“`html

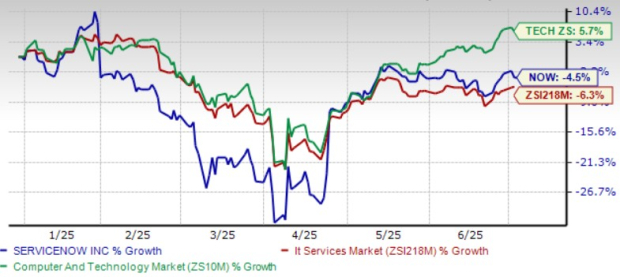

ServiceNow (NOW) shares closed at $1,011.89 on July 2, 2025, about 15.5% below its 52-week high of $1,198.09. The stock has dropped 4.5% year-to-date, underperforming the Zacks Computer and Technology sector’s 5.7% return but outperforming the IT Services industry’s 6.3% decline. The company anticipates unfavorable forex impacts of $175 million and reports a back-end loaded federal business affecting growth rates in 2025.

Despite challenges, ServiceNow has seen a 24.5% jump in share value since its first-quarter earnings report on April 23, 2025, driven by rising workflow adoption amid digital transformations. In Q1 2025, the company reached 508 customers generating more than $5 million in annual contract value (ACV), reflecting a 20% year-over-year growth. Subscription revenues hit $3.01 billion in Q1 2025, marking the same 20% growth in constant currency.

The Zacks Consensus Estimate for 2025 earnings is $16.54 per share, an 18.82% increase from 2024. For Q2 2025, the estimate is $3.54 per share, representing a year-over-year growth of 13.1%. Currently, ServiceNow has a Zacks Rank #3 (Hold), indicating caution for potential investors.

“`