This week’s earnings lineup is headlined by quarterly results from big tech giants, featuring Alphabet GOOGL and Microsoft MSFT reporting after market hours on Tuesday. However, despite exceeding their top and bottom line expectations, Alphabet shares were down over -7% while Microsoft’s stock dipped -2%.

A Tumultuous Tale of Trading

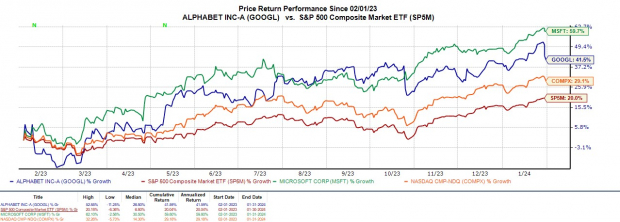

Lately, over the last year, Alphabet and Microsoft’s stock have soared +41% and +60% respectively, with today’s selloff prompting investors to ponder if it’s a buying opportunity or a cautionary tale of turbulence.

Image Source: Zacks Investment Research

Alphabet Q4 Review

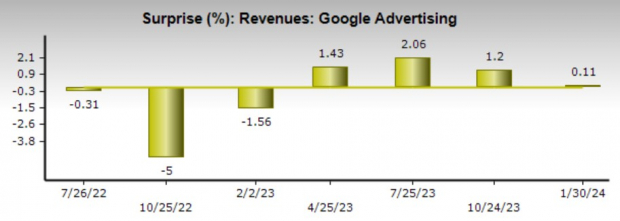

The dive in Alphabet’s stock comes as the market soured on the company’s ad revenue, despite fourth quarter earnings of $1.64 per share beating estimates by 2% and soaring 64% from $1.05 a share in the comparative quarter.

Image Source: Zacks Investment Research

Quarterly sales of $72.32 billion came in 2% better than expected, a 14% jump from the previous year. Amidst this, ad revenue of $65.51 billion slightly surpassed the Zacks Consensus of $65.44 billion in a bid to retain its position as the leader in total digital advertising revenue in the United States ahead of Meta Platforms META and Amazon AMZN.

With that being said, Alphabet’s ad revenue did rise 11% from the prior-year quarter, leading to an annual earnings increase of 27% to $5.80 per share, although total sales saw a decline of -9%.

Image Source: Zacks Investment Research

Microsoft Q2 Review

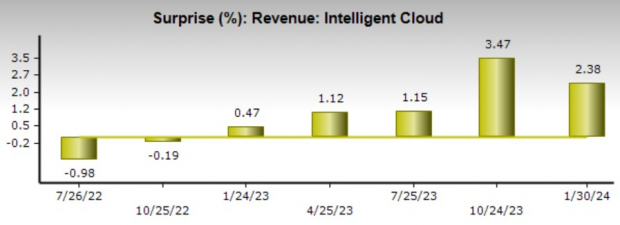

Reporting its fiscal second quarter results, Microsoft’s Q2 earnings of $2.93 per share pleasantly surpassed expectations by 6% and climbed 26% from $2.32 a share in the prior-year quarter. Second quarter sales of $62.02 billion topped estimates by more than 1% and jumped 17% from a year ago.

Image Source: Zacks Investment Research

Microsoft attributed the strong quarter to Azure and other Intelligent Cloud Segment services which expanded 20% YoY to $25.88 billion and topped estimates of $25.27 billion by 2%. The company highlighted that it has now moved to applying AI at scale with Microsoft having 53,000 Azure AI customers.

However, Wall Street wasn’t blown away by Microsoft’s sales guidance for the third quarter which played a role in today’s dip. Microsoft projects Q3 revenue to be in the range of $60-$61 billion and this does fall in line with the current Zacks Consensus of $60.56 billion.

Image Source: Zacks Investment Research

Reading the Valuation Tea Leaves

With Alphabet and Microsoft forecasted to have double-digit percentage growth on their top and bottom lines in fiscal 2024, reviewing their current valuations may provide better insights into potential stock purchases. At present, Alphabet’s stock presents an attractive option, trading at 22.6X forward earnings, nearly in line with the S&P 500’s 20.8X, while Microsoft’s 36.6X is at a slightly higher but not overly stretched premium to the broader market.

Image Source: Zacks Investment Research

The Bottom Line

Considering the strong rally in Alphabet and Microsoft’s stock over the last year, the trend of earnings estimate revisions in the following weeks will play a significant role in the possibility of more upside. Presently, both tech giants land a Zacks Rank #3 (Hold), supported by their reasonable P/E valuations, paving the way for long-term investors to potentially reap future rewards at current levels.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.