Shopify Set to Reveal Third-Quarter Earnings: A Look Ahead

Shopify (SHOP) will announce its third-quarter 2024 financial results on November 12.

Shopify’s Anticipated Growth

For this upcoming quarter, Shopify expects revenue growth in the low to mid-20% range year-over-year. The Zacks Consensus Estimate has revenue projected at $2.11 billion, reflecting a 22.96% increase from the same period last year.

Earnings per share (EPS) are anticipated to be 27 cents, which is unchanged from the last 60 days. This figure signifies an increase of 12.50% compared to the previous year’s earnings.

Shopify Inc. Price and EPS Surprise

Shopify Inc. price-eps-surprise | Shopify Inc. Quote

Shopify has consistently exceeded the Zacks Consensus Estimate over the last four quarters, demonstrating an average surprise of 31.17%.

Stay informed with the Zacks Earnings Calendar for market-impacting news.

Key Drivers for Q3 Earnings

In the third quarter, Shopify is likely to benefit from a robust growth in its merchant base. This success can be attributed to its user-friendly tools such as Shop Pay, Shopify Payments, and Shopify Audiences, which are all designed to help attract new merchants during a time of economic difficulty. This strategy proves particularly beneficial for small and medium businesses facing inflationary pressures.

Recent enhancements such as partnerships with UPS allow Shopify merchants to provide competitive international shipping rates. Efforts to simplify operations have drawn in both newcomers and established enterprises to the platform.

The company continues to invest in creating top-tier e-commerce solutions. Tools like Shop Pay and the Marketplace Connect app boost operational efficiency.

The integration of AI through Shopify Magic enhances products and workflows, expanding merchants’ reach. Shopify Checkout further supports merchants by giving customers a secure and straightforward checkout experience.

The anticipated growth in Gross Merchandise Volume (GMV) aligns with the increasing merchant count. In Q2 2024, Shop Pay processed $16 billion in GMV—39% of Shopify’s Gross Payments Volume (GPV). The total GPV reached $41.1 billion, corresponding to 61% of GMV processed.

Retail GMV increased by 27% year over year, underscoring the rising adoption of Shopify platforms, especially among large brands with multiple locations. The collaboration with brands like EVEREVE and MAJOURI significantly expands Shopify’s market reach across 130 locations globally.

Interestingly, over half of the new merchants added in the last quarter were from non-English-speaking regions, a trend likely to continue into Q3.

The Zacks Consensus Estimate for third-quarter GMV stands at $68 billion, indicating a 25.93% year-over-year increase.

For Subscription Solutions, the consensus revenue estimate is $593 million, representing 28.08% growth. In comparison, Merchant Solutions are expected to generate $1.51 billion, which indicates a 26.04% increase year-over-year.

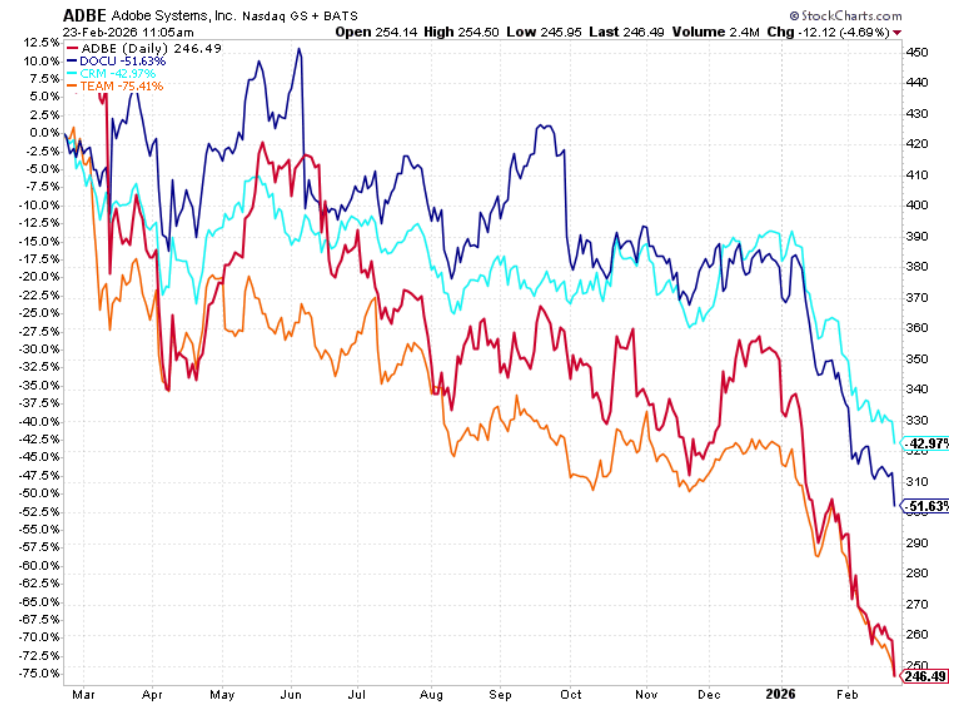

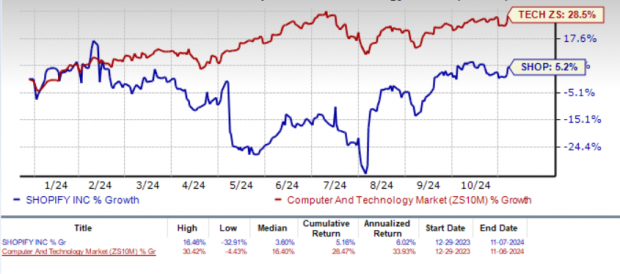

Shopify’s Share Performance

Shopify shares have appreciated by 5.2%, lagging behind the Zacks Computer & Technology sector’s growth of 28.5% and the Zacks Internet Services industry’s rise of 19.8%.

Year-to-Date Performance Chart

Image Source: Zacks Investment Research

Shopify’s Premium Valuation

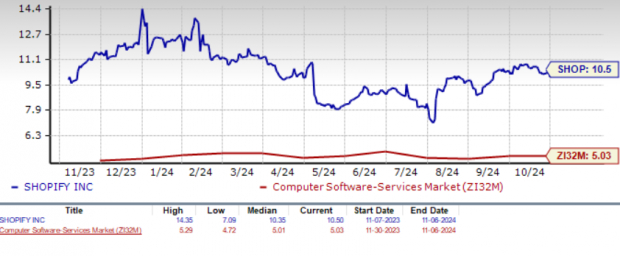

Currently, Shopify’s Value Style Score of F suggests an elevated valuation. The stock is trading at a forward 12-month Price/Sales ratio of 10.5x, significantly higher than the industry average of 5.03x.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

Strong Long-Term Prospects for Shopify

Shopify’s future appears promising, driven by a growing customer base and expanding partnerships. Its recent strategy of introducing over 400 updates and additional features has been pivotal in fostering growth, with 150 updates made in just Q2 2024.

Collaborations with well-known entities including TikTok, Amazon (AMZN), and Target enhance its offering and draw in more merchants. Furthermore, Shopify’s recent partnership with Oracle (ORCL) expands its capabilities.

Focusing on its core business by divesting the logistics sector represents a strategic move. The collaboration with Amazon gives merchants access to a wide-ranging fulfillment network, while the link with Target strengthens its market position.

Additionally, the partnership with Avalara supports tax compliance for Shopify merchants of all sizes. Working with Manhattan provides unified and seamless shopping experiences across channels.

Notably, Shopify’s international expansion is accelerating. The introduction of point-of-sale solutions in Australia and broader access to Markets Pro have been critical. By Q2 2024, 14% of GMV came from cross-border sales.

Conclusion

Shopify continues to thrive thanks to an expanding merchant base and the enhancement of its back-office solutions worldwide. While its current valuation may be high, the prospects for long-term growth remain strong.

Shopify carries a Zacks Rank #1 (Strong Buy) and a Growth Score of B, presenting a potentially favorable investment opportunity according to Zacks’ proprietary methodology.

For more insights, you can access the full list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free Today: Profiting from The Future’s Brightest Energy Source

The need for electricity is surging, while the shift away from fossil fuels continues. Nuclear energy emerges as a viable alternative.

Recently, the U.S. and 21 other nations committed to tripling the world’s nuclear energy capacities. This transition could yield significant profits for investors in nuclear-related sectors.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, outlines key players and technologies in this field, including three promising stocks.

Get your free copy of Atomic Opportunity: Nuclear Energy’s Comeback today.

Looking for the latest recommendations from Zacks Investment Research? Download your free report on 5 Stocks Set to Double today.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Manhattan Associates, Inc. (MANH) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.