New Target Price Set at 22.34, Reflecting 5.30% Increase

The price target for Shaanxi Coal Industry Company (SHSE:601225) has surged by 5.30% to 22.34 per share, a significant upward revision from the previous estimate of 21.22 as of January 16, 2024.

Analysts’ assessments have coalesced around this figure, with individual targets ranging from a low of 17.51 to a high of 26.25 per share. This average target price, while 16.96% below the latest closing price of 26.91 per share, denotes a newfound bullish sentiment towards the company’s growth potential.

Robust Dividend Yield Holds at 8.10%

Shaanxi Coal Industry Company continues to offer an enticing dividend yield of 8.10% at the current share price. Moreover, the company’s dividend payout ratio stands at a healthy 0.96, signifying a balanced approach to rewarding shareholders while retaining earnings for future growth.

A dividend growth rate of 5.06% over the past three years underscores the company’s commitment to enhancing shareholder returns consistently.

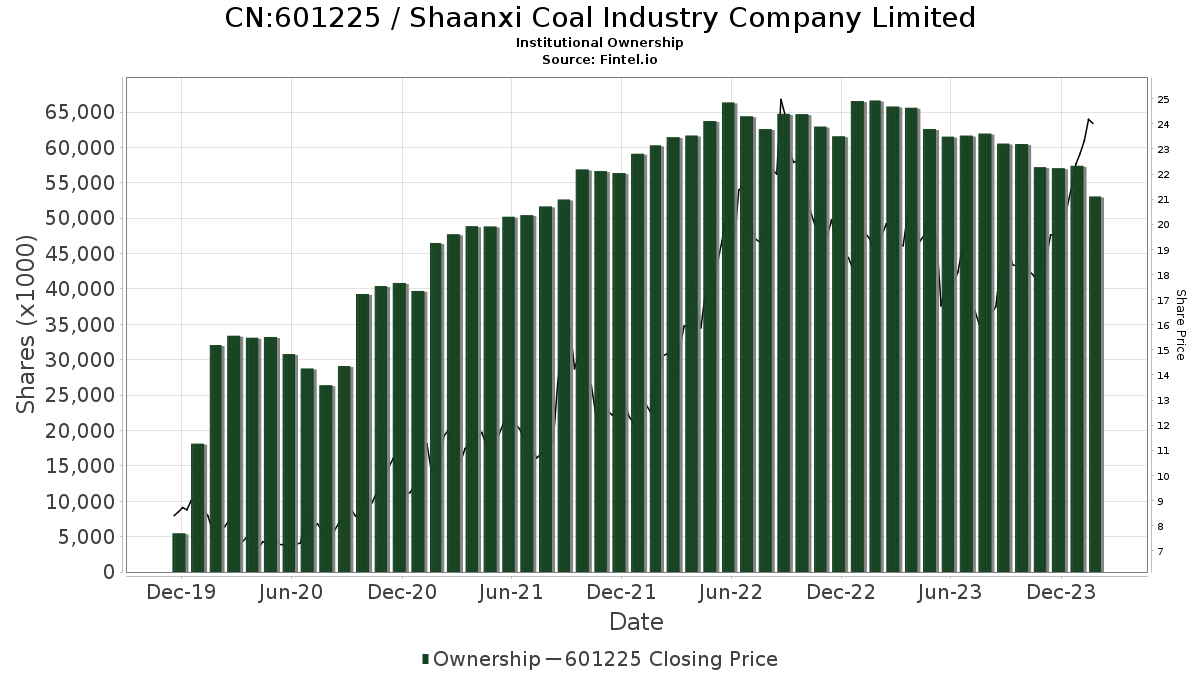

Institutional Holdings Experience Shifts

The latest data reveals that 95 funds or institutions maintain positions in Shaanxi Coal Industry Company, marking a modest decrease of 5.94% compared to the previous quarter. The average portfolio weight for all funds investing in 601225 saw a notable 15.10% uptick to 0.18%.

Insights into Shareholder Actions

Among notable institutional shareholders, Vanguard Total International Stock Index Fund Investor Shares (VGTSX) retained 0.09% ownership by holding 8,628K shares. Vanguard Emerging Markets Stock Index Fund Investor Shares (VEIEX) saw an impressive increase in its portfolio allocation by 48.91% in the last quarter, emphasizing growing confidence in Shaanxi Coal Industry Company.

On the flip side, iShares Core MSCI Emerging Markets ETF (IEMG) observed a decrease in portfolio allocation by 10.55%, showcasing a nuanced investor sentiment towards the company’s prospects. Such fluctuations in institutional holdings offer a glimpse into prevailing market sentiment and institutional confidence levels.

Fintel, renowned for its extensive research offerings catering to investors, traders, and financial advisors, provides a comprehensive array of data and insights encompassing fundamentals, analyst reports, ownership trends, and sentiment analysis. Their platform equips investors with valuable tools to make informed decisions and stay abreast of market movements.

For those seeking enhanced investment strategies and exclusive stock picks driven by advanced quantitative models, Fintel stands out as a go-to resource for maximizing profitability.

For more information, visit Fintel for the original article unveiling these insightful developments in the financial landscape.

The perspectives conveyed in this article solely represent the author’s opinions and do not necessarily align with those of Nasdaq, Inc.