ServiceNow Sees Notable Power Inflow, Reverses Early Weakness

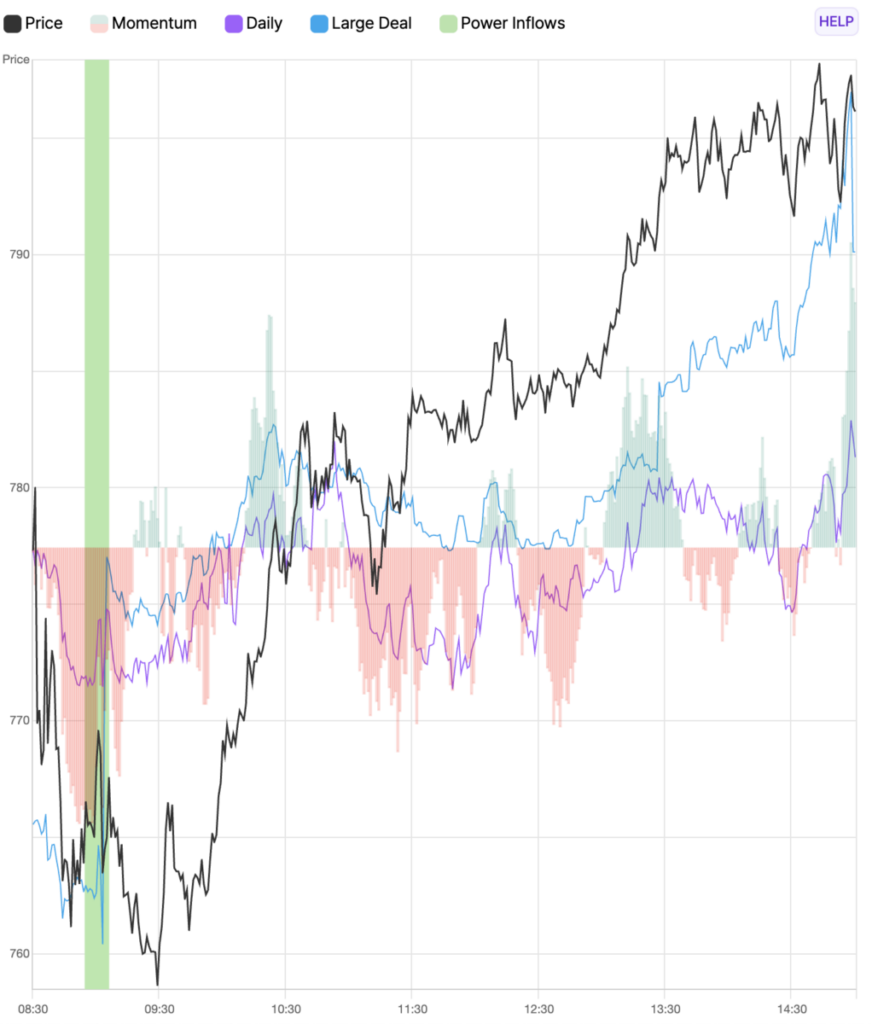

ServiceNow Inc. (NOW) has experienced a significant Power Inflow, a notable indicator for investors tracking where institutional money is moving. As of 10:04 AM on March 31st, the stock was priced at $764.48, alerting traders to a potential upward trend. This indicator is essential for understanding institutional behavior and making informed trading decisions.

Traders interpret this Power Inflow as a bullish signal, suggesting that now could be an attractive entry point for those looking to benefit from anticipated price increases. Market participants are advised to closely monitor Amazon’s Stock price for sustained momentum following this alert.

Understanding the Power Inflow Indicator

The Power Inflow indicator relies on order flow analytics, which examines both retail and institutional trading volumes. This analysis includes the timing, size, and patterns of buy and sell orders, enabling traders to gain insights into market conditions. Active traders view this particular indicator as a bullish sign, highlighting the potential for continued upward movement.

Typically, the Power Inflow appears within the first two hours of the market, helping traders gauge the stock’s direction throughout the day based on institutional activity. This early insight can significantly impact trading strategies, leading to more informed decision-making.

Successful trading often incorporates risk management strategies to safeguard against potential losses. While tracking smart money flow can yield beneficial insights, balancing this with an effective risk management plan can enhance long-term trading success. This approach allows traders to navigate market uncertainties more effectively.

For those interested in following the latest options trades for NOW, Benzinga Pro offers real-time alerts on options trading activities.

After the Close Update

The Power Inflow price matched $764.48, while subsequent returns at the High price of $798.44 and Close price of $796.14 were noted at 4.4% and 4.0%, respectively. These figures emphasize the importance of a comprehensive trading plan that defines both profit targets and stop losses, tailored to the trader’s risk tolerance. However, it’s crucial to remember that past performance does not guarantee future results.

Market News and Data brought to you by Benzinga APIs includes information sourced from firms such as TradePulse, which contribute to the reporting of data used in this article.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Market News and Data brought to you by Benzinga APIs