Investors will get a glimpse at how the consumer discretionary sector is fairing with Nike NKE set to release results for its fiscal third quarter after-market hours on Thursday, March 20.

While the broader market selloff hasn’t caused a further nose dive in Nike’s stock in recent weeks, NKE is only 7% above its 52-week low of $68 in mid-February and still well off its one-year high of $101 last March. Wall Street will be eying the retail apparel giant’s performance in China amid tariff concerns, and looking for an indication that a return to meaningful sales growth is ahead.

Brief Overview of Nike’s Struggles

Nike has grappled with the need to innovate its product line outside of classic models like the Jordan brand, while facing increased competition from Adidas ADDYY, Under Armour UAA, and New Balance in regards to shoe apparel. Furthermore, Lululemon LULU has taken significant market share from Nike as it relates to athletic clothing apparel.

Halting the decline in Nike stock and leading to a nice bounce off its February lows was the announcement of a collaboration with Kim Kardashian’s Skims brand. The partnership, called NikeSkims, will focus on creating innovative and inclusive activewear for women and should help Nike compete with Lululemon in this regard.

Nike’s Q3 Expectations

Based on Zacks estimates, Nike’s Q3 sales are thought to have decreased 10% to $11.12 billion compared to $12.43 billion in the comparative quarter. Notably, sales in Nike’s Greater China segment are expected to be down 13% to $1.81 billion versus $2.08 billion in the prior-year period.

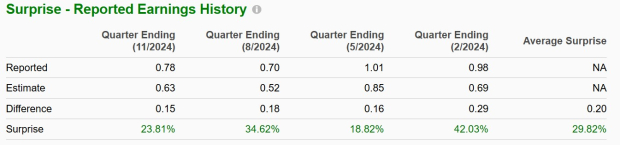

On the bottom line, Nike’s Q3 EPS is slated to drop to $0.28 from $0.98 per share a year ago. That said, Nike has exceeded the Zacks EPS Consensus for six consecutive quarters with an average earnings surprise of 29.82% in its last four quarterly reports.

Image Source: Zacks Investment Research

Monitoring Nike’s Outlook

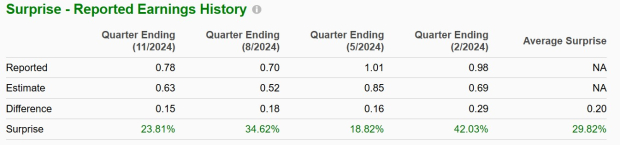

Overall, Nike’s total sales are now expected to decline 10% this year but are projected to stabilize and rise 1% in fiscal 2026 to $46.59 billion. Annual earnings are expected to drop to $2.04 per share from EPS of $3.95 in FY24. Optimistically, FY26 EPS is projected to rebound and rise 10% to $2.25.

Image Source: Zacks Investment Research

Tracking NKE Stock Performance

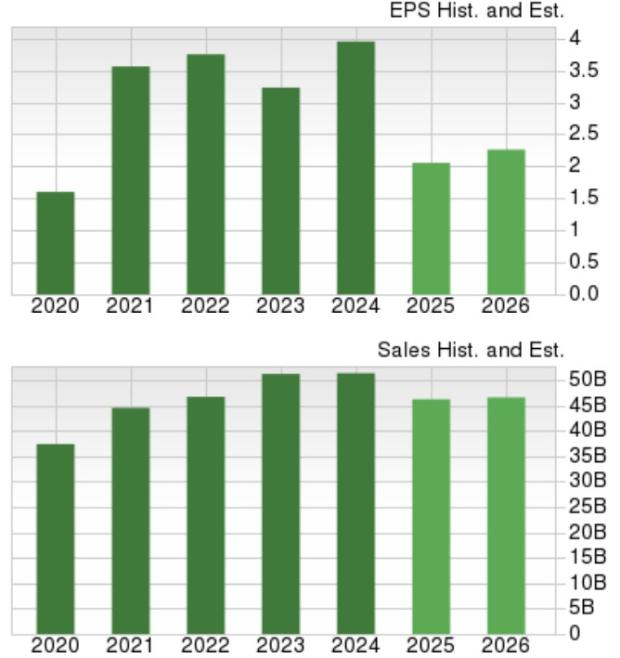

Nike stock is down 3% in 2025 with the benchmark S&P 500 seeing declines of -5%. However, over the last year, NKE has now plummeted 27% to largely trail the broader market‘s +7% and Adidas’ +11% with Under Armour and Lululemon shares falling 8% and 30% respectively.

Image Source: Zacks Investment Research

In terms of historical performance, NKE has gains of +43% over the last decade which has outperformed Under Armour’s -84% but has trailed the blazing performances of the benchmark, Adidas, and Lululemon.

Image Source: Zacks Investment Research

NKE Valuation Comparison

At current levels, NKE trades at a 35.6X forward earnings multiple, a noticeable premnium to the benchmark’s 21.1X and its Zacks Shoes & Retail Apparel Industry average of 11X. Still, it’s noteworthy that NKE does trade well below its decade-long high of 51.1X forward earnings and is closer to the median of 29.3X during this period.

Image Source: Zacks Investment Research

Bottom Line

For now, Nike stock lands a Zacks Rank #3 (Hold). It may be too soon to say NKE is in store for an extended rebound as more upside will largely depend on the ability to reach or exceed its Q3 expectations. More importantly, Nike will need to offer guidance that starts to reconfirm a return to growth at some point.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.3% per year. So be sure to give these hand picked 7 your immediate attention.

NIKE, Inc. (NKE) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Adidas AG (ADDYY) : Free Stock Analysis Report

Under Armour, Inc. (UAA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.