Embarking on a Brilliant Investment Journey

I strongly advocate for investing in SentinelOne (NYSE:S), given its vast potential for sustained growth and market dominance in the rapidly expanding $40 billion total addressable market [TAM]. The trajectory of the world’s digitalization underscores the perpetual importance of cybersecurity, making it an industry poised for continuous expansion. With strategic reinvestment in sales and marketing, the company is expected to surge ahead, potentially leading to enhanced valuation, far surpassing anticipated profitability. These factors make a compelling case for a long position in this promising business.

A Glimpse into the Business

SentinelOne specializes in providing cybersecurity solutions, particularly in defending endpoints, IoT, and workloads from malicious entities. Notably, its autonomous platform empowers customers to thwart real-time cyber attacks. Evidently, since FY20, the company has exhibited remarkable growth, scaling its revenue from $46.5 million to $573 million over the past 12 months—marking a more than 10-fold increase. In the midst of macroeconomic challenges, SentinelOne has continued to demonstrate robust growth (exceeding 40%) in recent quarters. Furthermore, the company boasts a robust balance sheet, holding nearly $800 million in cash and equivalents, with minimal debt, mitigating concerns regarding cash burn.

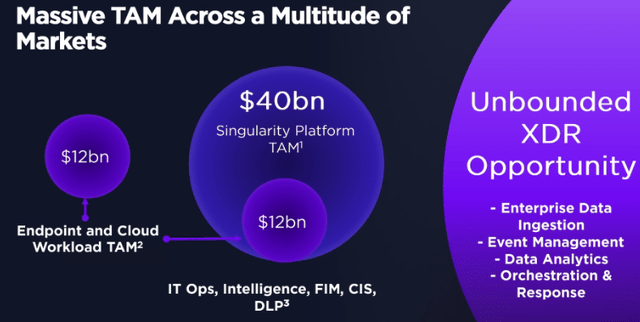

An Expansive TAM Paving the Way for Future Growth

SentinelOne operates within a significantly large TAM, projected to perpetually expand as the world progressively embraces digitalization. Currently addressing a $12 billion market (endpoint and cloud workload), the company is poised to tap into a $40 billion market as it explores additional opportunities in data analytics, event management, enterprise data ingestion, and orchestration and response. The imperative to stay ahead in the digital race propels businesses to increasingly invest in digital solutions, inadvertently rendering them more susceptible to security vulnerabilities. Given the inevitability and criticality of cybersecurity in safeguarding businesses against threats like the escalating ransomware attacks, the practice of cybersecurity is indispensable. The enduring evolution of cyber threats implies continued expansion of the TAM as businesses increasingly rely on digital tools for operations.

Robust Performance Underlines Undeniable Demand

The demand for cybersecurity solutions remains resilient as an essential, rather than discretionary, requirement. SentinelOne’s recent 3Q23 performance vividly attests to this, with a reported revenue of $164.2 million, reflecting a remarkable 42% year-on-year growth. Furthermore, the Annual Recurring Revenue (ARR) soared by 43% to $663.9 million, with ARR per customer showing a 15% yearly increase. The sustained dollar-based net retention of over 115% suggests that the existing customer base finds value in SentinelOne’s offerings and is willing to expand their contributions, despite the challenging macro environment.

The recent deceleration in growth (from over 100% to over 50%) can be attributed to SentinelOne’s concerted efforts to manage losses—a move necessitated by investors’ evolving inclination towards profitability over unbridled growth. The company has performed commendably on this front, with the EBITDA margin improving from -126% in FY22 to 43% in FY23, and is anticipated to turn positive in FY25. Looking ahead, the prevailing trend towards potential rate cuts by the Federal Reserve presents a favorable scenario for appreciating the valuation of profitless companies, while also amplifying investors’ risk appetite. As interest rates decline, and the company attains profitability, SentinelOne will be better positioned to augment its marketing investments to drive further growth. Considering SentinelOne’s mere 1% market share in a $40 billion TAM, a pivot to profitability at this stage seems unwarranted, given the immense room for expansion that lies ahead. Additionally, the appointment of a new Chief Marketing Officer [CMO] in 1Q24 suggests that management remains resolute in prioritizing investments in sales and marketing. Beyond marketing reinvestments, SentinelOne’s novel products are garnering substantial traction, exemplified by the strong interest in the newly launched Pinnacle One product, catering to security consulting services to enhance customer outcomes, and the remarkable triple-digit growth recorded in the combined cloud and data lake solutions, as highlighted by the management.

The Positive Implications of the PingSafe Acquisition

In a recent announcement, SentinelOne unveiled its intention to acquire PingSafe, a strategic move expected to culminate in 1FQ25. The acquisition is poised to bolster the company’s platform by enhancing its agentless Cloud Security Posture Management [CSPM] technology. With the capacity to offer both agent-based and agentless solutions, SentinelOne is anticipated to fortify its competitive stance within the industry. From a financial standpoint, while PingSafe’s relatively modest size translates to a deal consideration of only $100 million, the acquisition is poised to yield marginal enhancements to SentinelOne’s financials.

The acquisition underscores management’s proactive approach towards leveraging capital to augment its technology. In my assessment, M&A presents a swift and prudent avenue for bolstering SentinelOne’s product suite compared to deploying substantial sums into Research and Development. Given the perpetual emergence of novel hacking techniques, speed assumes paramount importance, and acquisitions afford the agility essential for a company like SentinelOne. Moreover, this strategic move signals management’s readiness to judiciously deploy capital for M&A, indicating a continued appetite for acquiring complementary entities, given the prevailing trend towards industry consolidation.

Valuation and Considerations

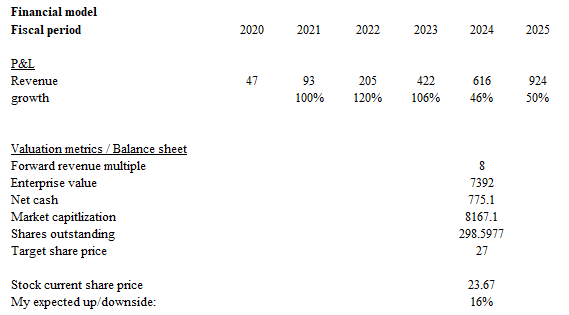

Based on my comprehensive research and analysis, my projected target price for SentinelOne stands at $23.67. Anticipated revenue growth of 46% as guided in FY24 (as per management’s December guidance, offering high visibility) translates to a 400 basis points acceleration from 3Q24 growth, which serves as a benchmark for FY25 growth and another 400 basis points acceleration. While projecting a growth acceleration, I maintain a conservative stance by factoring in the multiples at which SentinelOne is expected to trade, considering the potential near-term pressure on profitability stemming from escalated investments in sales and marketing, which the market may not warmly embrace. Nonetheless, at 8 times forward revenue—where SentinelOne currently trades—I still perceive a 16% upside. From a relative standpoint, juxtaposing SentinelOne against other cybersecurity peers such as CrowdStrike (CRWD), the valuation of SentinelOne does not appear exorbitant. CRWD, trading at 14 times forward revenue, is growing at a similar pace to SentinelOne but has already achieved profitability. As SentinelOne progresses towards profitability (as indicated by consensus estimates in FY25), there exists substantial potential for an uptick in multiples from present levels.

Inherent Risks

The reputation of a cybersecurity firm carries immense weight, as businesses repose their trust in products that exhibit robust reliability. The vulnerabilities faced by OKTA, for instance, resulting from multiple breaches, have precipitated a decline in demand sentiment and share price. SentinelOne is not immune to similar repercussions, should its reputation suffer a blow.

In Conclusion

I wholeheartedly propose a buy rating for SentinelOne, given the company’s potential for sustained robust growth within the burgeoning cybersecurity landscape. Moreover, there exists significant potential for an acceleration in growth if interest rates decline, affording management greater flexibility to augment investments in sales and marketing. The recent PingSafe acquisition is anticipated to further fortify SentinelOne’s competitive position, a strategic approach emblematic of the company’s commitment to enhancing its technological capabilities through savvy M&A endeavors.