The Upward Trajectory

Shareholders of Severn Trent (LSE:SVT) have cause for celebration as the one-year price target has received an optimistic boost, leaping to 2,975.51 per share. This significant 7.01% increase from the previous estimate on January 16, 2024, reflects growing confidence in the company’s potential.

Analyst Insights

Composed of multiple projections, the average price target serves as a compass guiding investors, with the latest estimates ranging from 2,305.83 to 5,460.00 per share. Notably, the average target signifies a robust 17.19% upsurge from the recent closing price of 2,539.00 per share.

Steadfast Dividends

As Severn Trent advances, it continues to offer investors a solid return through a 4.37% dividend yield alongside a sustainable dividend payout ratio resting at 3.16. This balance is crucial, as a ratio exceeding one spells trouble, indicating a company possibly eating into reserves to maintain dividends.

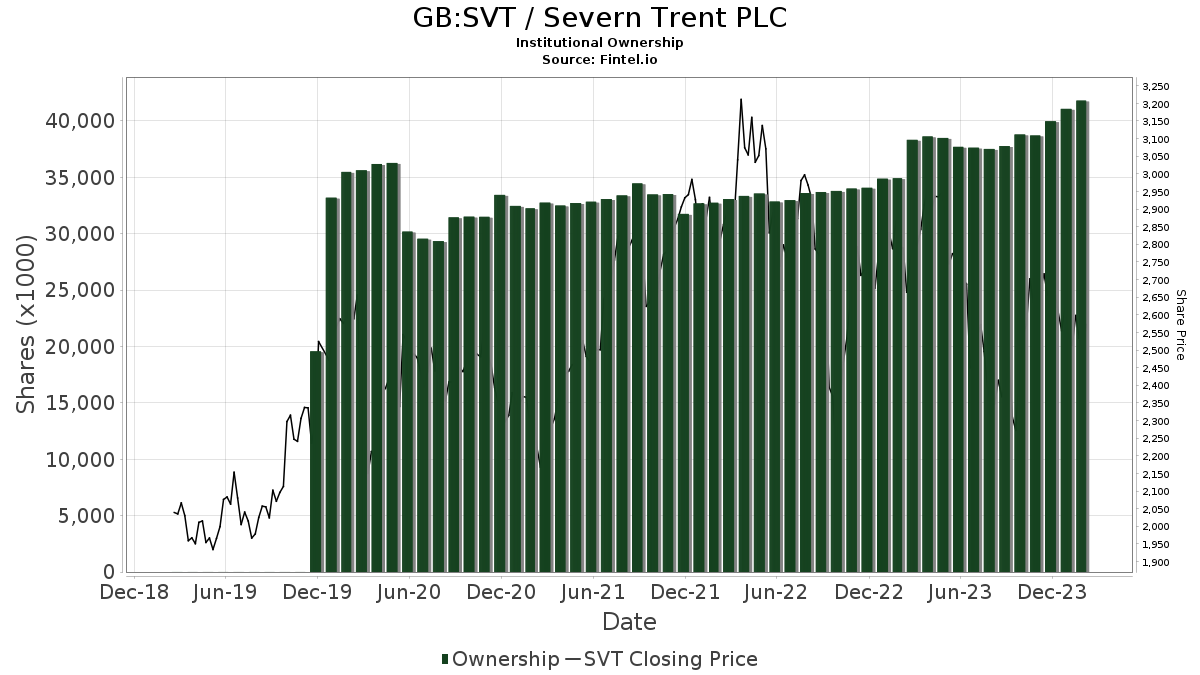

Institutional Support

Revealing institutional confidence, 270 entities have positions in Severn Trent. While a slight decrease in ownership was noted in the last quarter, the average portfolio weight has surged by 15.78%, demonstrating a growing faith in SVT’s potential.

Major Shareholder Moves

Lazard Global Listed Infrastructure Portfolio Institutional Shares, with 11,743K shares (3.93% ownership), have augmented their SVT holdings by 4.26%. In contrast, Vanguard Total International Stock Index Fund Investor Shares and Vanguard Developed Markets Index Fund Admiral Shares have increased and decreased their SVT holdings, respectively, in the last quarter.

Invesco S&P Global Water Index ETF and FlexShares Morningstar Global Upstream Natural Resources Index Fund saw conflicting movements, with one decreasing and the other increasing their stakes in Severn Trent.

Fintel abundantly offers meticulous investment research services catering to diverse financial needs, furnishing a treasure trove of data ranging from basics to advanced analytics. Our platform equips investors, advisors, and hedge funds with the tools needed to navigate the intricate landscape of the stock market.

Discover more about Fintel’s offerings and delve into a wealth of investment insights to fuel your financial journey.

This article’s original publication resides on Fintel, where in-depth financial analysis finds its home.

The opinions expressed here represent the author’s thoughts and not necessarily those of Nasdaq, Inc.