Zoom Communications Demonstrates Strong Growth and AI Leadership

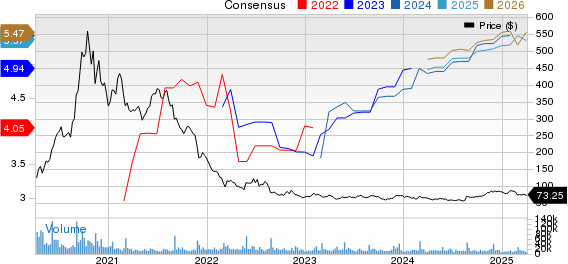

Zoom Communications, Inc. (ZM) has seen its shares rise by 16.4% over the past year, significantly outperforming both the Zacks Computer and Technology sector, which returned 5.4%, and the S&P 500 index, which rose by 9.5%. The company’s performance also eclipses the Zacks Internet – Software industry’s growth of 8.3% during the same period.

Zoom’s success has been buoyed by the launch of its Zoom AI Companion, which experienced a remarkable 68% increase in monthly active users in the fourth quarter of fiscal 2025. This innovative tool is central to Zoom’s transition into an AI-first company, and the regular introduction of sophisticated features is instrumental in maintaining its stock performance.

Navigating Competitive Waters with AI Innovations

Zoom faces stiff competition from established online meeting services like Cisco Systems’ (CSCO) Webex, as well as from integrated productivity solutions such as Microsoft’s (MSFT) Teams and Alphabet’s (GOOGL) Google Workspace. Both Cisco Webex and Microsoft Teams provide services that include online meetings, team messaging, and file sharing, while Google Workspace delivers an all-in-one solution that combines video conferencing with email, calendar, chat, and collaboration tools. Over the past year, shares of Cisco Systems have appreciated by 18.1%, while Microsoft and Alphabet have seen declines of 12.3% and 1.1%, respectively.

Despite these competitive pressures, Zoom is regarded as the benchmark for video conferencing. The company has broadened its offerings beyond video calls to include Zoom Phone, Zoom Contact Center, Workvivo, and Zoom Rooms. Notably, its AI-powered enhancements distinguish it in the market. Workvivo by Zoom has launched Workvivo AI, an intelligent workplace assistant designed to streamline internal communication. By providing this tool at no cost to users, Zoom aims to enhance productivity, thus fostering increased customer loyalty and retention.

Zoom Communications, Inc. Price and Consensus

In March, Zoom expanded its AI Companion by incorporating agentic AI skills, allowing users to autonomously manage tasks like scheduling and document creation. The AI Companion’s reach has widened within business services, now featuring specialized agents aimed at customer service, marketing, and sales. This continuous innovation, paired with strategic growth efforts, positions Zoom favorably within a competitive landscape.

Promising Guidance for Q1 Fiscal 2026

For the first quarter of fiscal 2026, ZM anticipates non-GAAP earnings per share between $1.29 and $1.31, with revenues expected to range from $1.162 to $1.167 billion.

The Zacks Consensus Estimate for ZM’s first-quarter fiscal 2026 earnings stands at $1.30 per share, which has not changed in the past 90 days, indicating a year-over-year decrease of 3.7%. The consensus revenue estimate is $1.17 billion, reflecting an anticipated year-over-year growth of 2.1%.

Consistently, ZM has surpassed the Zacks Consensus Estimate for earnings in the previous four quarters, with an average surprise of 10.33%.

Find the latest EPS estimates and surprises on Zacks earnings Calendar.

ZM Stock: Buy, Sell, or Hold?

Zoom’s strategy to evolve into an AI-first platform suggests significant upside potential as it addresses real-world business challenges. The company’s user-friendly software, ease of adoption, and expansive reach make it a preferred option among enterprises amidst fierce competition. With approximately $7.8 billion in cash, cash equivalents, and marketable securities as of January 31, 2025, Zoom is well-positioned to support its AI-focused initiatives. As companies increasingly implement generative AI to enhance productivity, Zoom’s specialized solutions in communication and workflow management are expected to catalyze improved customer engagement, retention, and long-term growth.

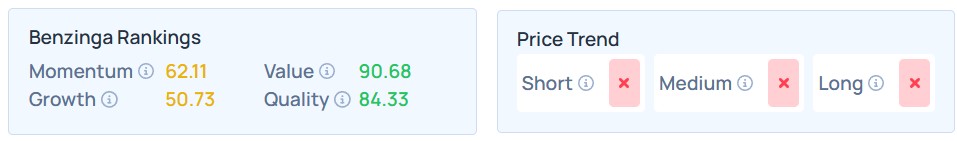

Currently, ZM holds a Zacks Rank of #2 (Buy), indicating an attractive entry point for investors. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Recently released: Experts have identified 7 elite stocks from a pool of 220 Zacks Rank #1 Strong Buys. These tickers are deemed “Most Likely for Early Price Pops.”

Since 1988, this complete list has outperformed the market more than twice over, with an average annual gain of +23.9%. Consider giving these carefully selected 7 stocks your immediate attention.

See them now >>

For the latest recommendations from Zacks Investment Research, you can download the report on the 7 Best Stocks for the Next 30 Days. Click here to get this free report.

Microsoft Corporation (MSFT): Free Stock Analysis report.

Cisco Systems, Inc. (CSCO): Free Stock Analysis report.

Alphabet Inc. (GOOGL): Free Stock Analysis report.

Zoom Communications, Inc. (ZM): Free Stock Analysis report.

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.