Rumors of Johnson & Johnson Acquisition Fuel surge

The realm of finance is once again bustling with excitement as shares of Shockwave Medical SWAV witness an impressive 15% surge this week. The spark igniting this rapid increase in stock value? Acquisition rumors. A recent publication by the Wall Street Journal hinted at talks between the innovative medical device company and industry behemoth Johnson & Johnson JNJ regarding a possible acquisition.

Innovative Technology Leads to Market Attention

Shockwave Medical’s prowess in crafting groundbreaking devices for heart disease treatment has not gone unnoticed. By utilizing shockwaves to disintegrate calcified plaque within heart vessels, Shockwave Medical has revolutionized cardiovascular care. This inventive approach, akin to the treatment of kidney stones, has garnered significant interest from industry giants.

Industry Buzz and Market Impact

The swirling rumors of a potential acquisition have sent Shockwave Medical’s stocks soaring, with a striking surge of over 11% during afternoon trading on Mar 26 post the news leak. Despite neither Johnson & Johnson nor Shockwave Medical having officially confirmed the speculations, the hints of a prospective deal have set the industry abuzz with anticipation.

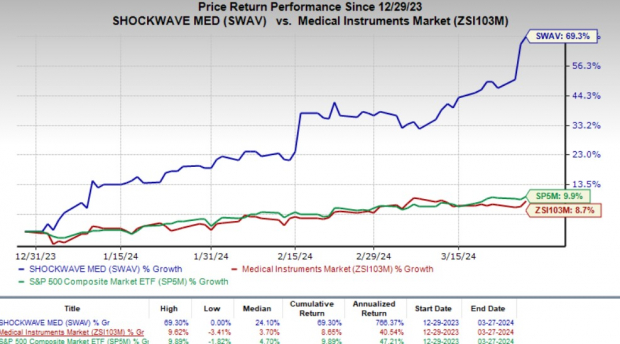

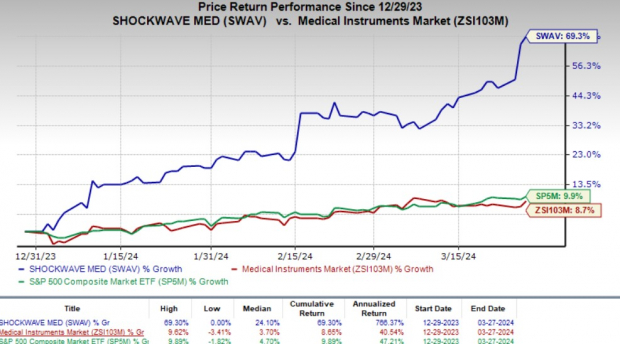

In the current year, Shockwave Medical shares have catapulted by a remarkable 69.3%, eclipsing the industry’s 8.7% rise and outpacing the S&P 500 Index growth of 9.9% in the same timeframe.

Image Source: Zacks Investment Research

Potential Suitors and Impressive Market Capitalization

Over the past year, media whispers have linked prominent players like Medtronic and Boston Scientific to a potential acquisition of Shockwave Medical. The allure of Shockwave Medical’s cutting-edge technology, coupled with its substantial market capitalization nearing $12 billion, makes it an enticing target for firms eyeing expansion in cardiovascular offerings.

For Johnson & Johnson, a successful union with Shockwave Medical could align seamlessly with its strategic aspirations of fortifying its cardiovascular product range. With a hefty $30.4 billion in annual revenues in 2023, Johnson & Johnson’s MedTech arm already stands as a frontrunner in the medical technology sector. Incorporating Shockwave Medical’s innovative solutions could potentially cement its position as a pioneering force in cardiovascular healthcare.

Market Momentum and Innovation

Recent milestones achieved by Shockwave Medical, including the acquisition of Neovasc and the launch of the Shockwave C2+ coronary IVL catheter, underscore its accelerating momentum in the market. With annual revenues hitting $730.2 million in 2023 and a stock valuation surging over nine-fold since its IPO in 2019, Shockwave Medical illuminates the realm of growth potential and innovation.

Zacks Rank and Promising Performers

Shockwave Medical is currently adorned with a Zacks Rank #2 (Buy), showcasing the promising future prospects that lie ahead.

Within the broader medical landscape, other top-rated stocks such as Cardinal Health CAH and Stryker SYK, both boasting a Zacks Rank #2, shine brightly. Cardinal Health’s stock has witnessed a noteworthy 50.9% surge in the past year, with earnings estimates witnessing an upward trajectory from $7.28 to $7.29 for fiscal 2024 and from $8.02 to $8.04 for fiscal 2025 in the last 30 days.

Stryker’s 2024 EPS estimates remain steady at $11.86 over the past 30 days, with the company’s shares soaring 28.5% in the last year, outpacing the industry’s growth of 5.2%. With consistent earnings beats, Stryker seems poised for sustained success, delivering an average earnings surprise of 5.09% over the past four quarters.

As the financial world buzzes with excitement over Shockwave Medical’s potential acquisition, the dynamics of the medical technology industry undergo a subtle yet significant transformation, offering investors a glimpse into the evolving landscape of innovation and strategic alignments.