ServiceNow’s Impressive 60% Growth and Strategic Innovations Fuel Promising Future

ServiceNow NOW shares have appreciated 60.3% in the trailing 12 months, outperforming the Zacks Computer & Technology sector and the Zacks Computers – IT Services industry’s returns of 34.7% and 20%, respectively.

The impressive growth of NOW is attributed to its expanding Generative AI (GenAI) portfolio, a growing client base, and a strong network of partners. Key partners like Amazon AMZN, Microsoft MSFT, and NVIDIA NVDA are enhancing ServiceNow’s AI capabilities, leading to notable top-line growth.

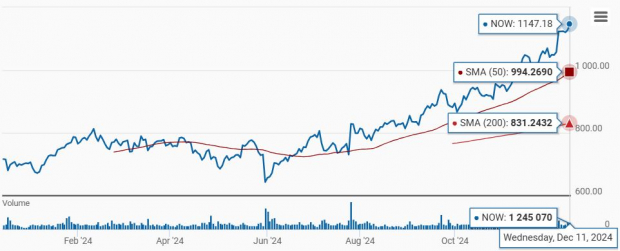

ServiceNow shares are trading above the 50-day and 200-day moving averages, indicating a bullish trend.

ServiceNow’s Stock Shows Strong Momentum

Image Source: Zacks Investment Research

Let us dig deeper to find out the factors driving NOW’s prospects.

NOW’s Robust Performance Overview

Image Source: Zacks Investment Research

ServiceNow’s Expanding Portfolio and Client Base

ServiceNow is heavily investing in AI and machine learning technologies to enhance its services. The growth in GenAI capabilities is particularly significant, with the total addressable market projected to reach $275 billion by 2026.

The recent update, Xanadu, introduces AI-focused industry solutions for sectors such as telecom, media, financial services, and public services.

Xanadu aims to improve customer agility, increase productivity, and elevate employee experiences by integrating AI functions across enterprise operations, including Security and Procurement.

With plans to implement Agentic AI, ServiceNow expects to enhance productivity significantly. This feature, available in November for Customer Service Management AI Agents and IT Service Management AI Agents, could reduce issue resolution times and improve agent efficiency.

ServiceNow is also committed to responsible AI through new governance innovations with the Now platform, adding over 150 GenAI features, including AI Governance for secure practices.

The company’s robust portfolio is anticipated to attract new clients. As of the end of the third quarter of 2024, ServiceNow had 2,020 customers with annual contract values (ACV) exceeding $1 million.

Additionally, NOW secured 15 contracts greater than $5 million and six over $10 million, closing 96 deals worth more than $1 million in net new ACV. Notably, the number of customers contributing more than $20 million annually grew by nearly 40% year-over-year.

Moreover, GenAI solutions gained popularity, with ServiceNow adding 44 new Now Assist customers spending over $1 million in ACV, including six contracts exceeding $5 million and two over $10 million.

Strong Partnerships Enhance ServiceNow’s Future

ServiceNow has recently expanded its collaboration with Amazon Web Services to integrate Amazon Bedrock models, which will enhance the development of AI-driven solutions.

The partnership with Microsoft aims to modernize business processes through a joint integration of Microsoft Copilot and ServiceNow AI agents, which is now available with the Xanadu update.

Additionally, ServiceNow and NVIDIA are developing practical use cases for AI agents on the Now platform, utilizing NVIDIA’s Agent Blueprints.

ServiceNow also initiated several partnerships with other firms, including Five9, Visa, Snowflake, Zoom, Siemens, IBM, and others, which are expected to boost its market share.

Boost in Subscription Revenue Forecast

For 2024, ServiceNow anticipates subscription revenues between $10.655 billion and $10.66 billion, an increase from its previous guidance of $10.575-$10.585 billion. This projection represents a 23% rise compared to 2023 on a GAAP basis and 22.5% on a non-GAAP basis.

In the fourth quarter of 2024, subscription revenues are expected to range from $2.875 billion to $2.88 billion, reflecting a year-over-year growth of 21.5-22% on a GAAP basis. At constant currency, a growth rate of 20.5% is anticipated.

Steady Earnings Trends for ServiceNow

The Zacks Consensus Estimate for 2024 earnings is projected at $13.87 per share, unchanged over the past 30 days, equating to a 28.66% year-over-year increase.

ServiceNow has consistently exceeded expectations in its earnings, beating the Zacks Consensus Estimate for four consecutive quarters with an average surprise of 9.46%.

ServiceNow, Inc. Price and Consensus

ServiceNow, Inc. price-consensus-chart | ServiceNow, Inc. Quote

The consensus estimate for 2024 revenues stands at $10.97 billion, suggesting a growth of 22.33% over 2023 figures.

The Zacks Consensus Estimate for 2025 earnings remains at $16.40 per share, representing an 18.27% increase year-over-year. Additionally, 2025 revenue estimates are set at $13.18 billion, indicating a growth of 20.13% compared to 2024 projections.

Strong Liquidity Makes NOW Stock Attractive

ServiceNow maintains a robust liquidity position, with $5.295 billion in cash as of September 30, 2024. The company’s free cash flow was $471 million in the third quarter of 2024.

Expectations suggest a free cash flow margin of 31% for 2024. This strong liquidity allows ServiceNow to explore growth opportunities, including acquisitions and share repurchases.

In the third quarter, ServiceNow repurchased about 272,000 shares at a cost of $225 million and has $562 million available for future buybacks under its existing program.

ServiceNow’s Potential Justifies Its Premium Valuation

ServiceNow’s stock is currently trading at a premium relative to market figures, shown by its Value Score of F.

The forward 12-month Price/Sales ratio for NOW is 18.08X, significantly above its median of 13.82X and the sector average of 6.28X.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

Given ServiceNow’s strong GenAI portfolio and extensive partnerships are set to enhance its client base and subscription revenues, this premium valuation appears justified.

Currently, ServiceNow holds a Zacks Rank #2 (Buy) and a Growth Score of B, making it an attractive investment opportunity based on the Zacks proprietary methodology. You can explore the complete list of today’s Zacks #1 Rank (Strong Buy) stocks.

Zacks Naming Top 10 Stocks for 2025

Interested in receiving early insights on our 10 top picks for 2025?

History shows these selections have performed exceptionally well.

From 2012, when our Director of Research Sheraz Mian took on this portfolio, until November 2024, the Zacks Top 10 Stocks have risen by over 2,112.6%, significantly outperforming the S&P 500’s increase of +475.6%. Now, Sheraz is reviewing 4,400 companies to identify the best 10 stocks to buy and hold for 2025. Make sure you don’t miss out on these stock picks to be released on January 2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.