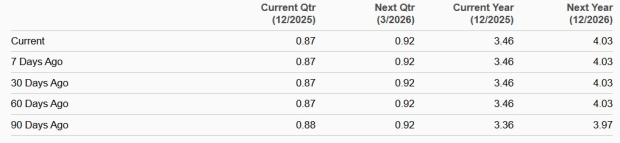

ServiceNow (NOW) plans to release its fourth-quarter 2025 financial results on January 28, 2026. The Zacks Consensus Estimate predicts revenues of $3.52 billion, representing a year-over-year growth of 19.2%. Earnings per share are expected to reach 87 cents, also reflecting a 19.2% increase compared to the same quarter last year.

The company anticipates fourth-quarter subscription revenues in the range of $3.42 billion to $3.43 billion, marking a year-over-year growth of approximately 19.5% on a GAAP basis. ServiceNow’s recent partnerships, including collaborations with NVIDIA and Microsoft, and strategic acquisitions such as Armis for $7.75 billion, are expected to enhance its security offerings and drive future revenue growth.

However, ServiceNow’s shares have declined 41.7% over the past year, underperforming compared to the Zacks Computer & Technology sector’s return of 28.4%. The company holds a Zacks Rank of #3 (Hold), advising investors to evaluate the stock’s potential before making purchases.