Serve Robotics Inc. (SERV) reported Q1 2025 revenues of $440,000, a 150% increase sequentially, as it scaled its autonomous delivery model. This growth was fueled by the deployment of 250 Gen 3 delivery robots in markets like Miami and Dallas, resulting in a delivery volume increase of over 75% and expanding its restaurant network to over 1,500 partners, a 50% rise since its last update.

In the same quarter, revenue composition included $229,000 from software services and $212,000 from fleet operations, marking a 20% quarter-over-quarter increase. Despite an adjusted EBITDA loss of $7.1 million, Serve Robotics maintains a strong cash position of $198 million, which will support its expansion plans, aiming for revenue growth to $600,000-$700,000 in Q2 2025.

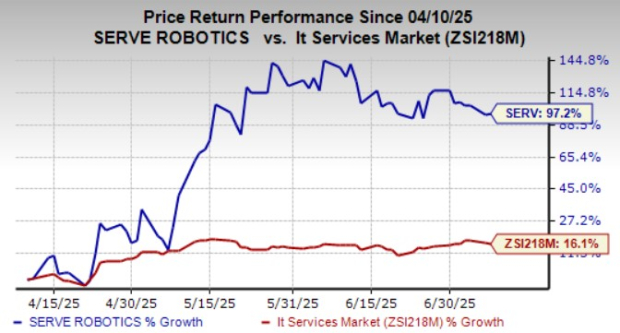

Overall, SERV’s shares surged 97.2% over the past three months, significantly outpacing the industry’s 16.1% growth, though its forward price-to-sales ratio stands at 24.76, above the industry average of 19.49. The company projects a long-term target of achieving a $60 million-$80 million annualized run rate by 2026.