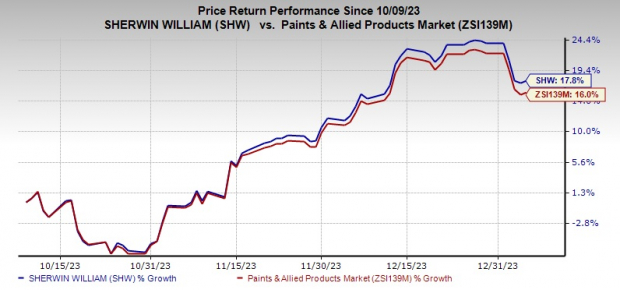

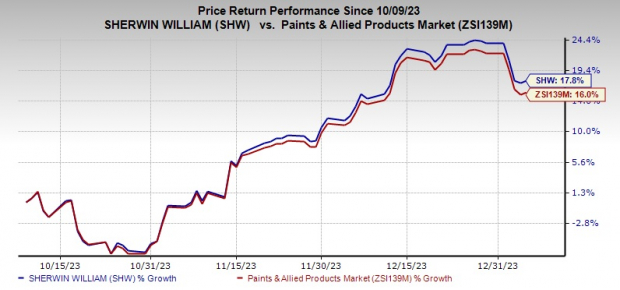

The Sherwin-Williams Company’s SHW shares have rallied 17.8% in the past three months, modestly outperforming its

industry’s growth of 16% over the same period.

The company has topped the S&P 500’s roughly 8.8% rise over the same period.

Image Source: Zacks Investment Research

Let’s take a look at the factors that are driving this Zacks Rank #2 (Buy) stock.

Sherwin-Williams is gaining from the strength in its Paint Stores Group division, along with initiatives to reduce costs and increase pricing, as well as expanded operations. The company is growing its retail operations in response to robust domestic demand. Auto refinishing demand was steady in the third quarter of 2023, with sales increasing by a mid-single-digit percentage.

Sherwin-Williams is expanding its retail footprint in order to gain market share. Paint Stores Group sales rose 3.6% year over year in the third quarter as a result of steady, effective pricing. The margin for the segment was 25.9%, up 420 basis points. Paint Stores Group opened 36 net new stores in the first nine months of 2023, with 16 of the additions in the third quarter.

The company seeks to increase supply chain efficiency, boost production and reduce expenses in order to improve profits. Efforts to cut operating costs helped it generate strong net cash flows from operations of around $1.9 billion in 2022. Leveraging robust cash generation, the company returned $1.41 billion to shareholders in dividends and share repurchases in the first nine months of 2023.

Also, the Performance Coatings Group, the Consumer Brands Group and corporate operations are the main areas of SHW’s restructuring initiatives. The estimated annual savings from these initiatives range from $50 million to $70 million, with a full run rate anticipated to be realized by the end of 2024.

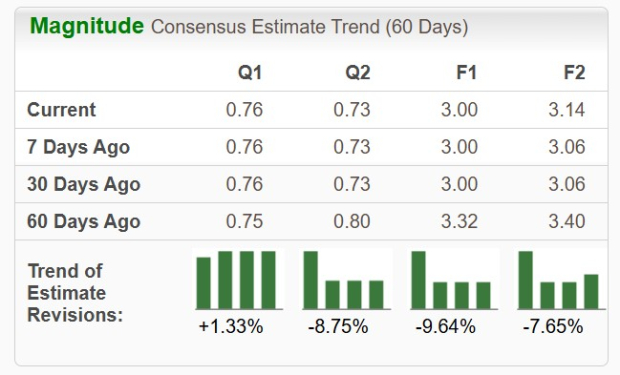

SHW’s earnings estimates have risen in the last two months, indicating analyst optimism. The consensus estimate for 2023 earnings has risen 18%. During the same period, the consensus estimate for 2024 increased 9.6%

The Sherwin-Williams Company Price and Consensus

The Sherwin-Williams Company price-consensus-chart | The Sherwin-Williams Company Quote

Other Stocks to Consider

Other top-ranked stocks in the Constructions space include Dream Finders Homes Inc. DFH, EMCOR Group Inc. EME and Fluor Corporation FLR.

Dream Finders currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for DFH’s current-year earnings has been rising over the past 60 days. It delivered a trailing four-quarter earnings surprise of 131.6%, on average. The stock has gained 229.2% over the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

EMCOR currently carries a Zacks Rank #2. EME’s earnings surpassed the Zacks Consensus Estimate in all the last four quarters. It delivered a trailing four-quarter earnings surprise of 24.9%, on average. The stock has rallied 46.5% over the past year.

Fluor currently sports a Zacks Rank #1. The Zacks Consensus Estimate for FLR’s current-year earnings has been rising over the past 60 days. It delivered a trailing four-quarter earnings surprise of 37.5%, on average. The stock has gained 15.2% over the past year.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.