ServiceNow’s Mixed Financial Performance Sparks Investor Concerns

Cloud-Driven Solutions at the Core of ServiceNow’s Business

With a market cap of $203.2 billion, ServiceNow, Inc. (NOW) is a leader in providing cloud-based solutions that automate digital workflows using its AI-powered Now Platform. This platform enhances productivity and reduces costs in areas such as IT, HR, and customer service. Headquartered in Santa Clara, California, ServiceNow caters to various global industries, including financial services, healthcare, technology, and government.

Stock Performance: A Closer Look

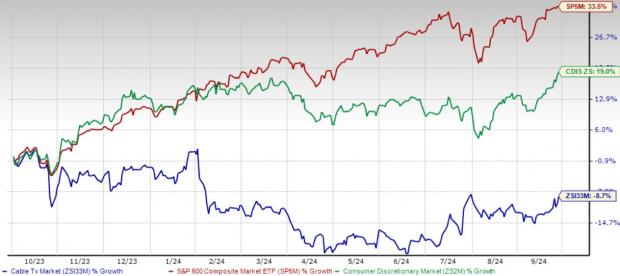

Over the past 52 weeks, shares of NOW have outperformed the overall market. NOW stock has surged 28.6% during this period, compared to a 22.3% gain in the S&P 500 Index ($SPX). Yet, YTD figures reveal a different story, with NOW down 7.2%, while the SPX has seen a rise of 4.1%.

Furthermore, ServiceNow has surpassed the Technology Select Sector SPDR Fund’s (XLK) 19.2% return in the same timeframe.

Q4 Results and 2025 Outlook Create Unease

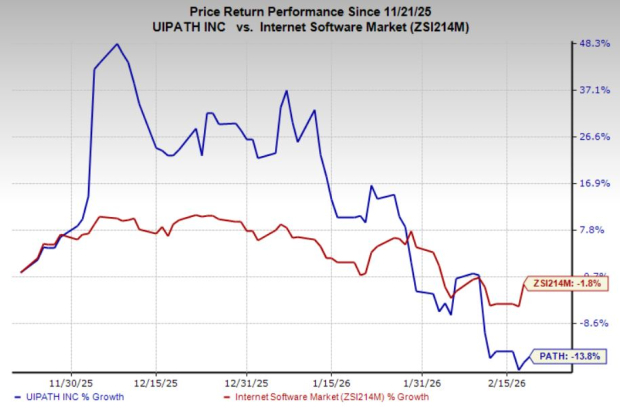

Despite a better-than-expected Q4 2024 which reported an adjusted EPS of $3.67 and revenue of approximately $3 billion on January 29, ServiceNow’s stock fell 11.4% the following day. This decline was largely driven by weaker-than-expected subscription revenue guidance for 2025. The company anticipated subscription revenue between $12.6 billion and $12.7 billion, indicating a slowdown from the robust 22.5% growth seen in 2024. Concerns regarding slowing enterprise IT spending and macroeconomic factors further weighed on investor sentiment, overshadowing the strong Q4 results. Although the company noted solid AI adoption and a high renewal rate of 98%, attention shifted to the slowing revenue growth.

Future Earnings and Analyst Opinions

For the fiscal year ending December 2025, analysts project NOW’s EPS to increase by 24% year-over-year to $8.93. Historically, the company’s earnings surprises have been favorable, having beaten or met consensus estimates in the last four quarters.

Currently, among the 37 analysts monitoring the stock, the consensus rating stands as a “Strong Buy.” This includes 29 “Strong Buy” ratings, three “Moderate Buys,” four “Holds,” and one “Strong Sell.”

Price Target and Market Sentiment

On January 30, Morgan Stanley analyst Keith Weiss reaffirmed a “Hold” rating on ServiceNow, setting a price target of $960.

As of this report, NOW trades below the average price target of $1,153.56. The highest Street price target of $1,426 suggests a potential upside of 43.4% from current levels.

On the date of publication, Sohini Mondal did not hold (either directly or indirectly) any positions in securities mentioned in this article. All information and data are provided solely for informational purposes. For more details, please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are those of the author and do not reflect the views of Nasdaq, Inc.