Intel’s Market Rebound and Financial Challenges

Intel (NASDAQ: INTC) has seen its stock price more than double over the past six months, despite a significant pullback after disappointing fourth-quarter guidance. In Q4, Intel reported a revenue drop of 4% to $13.7 billion, with a GAAP loss of $591 million, although it posted profitability on an adjusted basis. For the first quarter, the company anticipates revenue between $11.7 billion and $12.7 billion, indicating a sharp sequential decline.

Support from the U.S. government, which acquired a 9.9% stake in August 2022, and a $5 billion investment from Nvidia in September have bolstered Intel’s financial standing. Meanwhile, the company’s turnaround strategy under CEO Lip-Bu Tan aims to revitalize its culture and operations, although skepticism remains regarding its earnings and future profitability amid ongoing struggles in the foundry business.

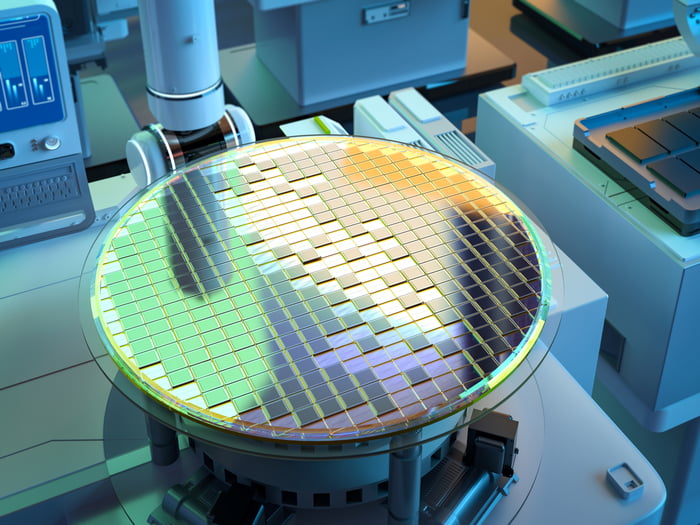

Taiwan Semiconductor Manufacturing Corporation’s Strong Position

Conversely, Taiwan Semiconductor Manufacturing Corporation (NYSE: TSM) has excelled, reporting a 25.5% revenue increase to $33.7 billion in its latest quarter, and boasting an operating margin of 54%. TSMC is responsible for manufacturing over half of the world’s contract semiconductor chips, with 77% of its revenue coming from advanced chips, highlighting its critical role within the global tech supply chain.