AMD Struggles Amid Chip Market Decline and AI Growth Opportunities

The stock market has faced recent downturns, with chip designer Advanced Micro Devices (NASDAQ: AMD) experiencing significant losses. Although the S&P 500 (SNPINDEX: ^GSPC) index reached record highs in January, it trades 13% lower as of April 12, compared to those peaks.

Since July 10, 2024, AMD’s stock has plunged 49%, indicating a tumultuous period for the company.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Yet, one might expect AMD to be thriving. The current surge in artificial intelligence (AI) is propelling AI-related companies to historic heights, leading to several achieving trillion-dollar valuations. AMD’s Instinct processors are noted for their cost-effectiveness in AI acceleration, while the Epyc range of server-grade CPUs excels in handling substantial computational demands. Together, these chips are components in some of the most powerful supercomputers globally.

However, despite this backdrop, AMD’s fortunes have not aligned as anticipated. Is it a good time to invest in AMD at these reduced stock prices, or is it wiser to observe from afar?

Reasons Behind AMD’s Stock Decline

Analysis of AMD’s stock struggles reveals that it’s not a lack of performance. The company has released three earnings reports since the downturn began, exceeding analysts’ earnings estimates twice and meeting revenue targets in all three reports.

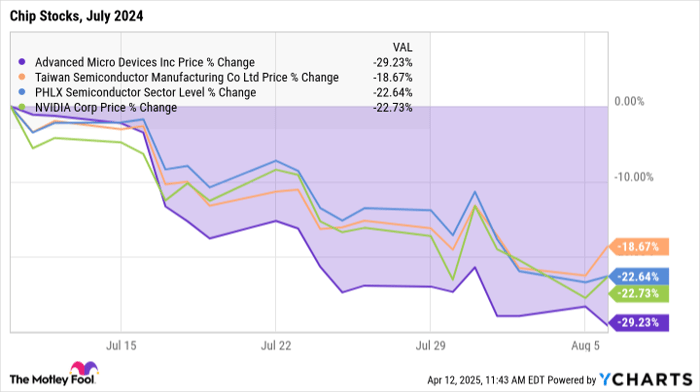

AMD was not alone in experiencing a downturn last July. Competitor Nvidia (NASDAQ: NVDA) witnessed a 22.7% drop in share price between July 10 and August 6, while chip giant Taiwan Semiconductor Manufacturing (NYSE: TSM) declined by 18.7%. The sector-tracking PHLX Semiconductor Sector Index softened by 22.6%. Nonetheless, AMD led this decline with a staggering 29.2% reduction:

AMD data by YCharts

This initial investor unease was fueled by concerns over international chip shipping between the U.S. and China. Given that 24% of AMD’s sales were directed to Chinese clients last year, the company’s significant decline is understandable in this unstable environment. Nevertheless, the semiconductor industry’s struggles were widespread at that time.

By December, AMD’s stock performance diverged from broader chip sector trends when several banks issued bearish reports, mainly citing weak contract wins in the booming AI sector.

Overall, AMD’s disappointing stock trajectory last year was largely influenced by associated AI market volatility.

Evaluating AMD’s AI Potential

Currently, AMD’s stock trades at 15 times forward earnings estimates and 5.9 times training sales, presenting a value proposition compared to Nvidia’s significantly higher ratios. Alternative valuation multiples could suggest a different overview, yet these two metrics demonstrate AMD’s compelling combination of strong revenue growth and improving profit margins.

From this angle, AMD’s stock appears undervalued. Notably, February’s fourth-quarter report did not support fears regarding its AI prospects. The new Instinct MI300X chip has gained traction among enterprise clients due to its appealing combination of competitive pricing, low energy consumption, and robust processing capabilities.

“AMD now powers five of the ten fastest and fifteen of the twenty-five most energy-efficient systems in the world, as listed in the latest top 500 supercomputer report,” noted CEO Lisa Su during the earnings call. Many of these high-performance systems support the AI sector.

Thus, the skepticism from analysts and investors about AMD’s positioning in the AI space seems unwarranted. The company is poised for growth, especially with the release of even more powerful Instinct MI350X chips anticipated later this year.

Investment Strategies for Navigating AMD’s Volatility

Despite its recent price drop, AMD’s stock isn’t necessarily a bargain. While it may not be wise to invest heavily in AMD stock, it could be a good choice for a price-sensitive AI stock portfolio. Alternatively, waiting for further price drops could be beneficial, though market stability remains uncertain.

A prudent strategy might involve dollar-cost averaging through smaller investments over time, or a progressive buying-in-thirds method. These approaches can mitigate market fluctuations, yielding a reasonable average price for your overall AMD position.

Should You Invest $1,000 in Advanced Micro Devices Right Now?

Before making any buy decisions on stock in Advanced Micro Devices, keep the following in mind:

The Motley Fool Stock Advisor analyst team has identified the 10 best stocks to purchase right now, and Advanced Micro Devices was not included in this list. The selected stocks are expected to generate significant returns in future years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $495,226!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $679,900!*

Now, it’s worth noting Stock Advisor’s average total return is 796% — a significant outperformance compared to 155% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of April 10, 2025

Anders Bylund has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.