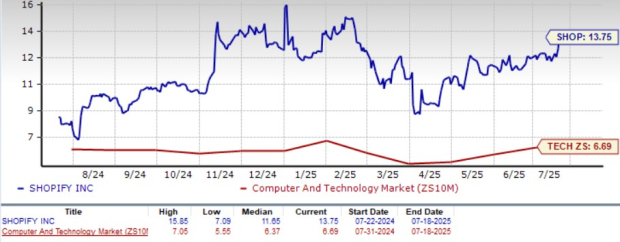

Shopify Inc. (SHOP) shares are currently trading at a significant premium, with a forward 12-month Price/Sales (P/S) ratio of 13.75, compared to 6.69 for the Zacks Computer & Technology sector. Competitors like Amazon (P/S 3.28), Alibaba (P/S 1.98), and Etsy (P/S 2.22) are trading at much lower valuations.

Year-to-date, Shopify shares have increased by 19.5%, surpassing the sector’s average return of 9.4% and the Zacks Internet Services industry’s decline of 0.2%. The company expects Q2 revenues to grow in the mid-twenties’ percentage year-over-year, with second-quarter merchant solutions revenues estimated at $1.88 billion, and subscription solutions revenues at $659.92 million.

The Zacks Consensus Estimate for Shopify’s 2025 earnings is $1.40 per share, reflecting a year-over-year growth of 7.69%, while revenues are projected to reach $10.86 billion, indicating a growth of 22.28%.