

The DCA Strategies tool at Bitcoin Magazine Pro lets investors modify their investment parameters, such as amounts, frequency, and start dates. This customization helps align strategies with individual financial goals.

The tool also enables investors to compare Bitcoin’s performance against other assets, providing crucial insights for building long-term wealth.

Final Thoughts: Seize the Opportunity Now

If you’re hesitant and think the moment has passed, the evidence is straightforward: Bitcoin is not just a viable investment—it stands as the best-performing asset of the last decade. With a DCA approach, even cautious investors can begin modestly and benefit from potential long-term gains.

It’s time to stop watching and start acting. Utilize Bitcoin Magazine Pro’s Dollar Cost Average Strategies tool to design your investment strategy. As history suggests—and trends indicate—Bitcoin’s future remains promising.

For live data and the latest analysis, visit bitcoinmagazinepro.com.

Disclaimer: This article is for informational purposes and should not be interpreted as financial advice. Always conduct thorough research before making investment decisions.

This article is a Take. The opinions expressed are solely those of the author and do not necessarily represent the views of BTC Inc or Bitcoin Magazine.

The views and opinions presented herein belong to the author and do not represent those of Nasdaq, Inc.