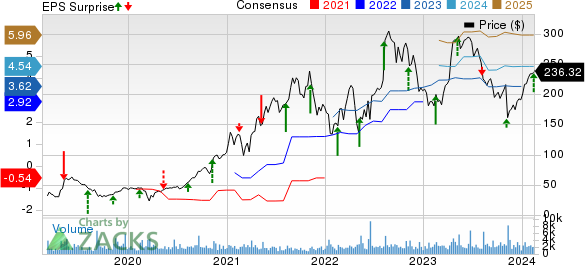

Shockwave Medical, Inc. exceeded expectations by reporting an earnings per share (EPS) of $1.16 for the fourth quarter of 2023, surpassing the Zacks Consensus Estimate of 92 cents by 26.1%. This figure also marked significant growth compared to the EPS of $3.71 reported in the year-ago quarter.

Robust Revenue Performance

The company posted a staggering 40.9% increase in revenues, reaching $203 million in the fourth quarter compared to the prior year. This tremendous growth was primarily fueled by a surge in product purchases, both domestically and internationally.

The U.S. witnessed a substantial 40% growth in coronary product revenues, while peripheral product sales also saw a noteworthy uptick of approximately 19%. Internationally, revenues from Shockwave’s Intravascular Lithotripsy (IVL) soared by 67% during the same period, indicating the company’s strong global traction.

A Glimpse at the Quarter’s Highlights

In August, the Centers for Medicare & Medicaid Services (CMS) introduced new Medicare Severity Diagnosis Related Group (MS-DRG) codes and payments for coronary IVL procedures, effective from October 1, 2023. The subsequent impact on revenues was significant and is expected to persist into 2024. These new codes are associated with higher payments and have been well-received in boosting physician remuneration for coronary IVL procedures.

Shockwave Medical also initiated a full commercial launch of its latest Shockwave C2+ Coronary IVL catheter, signifying a potential source of increased revenue in the coming quarters.

Revenue Outlook for 2024

For 2024, Shockwave Medical is anticipating revenues in the range of $910-$930 million, reflecting a growth of 25-27% from the previous year. The Zacks Consensus Estimate stands at $915.95 million, underscoring the company’s optimistic forecast.

Financial Position and Prospects

Exiting the fourth quarter, Shockwave Medical held cash, cash equivalents, and investments totaling $990.6 million, implying a healthy financial position. The company’s total assets amounted to $1.57 billion, signaling a robust balance sheet to support its operations and growth initiatives.

Despite concerns regarding escalating operating expenses, the company’s positive performance, revenue growth, and expansion in gross margin point toward a promising future. The management’s bullish outlook for the continued acceptance and penetration of IVL, particularly with the strong demand for the C2+ device in the international market, bodes well for the company’s prospects. Additionally, the higher pay rates for physicians conducting IVL procedures are expected to further drive the adoption of Shockwave’s products and contribute to sustained revenue growth.

However, investors should remain vigilant in monitoring the company’s operational costs as an area of potential risk.

Zacks Rank and Market Comparisons

Shockwave Medical currently holds a Zacks Rank #3 (Hold). Favorable alternatives within the medical industry include Universal Health Services (UHS), Integer Holdings Corporation (ITGR), and Cardinal Health (CAH). Universal Health Services boasts a Zacks Rank #2 (Buy) and has demonstrated resilient earnings performance as well as a promising stock growth trajectory.

Integer Holdings Corporation and Cardinal Health, both carrying a Zacks Rank of 2, have also exhibited robust earnings and stock price growth, positioning them as noteworthy contenders in the medical instruments and hospital industry sectors, respectively. Their impressive financial performance supports their potential as solid investment options.

Investment Opportunities in the Medical and Dental Supplies Industry

In a financial environment characterized by rapid changes, it’s essential to pay close attention to prospective investments. One such area of interest is the medical and dental supplies industry, which recently experienced a commendable growth of 9.4%. This growth presents a compelling case for investors to focus their attention on the prospects available in this sector.

7 Elite Stocks for Consideration

Market experts have distilled 7 elite stocks from the pool of 220 Zacks Rank #1 Strong Buys. These stock tickers are labeled as “Most Likely for Early Price Pops.” The full list, since its inception in 1988, has outperformed the market by over 2X with an average annual gain of +24.0%. This exemplary track record underscores the significance of these hand-picked stocks, compelling investors to give them immediate attention.

See them now >>

Furthermore, obtaining the latest recommendations from Zacks Investment Research is vital for diligent investors navigating today’s dynamic market. The free report on the 7 Best Stocks for the Next 30 Days not only offers valuable insights but also equips investors with the necessary information to navigate the turbulent waters of the financial industry.

Click to get this free report

Potential Stocks for Evaluation

For investors considering forays into this industry, evaluating specific companies is critical. Stocks such as Universal Health Services, Inc. (UHS), Cardinal Health, Inc. (CAH), Integer Holdings Corporation (ITGR), and ShockWave Medical, Inc. (SWAV) are pivotal players that warrant attention. Their stock analysis reports offer a comprehensive view of their potential for growth and profitability.

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

Investors can gather critical insights into the medical and dental supplies market by analyzing the stock of Cardinal Health, Inc. (CAH). The free stock analysis report offers a detailed assessment of the company’s potential prospects.

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

For investors seeking comprehensive information on Integer Holdings Corporation (ITGR), the free stock analysis report provides a valuable overview of the company’s potential for growth and profitability.

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

An assessment of ShockWave Medical, Inc. (SWAV) is crucial for investors eyeing opportunities in the medical and dental supplies industry. The free stock analysis report provides critical insights into the company’s growth trajectory and potential for profitability.

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

Conclusion

In conclusion, the medical and dental supplies industry represents a thriving sector with immense potential for investors. By carefully analyzing the market trends and considering the stock reports provided by Zacks Investment Research, investors can make informed decisions that pave the way for success in this dynamic industry.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.