At the close on Wednesday, the first update on short interest readings of the new year with data through January 12th was released.

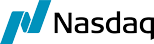

Recognizing the historical context, it is worth noting that for most of the year, those Russell 1,000 stocks entering the year with the highest short interest levels have demonstrated underperformance.

As evidenced below, the 10% of stocks in the Russell 1,000 commencing the year with the highest short interest as a percentage of float are down an average of 8.18% YTD.

This contrasts with an average gain of 1.11% for the decile of the least shorted names.

It is noteworthy that while all other deciles have also fallen so far in the new year, their losses are not nearly as substantial; mostly in the low-single digits (across all Russell 1,000 members, the average year to date decline is currently 1.6%).

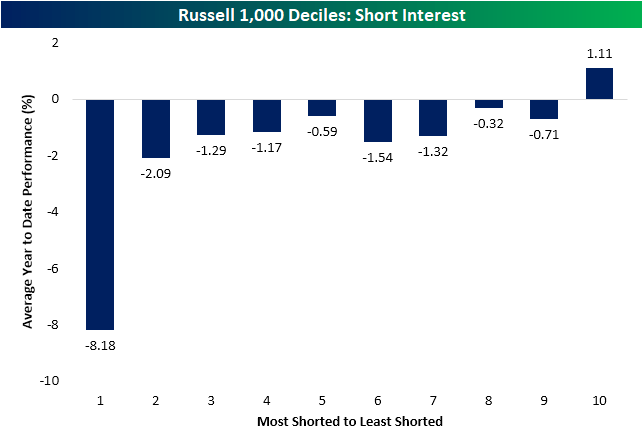

Breaking things down by industry further elucidates the narrative. As depicted in the first chart below, the industry groups with the highest short interest through mid-month include retailers, autos, and durables and apparel stocks.

It is worth noting that these are also three of the sectors that have registered some of the largest declines year-to-date. Notably, autos exhibit the most significant decline, at 11%.

Conversely, insurance, utilities, and banks typically possess the lowest levels of short interest. Although performance is somewhat mixed, the industry with the lowest average short interest reading, Insurance, represents the sector whose stocks have averaged the largest move higher so far this year.

In fact, it is one of the few areas of the market to boast a gain. As for Utilities, despite also owning low levels of short interest, the average stock has recorded a substantial 5.3% decline.

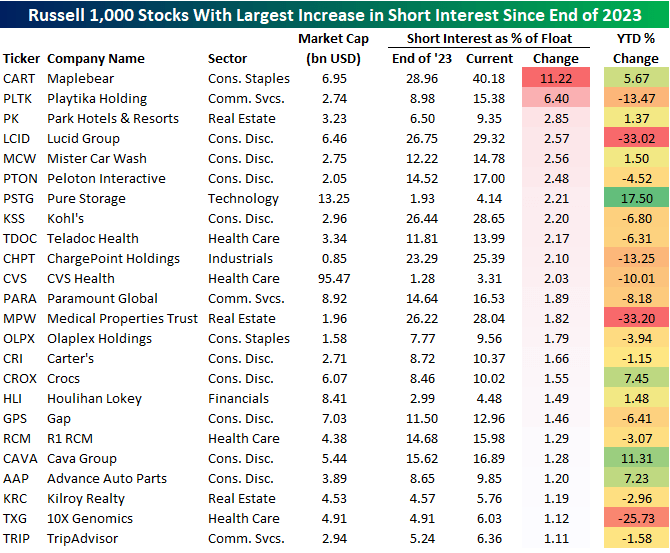

Between this first short interest report of the year and where things stood at the end of last year, the average Russell 1,000 member observed a marginal increase in short interest.

In the table below, we demonstrate the 25 members that experienced the most substantial increases. At the top of the list is recent IPO Instacart/Maplebear (CART). At the end of last year, short interest was already elevated at almost 29% of float.

Since then, shorts have continued to mount. Now, over 40% of float is short, the highest among any Russell 1,000 member.

Ironically, despite the general underperformance of highly shorted names year-to-date, CART is actually heading into the final days of January up 5.67% in 2024.

The next largest increase came from the mobile game maker Playtika (PLTK). Short interest for this company has risen from just under 9% to 15.4%. Unlike CART, this stock has experienced worse performance this year, with a 13.5% decline.

Of the listed stocks, that is some of the weakest performance, although there are far worse declines and higher current levels of short interest. Lucid (LCID) and Medical Properties (MPW) have experienced declines of 30%+ YTD, with more than a quarter of their float being shorted.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.