Volatility in Intel’s Stock

Intel’s (INTC) stock declined by 12% in today’s trading session after the chip giant reported favorable Q4 results post-market hours on Thursday. However, the company provided underwhelming guidance for the first quarter, leading to the stock’s tumble.

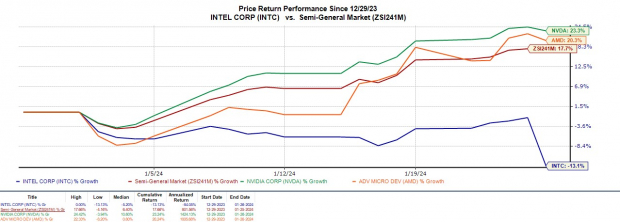

Investor sentiment remains high for chip stocks amid easing inflation, with the Zacks Semiconductor-General Industry up by 18% year-to-date and 121% over the last year, led by Nvidia (NVDA) and AMD (AMD).

Despite Intel’s stock being down 13% YTD, it has risen by 55% in the last year, leaving investors contemplating whether the recent dip presents a buying opportunity.

A Review of Q4 Performance

CEO Pat Gelsinger stated that the fourth quarter marked substantial progress on Intel’s transformation, with Q4 earnings exceeding the Zacks Consensus by 23%. Intel’s Q4 earnings soared by 440% from the prior year quarter, making it the company’s fourth consecutive quarter of surpassing earnings estimates.

Q4 sales of $15.4 billion surpassed expectations by 2% and increased by 10% year over year. This achievement was attributed to consistent execution and accelerated innovation, resulting in strong customer momentum for Intel’s products.

However, after a sharp recovery in 2022, Intel’s full-year fiscal 2023 revenue of $54.2 billion dipped by 14% year over year, with annual earnings of $1.05 per share decreasing by 43% from $1.84 a share.

Future Outlook and Challenges

To compete against Nvidia and AMD in AI-powered chips, Intel continues to build its external foundry business and at-scale global manufacturing, aiming to bring AI everywhere. This strategic shift is anticipated to add long-term value to shareholders.

Despite the positive outlook, discrete headwinds in Intel’s Mobileye segment, coupled with business exits, are impeding overall revenue for the first quarter. As a result, Intel’s first-quarter revenue guidance of $12.2 billion-$13.2 billion fell short of analysts’ expectations and the current Zacks Consensus of $14.3 billion.

Intel also anticipates Q1 earnings to be $0.13 a share, considerably below the Zacks Consensus of $0.35 a share, consequently fueling the recent selloff.

Considering the Investment Move

Given the weaker-than-expected guidance, it may be too early to consider purchasing Intel’s stock, as earnings estimates are likely to decline. For now, Intel’s stock holds a Zacks Rank #3 (Hold) and may continue to reward longer-term investors. However, the company’s transformation and outlook should be closely monitored going forward.

Domestic financial markets continue to be volatile, and prospective investors should take a cautious approach when considering such investments to secure a stable financial future.