Written by Sam Kovacs.

Stepping into Chaos

I predicted a boisterous revival for REITs in 2024.

Yet today, I proclaim that the travails of office real estate investment trusts, or REITs, are only just unfolding.

Unfolding Crisis

Office REITs face intense turmoil within the real estate sector.

A slouching shadow of distress looms over the horizon.

During the pandemic, corporate America dabbled in a mass experiment of remote work, and the results were a revelation.

Fast forward four years, and while a fully remote model hasn’t triumphed, the hybrid model, a blend of home-based and office-based work, appears here to stay.

This poses a conundrum for commercial real estate. If businesses realize they don’t need as much office space, they will opt to downsize.

Why wouldn’t they? Spend less for less space or the same for a smaller yet more exquisite space.

This shift has caused vacancies to surpass levels observed in the mid ’80s and ’90s following a spate of overbuilding.

Renewal or Retreat?

A wave of lease expirations looms on the horizon.

Major corporations are either allowing leases to lapse or subleasing unused space:

- July: Charles Schwab (SCHW) aims to reduce its real estate footprint in multiple locations.

- September: Johnson & Johnson (JNJ) is downsizing its Tampa office space by over 60%.

- October: Dropbox (DBX) is relinquishing 165,000 square feet of office space at its San Francisco HQ.

- October: Microsoft (MSFT) is vacating 50,000 square feet of office space in San Francisco.

- November: Phillips 66 (PSX) is consolidating employees to lower floors.

- November: General Electric (GE) is exiting a building in Downtown’s central business district.

A survey in June 2023 revealed that half of the world’s biggest companies planned on reducing office space by 2026, with a 10% to 20% reduction being the norm.

But why wait until 2026? Why not do it today?

Office leases traditionally span ten years, hampering landlords’ ability to respond to changes in office space needs.

Data on corporate mortgage-backed securities collateral indicates that more square feet are set to expire in 2024 and 2025 than in 2023.

In major cities, millions of square feet are set to expire in 2024.

This poses a grave predicament for office REITs, as the options boil down to renewing at lower rents or braving vacant office space.

An excess of the latter could precipitate further declines in rents.

Market Woes

This debacle is felt by all, including supposedly prestigious real estate locations.

Boston Properties, Inc. (BXP), often touted as a top office real estate firm, has seen a 5.6% decrease in net rents from re-leasing activity, according to their 10-K for second-generation leasing.

Further declines are anticipated in 2024, and as overall vacancy rates climb, tenants renewing leases gain more bargaining power, prompting rents to spiral downward.

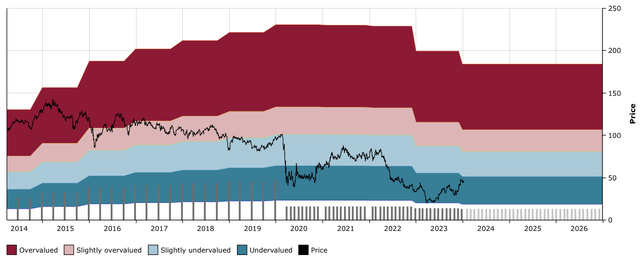

The performance of BXP’s stock over the past eighteen months reflects this trend.

The worst may yet be lingering. One should never underestimate the depths a stock can plummet to.

Occupancy Ordeal

Kilroy Realty Corporation (KRC), another marquee office REIT, endeavors to assure investors that their buildings, being younger and of superior quality, are less vulnerable to the office crunch.

But to me, this claim is akin to stating that a boxer is better prepared than others to withstand a punch from a martial artist.

Challenges Ahead for Office REITs in 2024

Kilroy Realty Corporation: A Dismal Outlook

Kilroy Realty Corporation (KRC) finds itself on shaky ground as it grapples with the impending storm of lease renewals. The office REIT knows that facing renewals will prove to be a daunting challenge over the next couple of years.

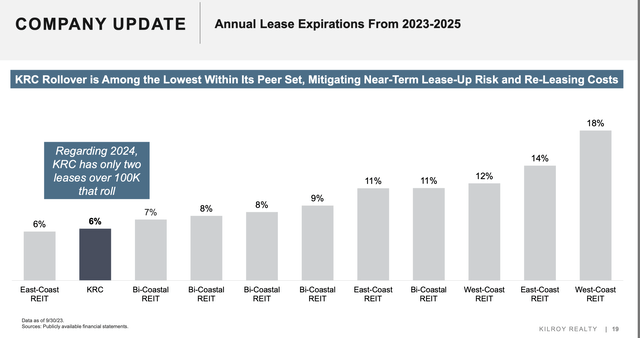

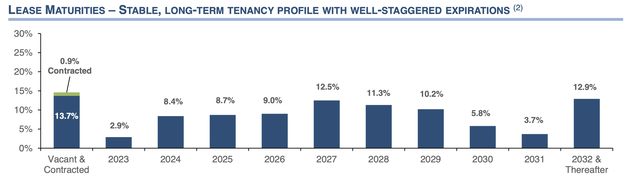

To brace itself, KRC points out that it only has 6% of leases expiring annually between 2023 and 2025. However, the numbers reveal a different story.

An estimated 8% of leases expired between June 2022 and September 2023, resulting in a significant decrease in Kilroy’s occupancy from 94% to 87% over the same period.

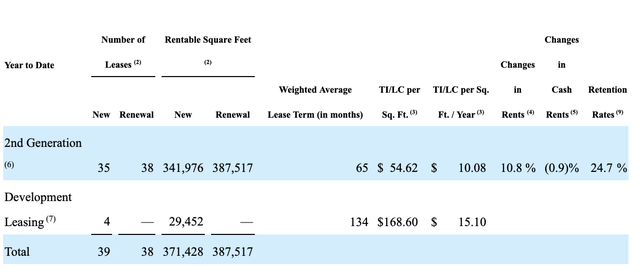

The most recent 10-Q report shows that only 24.7% of expiring leases have been renewed in the past 9 months, and cash rents have declined by 1% during this time.

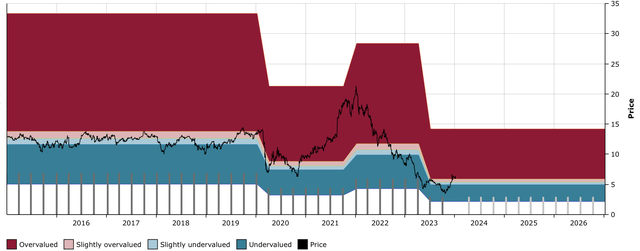

KRC’s stock price has experienced a significant decline, and there are no signs that the worst is over.

City Office REIT: Troubled, with More Trouble Ahead

City Office REIT, Inc. (CIO) is not faring any better as it grapples with its own set of challenges. The company had to cut its dividend in 2023, and now faces further hurdles in 2024.

An in-depth assessment reveals negative gross spreads and declining occupancy at several of the company’s properties, exemplified by the “Superior Pointe” property in Denver.

With an additional 8.4% of leases set to expire in 2024, City Office REIT seems poised for further turmoil.

SL Green: More Trouble Ahead?

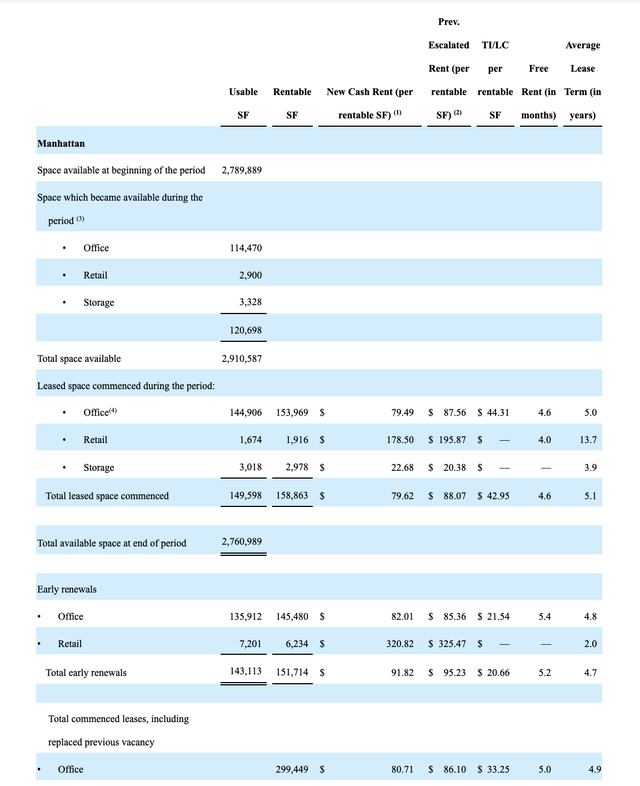

The woes of the office REIT industry extend to SL Green Realty Corp. (SLG), a Manhattan-based entity that has had to contend with multiple dividend cuts. The company’s struggles continue into 2024.

A negative 10% cash spread for leased office space during the third quarter of 2023, paired with declining rental rates, paints a bleak picture for SL Green Realty Corp.

The company’s troubles seem far from over.

Where Do We Go from Here?

Despite the dire outlook for certain office REITs, there are some outliers showing more promising renewal numbers. Companies like Cousins Properties Incorporated (CUZ) and Brandywine Realty Trust (BDN) are displaying better prospects in this challenging landscape.

However, mass renewals across the office REIT industry are anticipated to lead to higher vacancies, lower cash rents, and continued stock price troubles. The sector might experience a collective rise, but cracks in the office REIT industry could lead to widespread distress, more dividend cuts, and pervasive turmoil.

Given the inherent risks and diminishing returns, investors may find solace in exploring alternative REITs that offer more stable prospects and have weathered the storm of 2023 with greater resilience.