As the Dow Jones Industrial Average Index ($DOWI) bids farewell to Walgreens Boots Alliance (WBA) and welcomes Amazon (AMZN) into its esteemed 30-stock lineup, investors are left contemplating – should another modern powerhouse, Nvidia (NVDA), be the next addition to this historic index? Let’s delve into the possibilities.

A Glimpse into the Dow 30

Since its inception in 1896, the Dow Jones Industrial Average has stood as a stalwart in the global market index arena. Unlike its market cap-weighted counterparts such as the S&P 500 Index ($SPX), the Dow remains a price-weighted index, reflecting stock prices rather than market capitalization. Interestingly, the original companies that formed the Dow are long gone, signaling the index’s adaptive nature.

Recent history paints a changing landscape for the Dow. In 2020, the index bid adieu to Exxon Mobil (XOM), Pfizer (PFE), and Raytheon Technologies, replacing them with Salesforce (CRM), Amgen (AMGN), and Honeywell (HON), respectively. This realignment coincided with Tesla’s (TSLA) historic inclusion in the S&P 500, underlining a shift towards innovation and disruption across major indices.

An Amazonian Addition: The Why Behind Dow’s Move

The catalyst for Amazon’s foray into the Dow Jones realm was Walmart’s stock split, leading to a recalibration of the index’s retail exposure. S&P Dow Jones Indices’ decision to swap Walgreens Boots Alliance for Amazon underscores the index’s adaptability to reflect the evolving U.S. economy, as articulated by the managing entity.

Furthermore, the replacement of JetBlue Airways Corporation with Uber in the Dow Jones Transportation Average mirrored a growing trend towards ride-sharing services, resonating with the broader market shifts towards tech and consumer behavior.

The Dow Jones Stamp of Approval

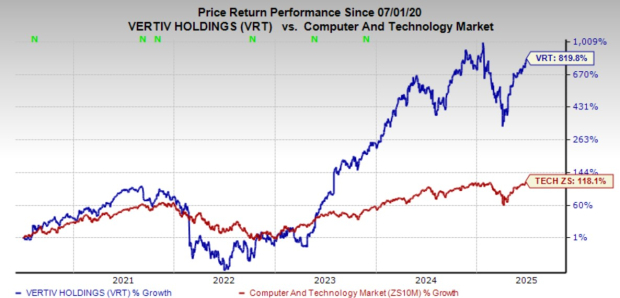

Inclusion in benchmark indices like the Dow injects a stamp of credibility and buying support into listed stocks. Tesla’s S&P 500 inclusion in 2020 validated electric vehicles’ future, enhancing market confidence. Nvidia’s meteoric rise in the AI sector positions it as a strong contender for Dow inclusion, aligning with the index’s narrative of reflecting the dynamic U.S. economic landscape.

Should Nvidia Claim its Dow Throne?

The AI resurgence has dominated financial dialogues, with Nvidia emerging as a key player, boasting a $2-trillion market valuation. Nvidia’s addition to the Dow would echo the rationale behind Amazon and Uber’s inclusions, infusing diversity and relevance in the index composition.

Analogous to Uber’s entry over JetBlue due to low weighting, Nvidia’s presence could counterbalance the Dow’s existing low-weight constituents like Intel (INTC) and Verizon (VZ), mirroring the market’s pulse.

Splitting Hairs: The Nvidia Conundrum

Nvidia’s soaring stock price looms as a potential impediment to its Dow entry, due to its disproportionate weighting. A strategic stock split could level the playing field, mirroring Walmart’s preluding Amazon’s induction. Failure to include Nvidia risks skewing the Dow’s representation of the evolving market narrative.

Disclosure: The author (Mohit Oberoi) holds positions in: AMZN, NVDA, PFE, TSLA, MSFT, and INTC. The content presented is for informational purposes only. Refer to the Barchart Disclosure Policy for accurate information.

The opinions expressed are solely those of the author and do not necessarily reflect Nasdaq, Inc.’s viewpoints.